This week, we’re thrilled to welcome Razvan Gavrilas, Founder and Chief Architect of cognitiveSEO to the iPullRank blog.

By Razvan Gavrilas | @razvan_gavrilas | cognitiveSEO

Having a lot of mentions of your brand on the web and basically earning media attention is a great asset. Yet, it is just half of the battle. Knowing where brand mentions come from and understanding which pieces of content drive a brand is the other half of the battle, and it is just as important as the first one.

Running an in-depth brand mentions audit could help you make sure that you are not overlooking any efficient strategies that might be working wonders for your competitors. There might be many ways in which you can boost your business, but the truth is that the more you can find out about your niche and your competitors, the more you can learn, adapt and ultimately flourish.

Therefore, by doing a bit of reverse engineering, let’s see how doing an effective brand audit can help you uncover your competitor’s strategies. In line with the old saying, “I hear and I forget, I see and I remember, I do and I understand,” let’s take a very specific niche and apply our research on it: the top Michelin Starred Restaurants in the UK.

1. Research Your Brand & Competitors

To best explain how to research your brands’ and competitors’ mentions, I will do a case study on the Michelin Starred Restaurants in the UK. There is probably no higher recognition in the restaurant business than a Michelin star. Getting one has got to be one of the most coveted awards. Getting the maximum of three is, for most chefs, a dream and the pinnacle of their life’s work.

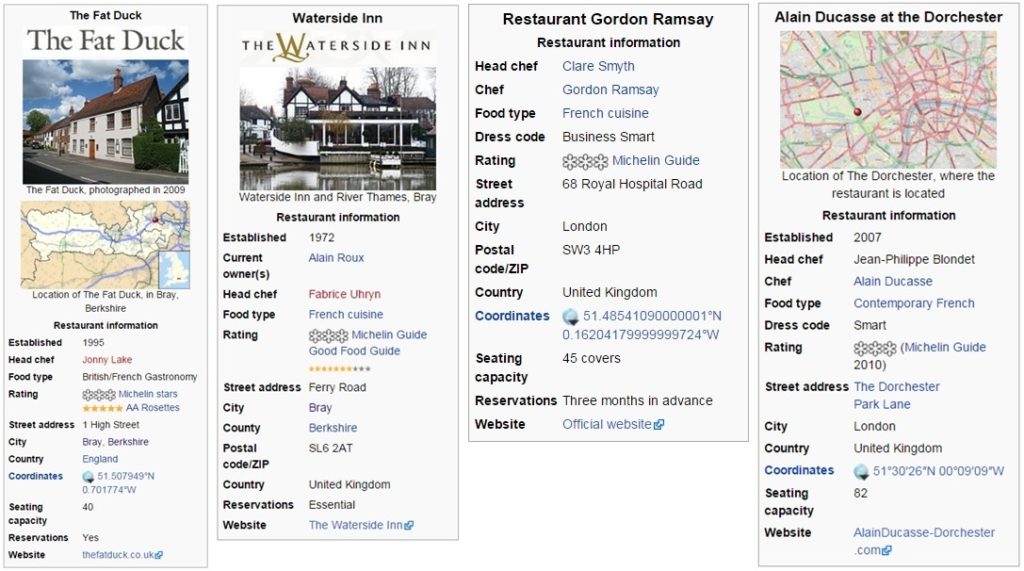

In 2015 there were only 4 restaurants in the UK awarded with three Michelin stars:

- Restaurant Gordon Ramsay

- Alain Ducasse at The Dorchester (both in London)

- The Fat Duck

- The Waterside Inn (both in Berkshire)

The Fat Duck has ostensibly been dropped from the list in 2016 after having re-opened in the fall of 2015 (not in time to be considered). Given its previous prestige and influence, we’ll give it a pass.

These are all world-class restaurants with no shortage of customers. But is there still something to learn from their online presence? They are, after all, in a particular strand of competition – the attention of wealthy gourmands in the UK (or just wealthy status-seeking people).

In order to find out how each restaurant is performing (and along with them, their niche), we’ve started doing some media monitoring. We did this in order to get insights on the web mentions linked to the brands (the four restaurants mentioned above) and the topics related the them that interested us most.

Some tools you could use for web mentions monitoring are:

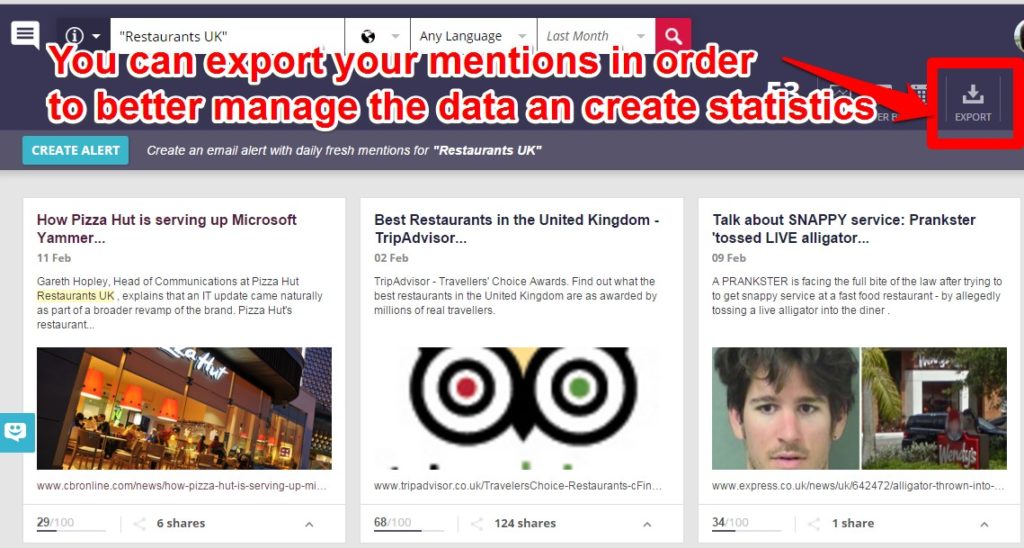

Each of these tools provided different results. You should test them all and decide which one fits you best. We found BrandMentions as being the one who provided the largest list of mentions as well as the freshest. Therefore, we decided to continue our research using this tool for web mentions monitoring.

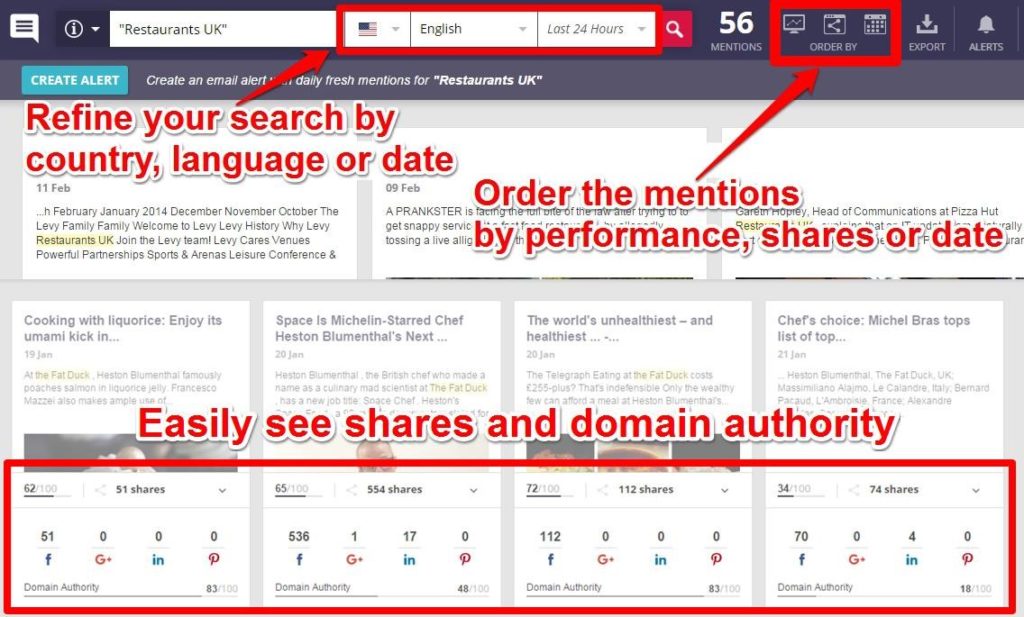

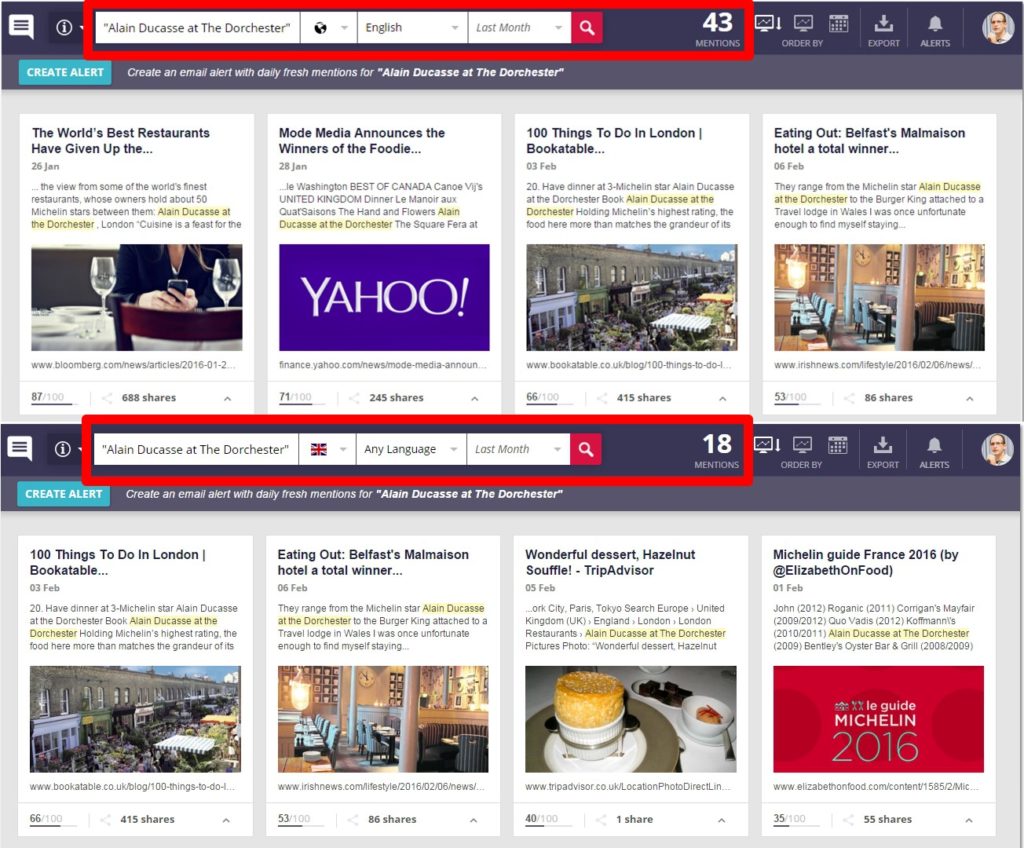

So, using BrandMentions, we ran three searches on the three-star culinary wonders. Taken in consideration:

- All mentions from the previous month

- All mentions in English from the previous month

- All mentions in the UK from the previous month

Using this tool, we exported all of the mentions into Excel. By analyzing the data, we can figure out how our UK starred restaurants are really performing in a side by side comparison.

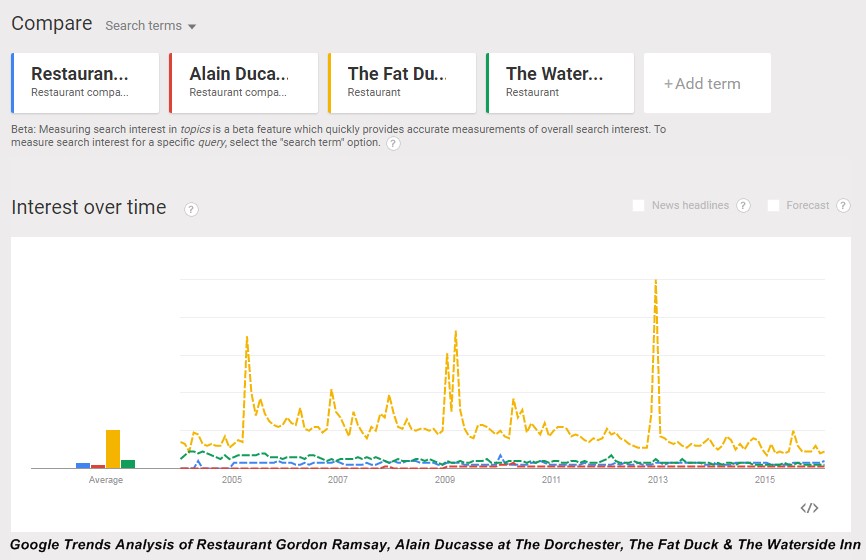

2. Find the Most Popular Restaurant in its Niche

Finding the most “mentioned” player or the one who performs best on the web is quite a difficult task without having the proper tools. You can try figuring out which is the most trending, yet Google Trends will only give you relative and not absolute data. When it comes to searching big topics (2016 elections, Oscars, Valentine’s Day, etc), Google Trends can be of real help. Google Trends aggregates data from Google Search, YouTube and Google News, and ranks the most searched for stories. It could be one of the most comprehensive trends aggregate you’ll find on the web as watching spikes in search terms during major events, you can quickly determine what topics are grabbing people’s interest. Yet, when you are looking for some particular brands in a niche, it doesn’t bring much added value to your research as the data is not very helpful.

As you can see in the screenshot below where the restaurants that we took for analysis are compared within Google Trends, we are only offered a relative interest over time and not a complete picture of what’s going on. Interpreting analytics effectively to gain useful insights about your customers is no easy task. Customer behavior can easily become lost in the math behind results or overlooked and simply taken at face value.

Since we are interested in the best player out of the 4 brands between Restaurant Gordon Ramsay, Alain Ducasse at The Dorchester, The Fat Duck and The Waterside Inn, we used the BrandMentions tool to identify the exact number of mentions each brand has in order to measure their online popularity.

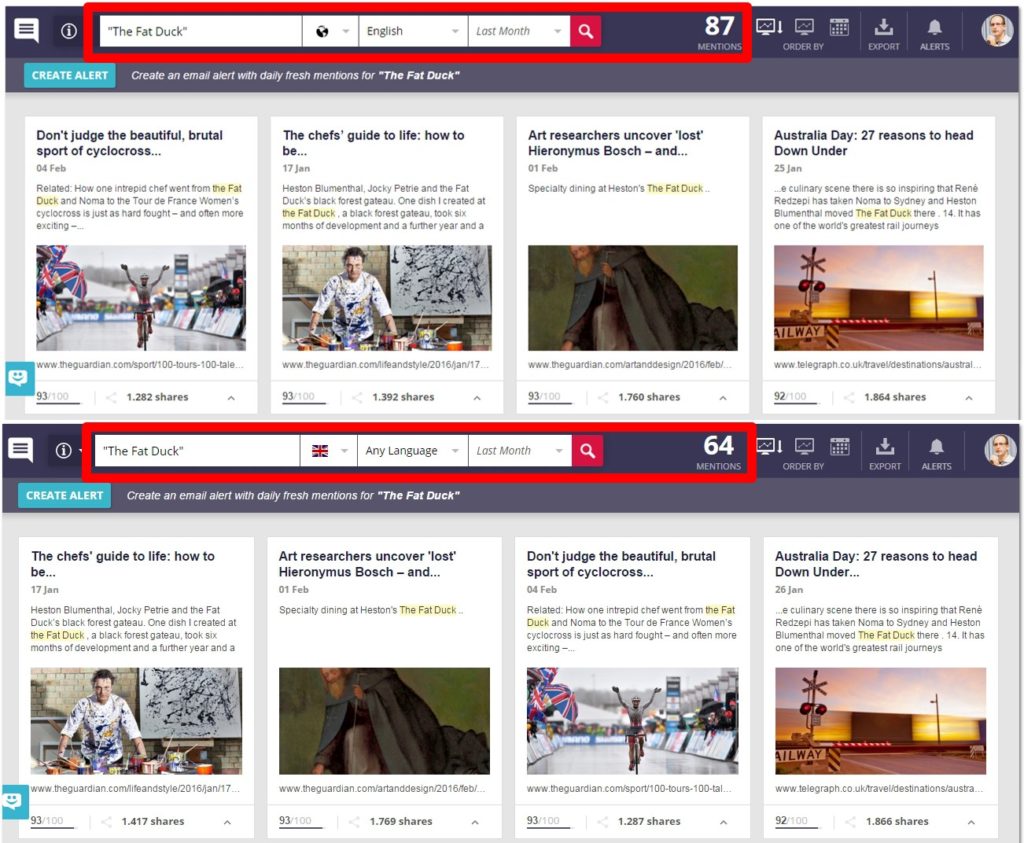

Judging just by the number of mentions from the last month, as we see in the screenshot below, the winner is The Fat Duck, followed by Restaurant Gordon Ramsay, Waterside Inn and Alain Ducasse at the Dorchester.

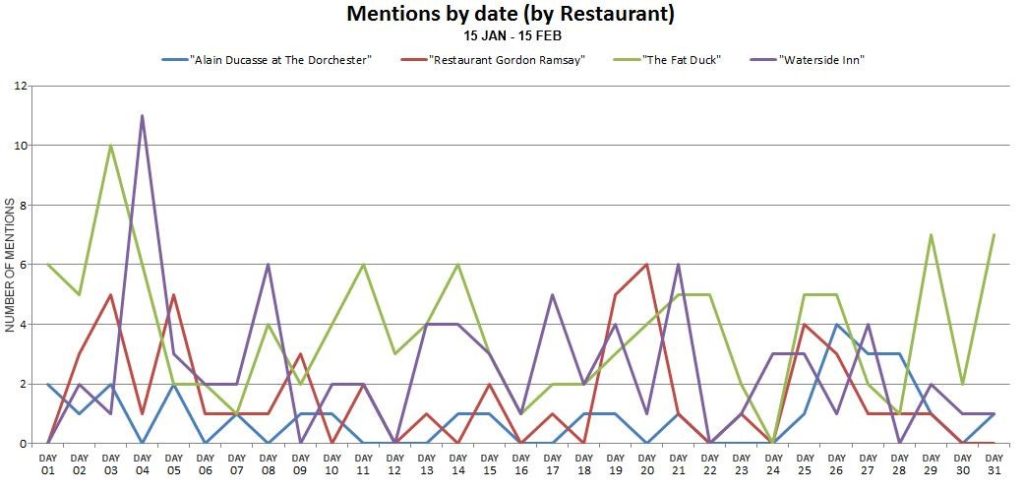

Numbers are indeed a great indicator, yet, we can go a bit further with our research and see how the 4 brands performed throughout the month. Spotting their highs and lows might tell us a lot about their strategy and their online presence.

What we did after the initial search, was to download a CSV file of each brand’s mentions, and play around with the data in order to best understand strategies and directions.

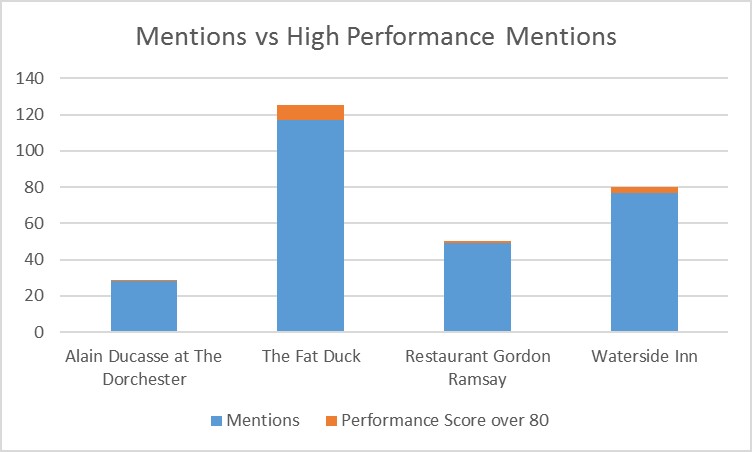

It seems like all four brands are very active, if we look at the date of their latest mentions. Even if some of them (for instance Alain Ducasse at The Dorchester) have considerably less mentions than its competitors, they manage to have a lot of fresh mentions reported to its total number of shares. Further, when we looked at the quality and shareability, all four restaurants have a good ratio of high performance, shared mentions. We are going to investigate this data in terms of performance and shares later on the article.

By comparing number of mentions over a month, we can clearly see how each brand performed by day. The chart is based on all the mentions gathered from the period 15 January – 15 February.

As we’ve mentioned above, The Fat Duck is the big winner however, as we look at the chart below we can see that it’s victory is due to the fact that it has quite a constant number of mentions (except some spikes) and not the biggest spikes. Also, it seems that it’s doing far better at the end of the month unlike its competitors who are reporting just a few mentions in the same period of time. The Fat Duck also starts and finishes the month strong.

Waterside Inn who is on the 3rd place out of 4 seems to be having the highest spikes. Yet, its lack of “being mentioned” consistently pulled this brand down.

Gordon Ramsay’s Restaurant finishes the month in a descendent trend yet, the number of mentions from the very beginning of the month and also from 18th until 21st of the month manage to place him 2nd on the overall top. For Restaurant Gordon Ramsay, but also its competitors, it should be interesting to see what kind of mentions appeared during that period of time, or what kind of strategy was applied and to try to replicate it.

Alain Ducasse at the Dorchester has a poor and (unfortunately for the brand) constant trend across the entire month. On the last days of the month, we can spot a throb, yet nothing that can place it on another place than the last in the top of 4.

3. Unveiling Each Competitor’s Strategy

Numbers are indeed important, yet there are a lot of things we can learn from the type of mentions themselves. Each mention has a main performance score, a subdomain authority score and a number of shares. When trying to find the best practices from the competitor’s strategy, these criteria are of great importance.

By filtering the mentions by country, language or date, we can also uncover: Does a brand have a strong presence in a certain country? Are the mentions written in English only? How is the brand standing in terms of the number of mentions in the last 24 hours?

Let’s take each of the brands that we chose for this analysis and try to uncover their strategies.

The Fat Duck

The Fat Duck doesn’t impress only with the sheer number of mentions, but also in terms of “volumes”. Set aside the Live Stream golden-egg-laying-goose and there’s still plenty to look at: close to 28000 shares in total. Roughly a third of those come from Metropoli, a supplement to El Mundo (one of Spain’s leading newspapers). Argentine (with a mention from leading conservative paper La Nacion) and Norway (with a mention from well-circulated tabloid VG) also make rounds, each raking in over 1000 shares.

Still, most of the attention comes from English-speaking websites, in particular from specialty websites such as True Cooks (over 3,500 shares) or The World’s 50 Best (over 2,500 shares).

Even when narrowing down to the UK sites, The Fat Duck is still the winner. There’s simply no substitute for 3 mentions from The Guardian, averaging 1500 shares per mention.

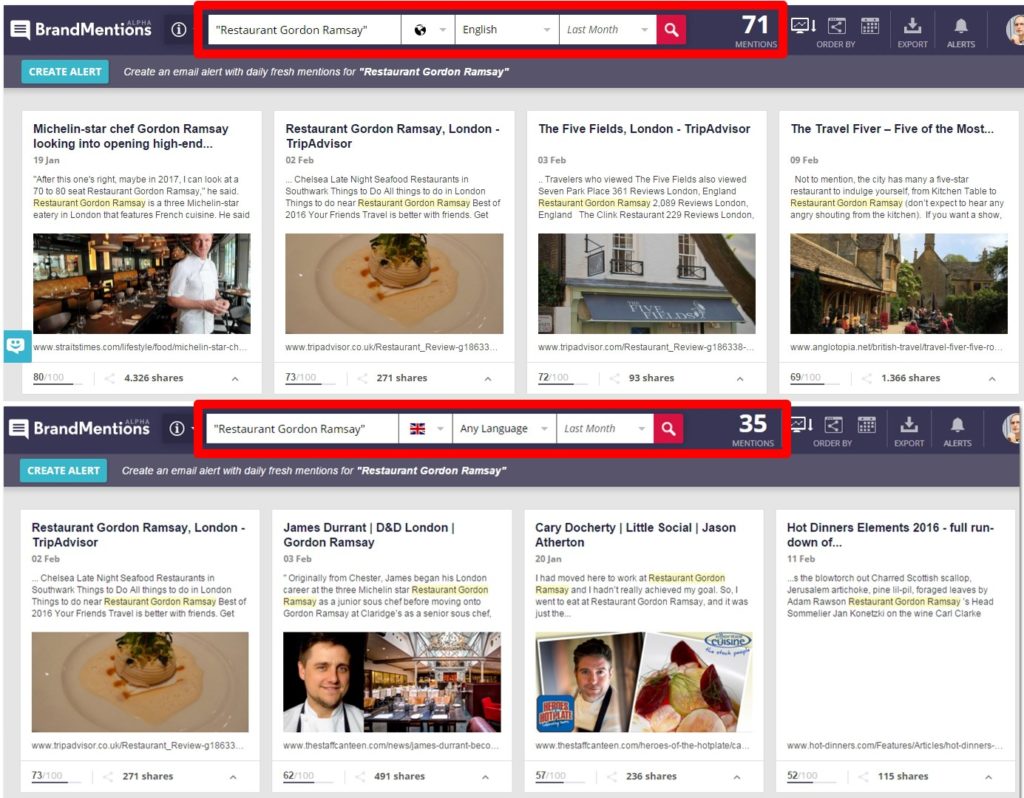

Restaurant Gordon Ramsay

Restaurant Gordon Ramsay enjoys quite a bit more attention both within and outside UK. In fact, the bulk of its shares (close to 70% out of the total of over 12000) comes from Straits Times, Singapore’s highest-selling paper. There’s also quite a bit of attention (even if in the hundreds, rather than thousands) from Spanish-speaking Infobae and French-speaking Opaz.

When narrowing searches to English-speaking sites only, it becomes evident that foreign appeal is not Ramsay’s only weapon. Over 1000 shares come from Anglotopia, a site bound to attract both tourists and passionate Anglophiles.

Perhaps somewhat surprisingly, there’s little media presence in the UK (compared to the total number of English-speaking mentions) when it comes to Restaurant Gordon Ramsay. Not to fear though, as the attention of specialty websites such as The Staff Canteen (which markets itself as “The UKs leading networking website for chefs”) more than compensates, to the tune of a few hundred shares.

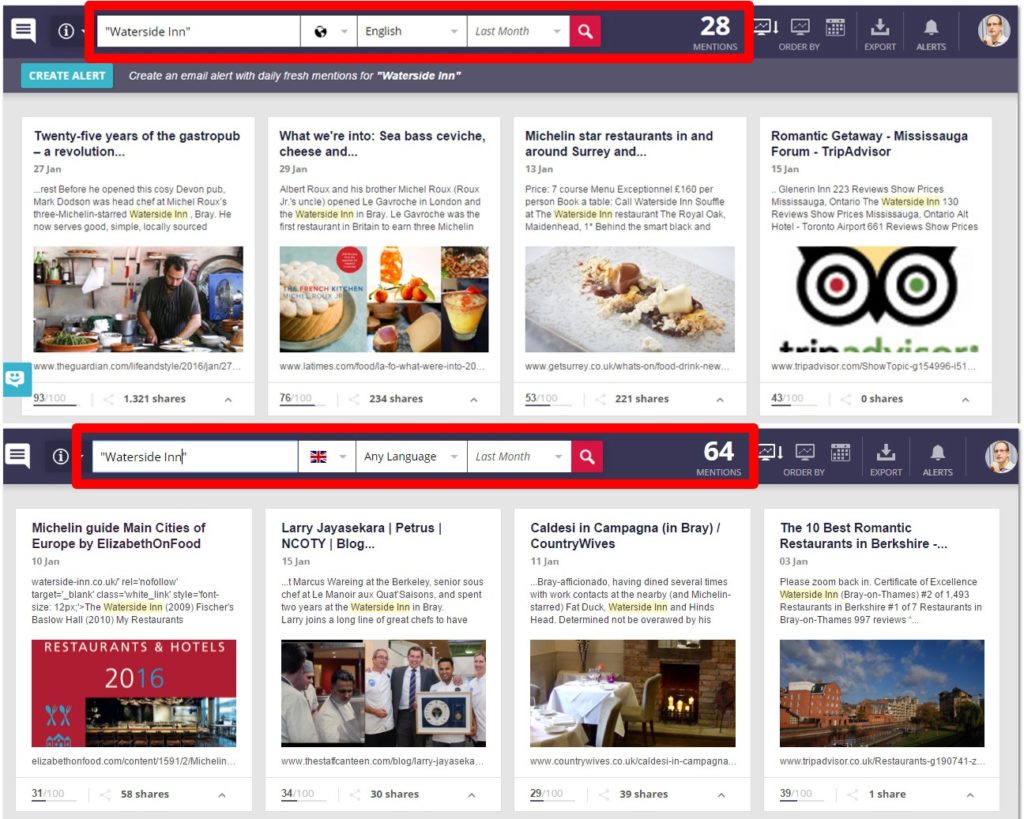

The Waterside Inn

Waterside Inn proves that more mentions don’t necessarily bring in proportionately more shares. That’s especially true for the international entries. Mentions as diverse as Israel or Vietnam bring in exactly zero shares. While that’s in no way harmful to the restaurant, it also doesn’t help as much as it could. Still, it ultimately manages to bring in over 5700 shares from its 77 mentions.

Faring better with mentions from English-speaking websites, Waterside Inn gets close to 1,500 shares from Canada’s In Sauga publication, 230 shares from the US, with LA Times and quite a few hundred from TripAdvisor.com. It also gets mentions from specialty sites such as Top 50 Gastropubs, but it doesn’t seem to have as big an impact as you might expect (only a dozen of shares).

Its greatest success however, seems to lie with UK-specific mentions. It gets attention not only from The Guardian (raking in some 1,300 social shares), but also from The Telegraph (with 450 shares), while also capturing the interest of more local publications such as Henley on Thames or South Wales Evening Post (each a few hundred).

Alain Ducasse at the Dorchester

Alain Ducasse at the Dorchester has the smallest online presence of the four. It can only be found in a couple of mentions with a performance score of over 70 and has an overall number of shares of just over 1,500 (about a quarter of the number boasted by the Waterside Inn). It only holds 3 mentions with more than 100 shares (and none with more than 1,000). Two of these mentions come from respectable general audience news sources – Bloomberg and Finance Yahoo -, while the third comes from a Russian travel site, Conde Nast Traveler.

When narrowing results to English-speaking sites, you can notice that it is where almost all of the results were coming from anyway (just 2 sites were dropped from this new search). That’s not necessarily surprising, but it does suggest that Alain Ducasse at The Dorchester might not have a lot of visibility in non-English speaking countries. Which, if you’re a 3-star Michelin restaurant, might be an avenue worth pursuing.

When restricting the search to UK websites only, quite a few results are discarded from the previous search (more than half), which means that at the very least, Alain Ducasse at The Dorchester has some worldwide notoriety in English speaking countries.

If we were to sum up their basic strategy, in terms of performance, shares, and UK vs worldwide mentions, things look something like this:

When it comes written in English and relevant for UK:

- For Alain Ducasse at the Dorchester, almost all of the results are written in English and relevant for UK.

- Waterside Inn’s greatest success seems to lie with UK-specific mentions.

- There’s little media presence in the UK when it comes to Restaurant Gordon Ramsay.

- Even when narrowing down to the UK sites, The Fat Duck is still the winner.

When it comes to “shareability”:

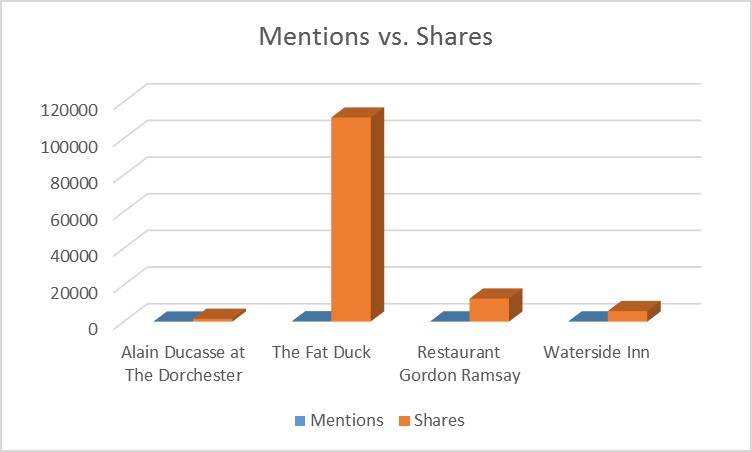

- The Fat Duck had the highest number of mentions and highest number of shares (though the discrepancy between it and the others was much higher for shares than for mentions).

- Alain Ducasse at The Dorchester had the lowest number of mentions and lowest number of shares.

- Although Waterside Inn has considerably more mentions than Restaurant Gordon Ramsay, it turns out that the latter has more high-shares mentions than the former. (We considered “high-share mentions” as mentions which are responsible for more than 1,000 overall shares.)

When it comes to performance:

- There is a direct correlation between the mentions publication and the performance score

- While three of the restaurants managed to have mentions in high quoted publications, which implicitly gave them mentions with high shares, Alain Ducasse at the Dorchester can only be found in a couple of mentions with a performance score of over 70

4. Putting it all together

So what are, the main takeaways from this audit, precious info that any brand from a competitive niche should look at when trying to outsmart its competitors?

The Mentions Source

We cannot pretend to understand our restaurants’ mentions trend without taking into consideration the mentions’ source. Anytime people talk about us or our professional achievements is great. However, although it is nice to capture peoples’ attention, it often occurs that some opinions are valued more than others. If I were a physicist, I am sure that my family’s appreciation on my work would have mattered, yet, not as much as an opinion coming from Stephen Hawking. Same things happen in the case of our restaurants; there are some sources that weight more than others, usually bringing with it high authority and credibility, and also a high number of shares.

- The largest number of mentions comes from Tripadvisor (or some specific country-version of it: .com, .co.za, .co.uk, .co.il, .com.au, .com.in).

- Out of the 325 total mentions that all 4 restaurants got together, 35 came from Tripadvisor.

- Quite a few of the entries are from blogs and general discussion boards (such as Reddit or 4chan), but they are generally low performance and attract few shares. At its best, a blog that holds some external credit (Forbes Travel Guide blog) holds a 44 performance score and attracts only 56 shares.

- The one consistent source of high performance scores and high number of shares appears to be The Guardian. Also Bloomberg (2 entries) and The Independent (1 entry) hold similar, but smaller appeal, with lower performance scores.

- The one anomaly in all of this is a Live Stream mention for The Fat Duck, which amounts for over 80,000 shares, a ridiculous amount by any means (although the performance score is at a solid 82). While this goes to show that pure luck can still play a role, it is worth noting that even without this mention, The Fat Duck would still be in the lead, with more than double the number of total mentions compared to the next competitor, Restaurant Gordon Ramsay.

There is no such thing as a “mention source formula”, meaning that if you get a mention from source X, your brand will automatically be boosted. However, in the Michelin starred Restaurant niche, it seems that there are some important pin-points in terms of sources from which we mention: The Guardian, The Independent and Tripadvisor.

The Mentions Performance

The performance score of each mention is calculated based on the number of shares and the domains authority. Therefore, the number of mentions and their source is of high importance. And it’s true that all mentions matter, but some of them matter most than others. When looking into the competitor’s yard, we tend to look at its best practices and try to replicate what worked best for them.

The Fat Duck seems to remain the indisputable leader when it comes to high-performance mentions. What is very interesting is that Waterside Inn, which does not perform very well in terms of mentions’ number, but is the second best when it comes to mentions with very high performance score.

The Mentions Shares

We’ve realized that the relationship between the number of mentions and volumes of shares is hardly linear. It looks like this:

- The Fat Duck had the highest number of mentions but also the highest number of shares

- Alain Ducasse at The Dorchester had the lowest number of mentions and lowest number of shares.

- Waterside Inn had more mentions than Restaurant Gordon Ramsay, but the latter had many more shares than the former.

There were some interesting findings when we researched this. It made us realize that shareable content can be difficult to come by. From the total number of mentions for all 4 restaurants:

- There are 79 mentions with 0 shares, some of them including pretty heavyweight names like TripAdvisor, Daily Telegraph or MSN.

- More than 60% of mentions have 10 shares or less.

- There are only 13 mentions with between 1001 and 10k shares. This is the “share heaven” and the realm of quality media with national coverage (leading publications from Spain, Argentine, UK, etc.)

- 1 mention with over 10k shares.

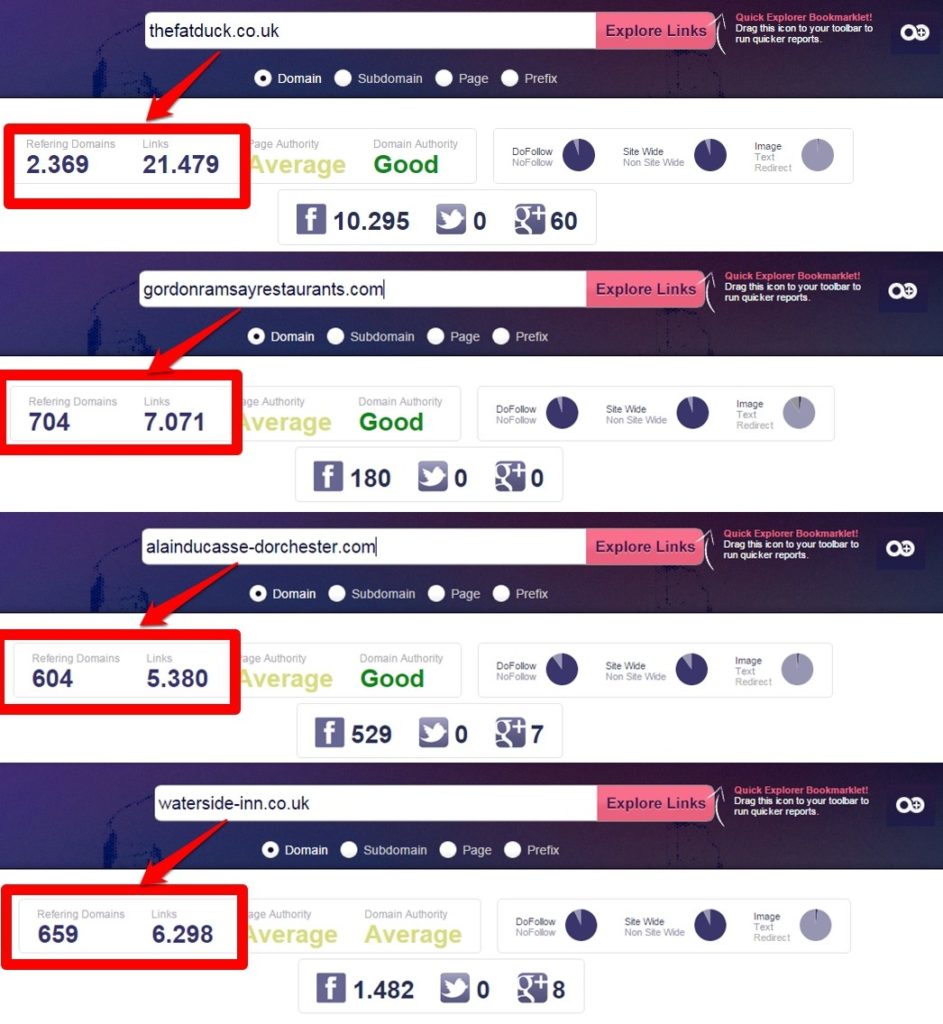

Mentions vs. Link Profile

It’s always interesting to correlate the online mentions with the site’s link profile. As we can see in the screenshot below, The Fat Duck remains the leader. Just as in the case of mentions, studying the competitor’s link profile can bring many great link opportunities.

Perhaps the easiest way to take advantage of your competitor’s link profile to crawl your competitor’s broken backlinks and using the Link Reclamation Technique, try to “borrow” its link juice to get higher traffic and rankings.

Conclusion

There is no secret that niche and brand audits are a must for every business that wants to succeed in the ever-changing online environment, and that they are the first step in the development of any digital marketing plan. We all want to know as much as possible from the niche we are competing in, whether we are a well-established business or a small company that wants to expand into new markets. And the more you can find out about your competitors, the more you can learn, adapt and flourish.

Although it may take a lot of time and energy, such a brand mention audit will eventually pay off. Think of the perspective that any of the analyzed restaurants could have if they were aware of what their competitors are doing. They can see what type of content is working for their competitor and where they can replicate that success to their advantage. What publications are the most authoritative in the niche, and which attention you should grab? What social networks are most interested in this niche, and what type of content is working on each of them? Which country should we concentrate our efforts? Is there a market for non-English speakers as well? All of this are ideas that put together in a digital marketing strategy will probably not make overnight miracles, but will constantly and consistently boost any brand.