What if you were a mind reader?

What if you knew exactly what your readers and customers wanted from you before they asked for it? For media companies, this is the goal and also the problem. You’re dealing with a constantly moving target — reader and customer expectations change rapidly.

High-quality market research keeps your finger on the pulse of your readers and your customers. So why aren’t more media companies doing it consistently?

Why media companies should conduct market research

Media companies need market research more than ever. Readers are constantly being blown back and forth by various events — misinformation, a lack of transparency, conflicting narratives, and general confusion. Customers may be cautious as they work to navigate the changing social climate.

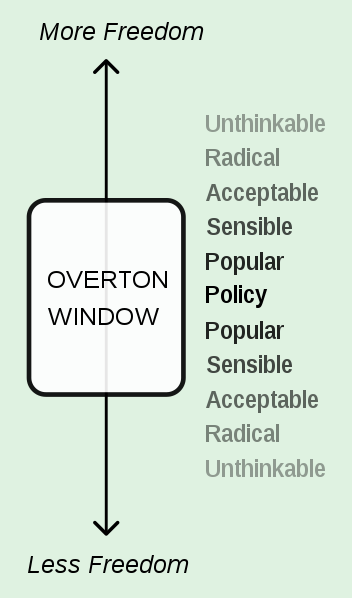

The Overton Window is shifting rapidly.

Trust is in freefall.

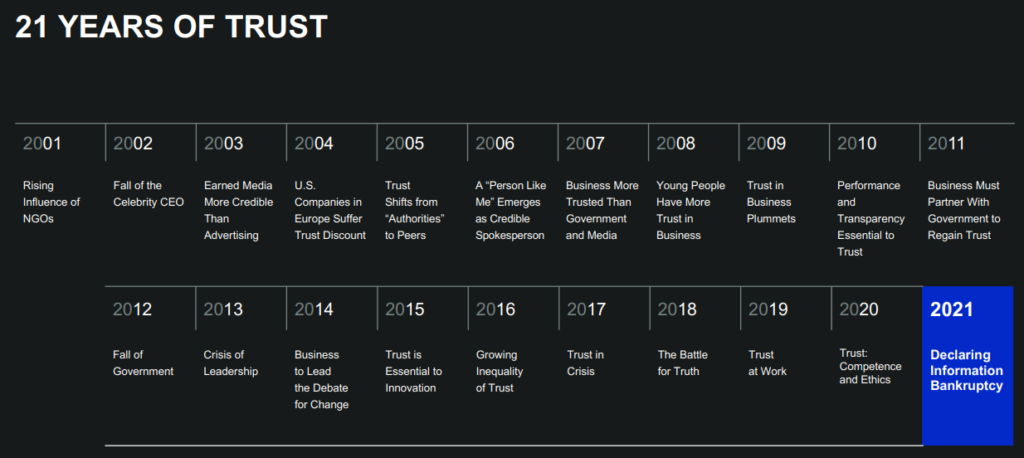

The Edelman Trust Barometer has declared 2021 as the year of information bankruptcy.

This declaration has led to some sobering changes.

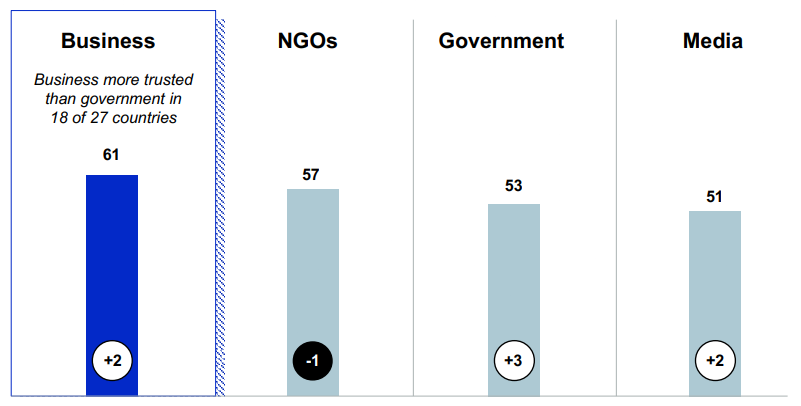

In 2009, trust in businesses plummeted. Since then, businesses have reversed course, and now in 2021, they are viewed as more trustworthy than governments in 18 of 27 countries and more reliable than media companies.

What’s going on here?

The Overton Window is shifting and clashing with reader (and customer) expectations. Readers disagree with media brands (and each other) regarding acceptable, sensible, or popular content. Media companies are caught in a difficult balancing act, juggling conflicting expectations from their persona groups.

It’s been a tough year for media companies. Many of them have lost a significant amount of their viewership as visitors and customers have changed their expectations repeatedly.

This is why accurate market research matters.

Consistent market research keeps your attention on the viewers, customers, and ideas that matter most. It keeps your brand aligned with the Overton Window, which keeps you aligned with viewers and customers, boosting trust over time.

It’s common sense.

The more aligned you are with visitor and customer expectations, the easier it is to serve (and retain) them.

How do media companies research customers?

Michael Leitner, journalist and researcher at Futurezone and Kurier, stated that “Media organizations started listening to their users’ needs.” He continues to say:

“If you want to keep your subscribers, watch their behavior: Behavioral data seems to have the strongest correlation with user satisfaction and therefore retention. Most organizations follow the RFV model (Recency – Frequency – Volume) created by the Financial Times in order to set KPIs for their retention strategies. Based on that, they try to increase engagement and retention by forming habits, for example, by improving the onboarding process and creating content that gets subscribers to come back regularly. Demographics, content types, and other metadata, like operating systems, can be a predictor for subscription likelihood and retention, but aren’t as relevant as behavior.”

It’s a data-driven approach which is a good thing, right?

It can be if you know what to do with the data. Unfortunately, many unsophisticated media companies attempt to “hit everything with the machine-learning hammer.”

“Although it’s tempting to automate as much as possible in the current data-driven environment, it doesn’t always make sense to do so. Several publishers interviewed for this paper pointed out that they abandoned data projects when it turned out that either the possible savings didn’t justify the costs or when they couldn’t find a lever to influence what they were measuring…

Current studies seem to indicate that the media industry as a whole is cautious about automation. According to a PwC study, only seven percent of interviewed media executives are planning to make “substantial investments” into AI technology in 2019, much less than the general average of 20 percent.”

Media executives are in a bit of a dilemma. They’re aware of the significant positive impact of data on their business; they also realize they can’t put all of their eggs in the AI/big-data basket. But they don’t have the experience needed to evaluate the data to make actionable decisions properly.

How market research helps media companies understand their customers?

You’ll need to identify your target audience before you’re in a position to monitor visitors and customer behavior. The better you understand your visitors and customers, the easier it will be to attract, convert, and retain subscribers.

What exactly does this mean?

It means you’ll need to be able to answer the essential questions about your visitor customer interactions. Here’s a shortlist of several questions you can ask your target audience.

- What’s your biggest problem or frustration about _____?

- Why is it a problem?

- What are the consequences of ignoring these problems or frustrations?

- The content I consume should give me _____?

- What do you do when your expectations aren’t met?

- What’s the biggest risk factor when it comes to _____?

- Content is valuable when it gives me _____?

- What trending topics do you feel everyone should know about?

- Why do you feel everyone should know about this post?

- What was the last post you shared with friends?

- What do you read the most?

- Who are your biggest influences?

These questions are based on a variety of research methods, including:

- Segmentation: It’s sorting visitors and customers into like-minded groups you can speak to on a familiar, direct, and intimate level. There are hundreds of ways to segment your audience — market, sagacity, behavioral, demographic, psychographic, ethnographic, etc. The important thing here is that your segments are actionable.

- Demographics: The study of populations including religion, ethnicity, nationality, socio-economic class, and education; demographics are typically tracked via direct and indirect methods.

- Psychographics: A profile of your customer segments AIOs, attitudes, values, behavior, expressions, and gestures. All of these subsets together create your customers’ “culture.”

- Ethnographics: A qualitative research method that focuses on observing individual cultures, norms, and behaviors. Ethnography can be conducted in person or online to map group systems, symbols, communication, and meanings to social relationships. This research method is used when organizations want to understand customers’ behavior.

As it turns out, these are the tools you’d use to identify where a specific customer segment falls in the Overton window. Another key point is that you’re able to speak to customers as a “native.”

What does this look like for an online publication?

For example, Cosmo magazine would use a specific set of cultural and social norms to speak with millennials and a different set to speak with Gen Z.

There’s an incredible amount of research behind these headlines. A quick and dirty evaluation tells us that they’re speaking to:

- Women

- Between the ages of 18 – 49

- Who are Millennials or Gen Z

- Working towards a degree or working as a professional

See the slang and culture in each of these headlines? What’s also interesting about the age is the fact that consistent market research is a must-have. The upper end of their age group continues to age out. This means they need to shift with their demographic and the Overton Window.

Cosmo readers are also interested in:

- Beauty and fashion

- Career and growth

- Food

- Fitness and reproductive health

These headlines and the articles that follow show that Cosmo has done the work. They understand their target audience, the cultural accouterments, and linguistic details that make their posts feel like readers are talking with a close friend.

What are the types of market research?

- Brand awareness: This measures whether customers are aware of your brand and whether they can remember your brand once introduced. Here’s the important detail; recognition isn’t the same as recall. The Huffington Post has brand recognition; the small regional or local publisher you frequent has recall. They remember when the local brand comes up, never before.

- Customer personas: These are specific archetypes of people in your target audience. Using our Cosmo example, if women age 18 – 49 is the segment, hipster foodies would be a particular customer persona within that group. As a general rule, your personas are a composite of people within a specific segment or cohort.

- Campaign research: This is performance data from your previous advertising or marketing campaigns. If Cosmo finds that hipsters send more referral traffic to their affiliate or channel partners, this will help them prioritize the segments, cohorts, or personas to target first/disproportionately. This is the best kind of data because it’s tied to performance and (hopefully) conversions and revenue.

- Competitive analysis: This research method shows you where to attack. It’s used to gauge success compared with a direct competitor and measure their potential reactions to your organization competing with them. Done well, this analysis shows you where your competitors are vulnerable and whether you should make a move.

- Customer loyalty: This is a byproduct of return visits. These customers provide your company with fidelity, stability, and consistency. When customers extend their loyalty, your media company becomes “our company.” Customer loyalty is a lot like marriage; you’re expected to operate in line with the values, culture, norms, and ethics identified in your initial research.

- Focus groups: These are group interviews that take place with a specific segment of your persona group. Focus groups are qualitative methods used to: test new concepts, evaluate content and promotions, develop ideas or questionnaires, position products or services, assess product or service usability.

- Interviews: These are one-on-one interviews with a representative member of your persona group. These customers can provide you with an in-depth look at the specific questions I mentioned above.

- Market segmentation: Again, these are groups of like-minded individuals; to use our Cosmo example, these could be single women, hardworking professionals. It could be married women in the same life cycle. Market segmentation makes it easier to target a specific subset of your target audience, tailoring your message around the data that customers expect.

- Observational research: This includes ethnographic research, UX/UI research, case study research, phenomenological research, and more. These details are focused on direct observation and testing, but they’re qualitative research methods.

- Pricing: If you’ve identified your target audience and you know who your direct and indirect competitors are, you have the data you need to set your pricing. Pricing is a measurement of your customer’s ability and willingness to pay for your product, whether that’s a subscription, service, or via advertising.

How do you create personas for your publishing company?

Your personas will be based on the upfront work you’ve done already. It uses real data that’s designed to help you segment your audience.

- Complete customer research; incorporate the data from your upfront research.

- Build a list of keywords: You can use tools like Semrush, Soolve, or UberSuggest to build a list of keywords.

- Create a list of possible personas: Outline the activity, desires, frustrations, keywords, metrics, and demographics associated with your content.

- Validate these personas: Create content that appeals to each of these items, then test the results. Analyze the results. Are keywords improving? Are the metrics producing the results you need?

It’s an iterative process.

You’ll want to continue to optimize your personas as you go along.

What should you do with market research once you have it?

The easy answer is — use it to serve your customers. How specifically do you go about doing that?

1. Refine your personas

Here’s a common mistake — organizations spend a significant amount of time creating their personas then, they forget about them. You want to treat your personas as living, breathing things. Once created, you can (and should) use your personas for a variety of essential tasks.

- Creating advertising and marketing copy

- Create content that appeals to each specific persona

- Update your business or marketing plans

- Use to adjust or scale pricing

- Create products that customers want

2. Find new customers, upsell existing customers

With your data in hand, you should be able to answer the following questions:

- Is there a demand for your content, product, or service?

- How many people are interested in your offer?

- What’s the income range for your customers?

- How many competitors are already offering something similar?

- What do potential customers spend on these options?

- Where do customers spend their time?

If you have the answers to these questions, you’ll know where to spend your marketing dollars; you’ll be prepared for the unexpected, and you’ll have what you need to make the necessary changes to optimize your campaigns.

3. Find an edge over your competitors

You’ll have a clear idea of your competitors. You’ll also have a clear sense of the competitors you should pursue and the ones you should avoid. With this information, you’ll be able to identify:

- Your strengths and weaknesses

- Your competitor’s strengths and weaknesses

- The window for market entry

- Any barriers that may prevent you from entering or competing effectively

- Secondary or tertiary competitors who may become a problem

How can media publishers identify their competitors?

Find the companies and organizations pursuing the same segments, cohorts, and personas as your organizations. It can be as simple as running a Google search or as complex as using tools like Nielsen, SEM Rush, Adobe Analytics, or Google Search Console.

4. Audit and improve employee training and the customer experience

If you know your customers well, you’ll be able to train your employees well. You can use your market research and persona data to train employees — give them the right procedures, scripts, and templates. Once you’ve tested your personas, give your employees the manuals, practice, and training they need to take care of your visitors and customers.

One hand washes the other.

If you know your customers well, you can train your employees well. If you train your employees well, you’ll take good care of your customers.

What tools can you use to conduct market research?

There are lots of free and paid market research tools available to use. These tools range from entry-level to enterprise-class tools.

- AuthorityLabs: Search engine ranking and keyword data to automate your SEO monitoring, track local and mobile rankings, and recover not provided keywords

- BuiltWith: Find out what websites are built with and filter by location, traffic, vertical and more.

- Bureau of Economic Analysis: Source of accurate and objective data about the nation’s economy.

- Google Alerts: Monitor the web for interesting new content.

- Google Trends: Analyzes the popularity of top search queries in Google Search across various regions and languages. The website uses graphs to compare the search volume of different queries over time.

- Microsoft Power BI: Power BI is a collection of software services, apps, and connectors that work together to turn your unrelated data sources into coherent, visually immersive, and interactive insights.

- NielsenIQ: Your home for complete consumer intelligence.

- Pew Research Center: Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes, and trends shaping the world.

- Qualtrics: Unlock breakthrough insights with market research panels.

- Quantcast: AI-driven real-time advertising, audience insights and measurement.

- Semrush: Do SEO, content marketing, competitor research, PPC and social media marketing from just one platform.

- Social Mention: This tool finds who’s talking about your brand or competitors in the news & social media.

- Soovle: Trending internet keywords.

- Sparktoro: Instantly discover what your audience reads, watches, listens to, and follows.

- Statista: The Statistics Portal for Market Data, Market Research and Market Studies.

- SurveyMonkey: The World’s Most Popular Free Online Survey Tool

- Typeform: People-Friendly Forms and Surveys

- The Census Bureau: The Census Bureau is the leading source of quality data about the nation’s people and economy.

- Think with Google: Digital Marketing Toolbox: Tools designed to help improve your brand’s marketing, web performance, analysis, digital experience, and more.

- UberSuggest: UberSuggest helps you generate keyword ideas for your content marketing strategy and production.

- UserTesting.com: Experience what your customers experience. Get a vivid, first-hand view of what your customers are thinking and experiencing with Customer Experience Narratives (CxNs).

- Website Grader: Grade your website for speed, mobile, search, advertising, readability, technology, security and more.

This list of tools isn’t intended to be comprehensive. It’s a helpful start for those looking for a list of tools they can use to get started.

Media companies need consistent market research

As the Overton Window is shifting, media companies need to be able to change with it.

Readers are constantly being blown back and forth by various events — misinformation, a lack of transparency, conflicting narratives, and general confusion. Customers may tread lightly as they work to navigate the changing social climate.

Trust can recover.

The more aligned you are with visitor and customer expectations, the easier it is to serve (and retain) them. Consistent market research keeps your attention on the viewers, customers, and ideas that matter most. It keeps your brand aligned with the Overton Window, stay aligned with your viewers and customers, and you’ll find your media company succeeds where others fail.