Ecommerce isn’t immune to the constant changes happening in search right now. How we make purchases online is also evolving. OpenAI is partnering with shops like Walmart and Shopify in a “rolling” admission of companies being inducted into their product feeds to allow users to purchase products directly from ChatGPT.

It’s pretty much a certainty that other shops and AI companies will follow suit with their own collaborations. For ecommerce brands, this means clicks will be even lower than before, and traffic to their sites could plummet until they strike a deal with the “devil” (an AI company).

From the first time West Germany ordered supplies via electronic typewriters in 1948, to the cell phone armband I ordered from Walmart a couple of weeks ago for when I go jogging, the ecommerce journey has been long and complicated. The addition of AI will seemingly only make things more complicated for ecommerce marketers before it evens out.

How will Google adjust its approach to product availability? Will Amazon still reign supreme in shopping? Do they have an even bigger plan up their sleeves? Or will Amazon actually get left behind in an AI ecommerce world? Let’s look at the history of ecommerce and how to prepare for what comes next.

The Old Way: Ads, Keywords, and Product Feeds

When it launched in 2002, Google Shopping didn’t start as a helpful catalog of what exists on the internet. It was originally driven by advertising instead of organic discovery.

When someone searched for “running shoes,” Google wasn’t thinking, “I’ll show this person the best running shoes.” It was thinking, “I’ll show this person the running shoes from advertisers who bid the most for this query.” Though one could argue that it’s still doing this with sponsored product carousels.

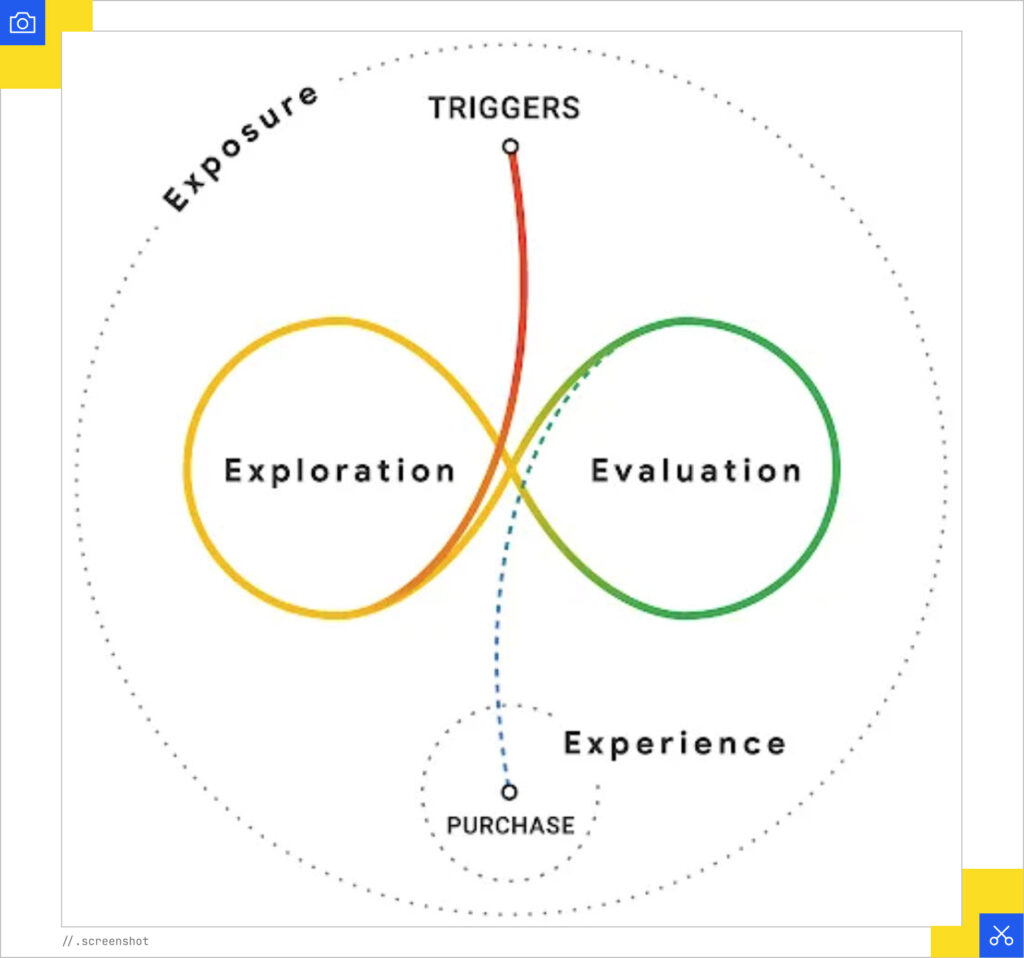

Google showed how online shopping worked with their “Messy Middle” study in 2020 that mapped the loop shoppers enter between exploration (passively browsing options) and evaluation (actively comparing specifics). People often switch between these two modes until something triggers a decision.

The actual moment of product consideration was gated behind ad spend. You could have the best product, the best price, and the best reviews but if you weren’t bidding, you weren’t visible.

When Amazon launched in the 90s, the interface was a bit clunky and chaotic, but they built a closed system where organic search was the default because they controlled the entire funnel.

For years, you had to pay Google to be seen, or sell on Amazon and let their algorithm decide your fate.

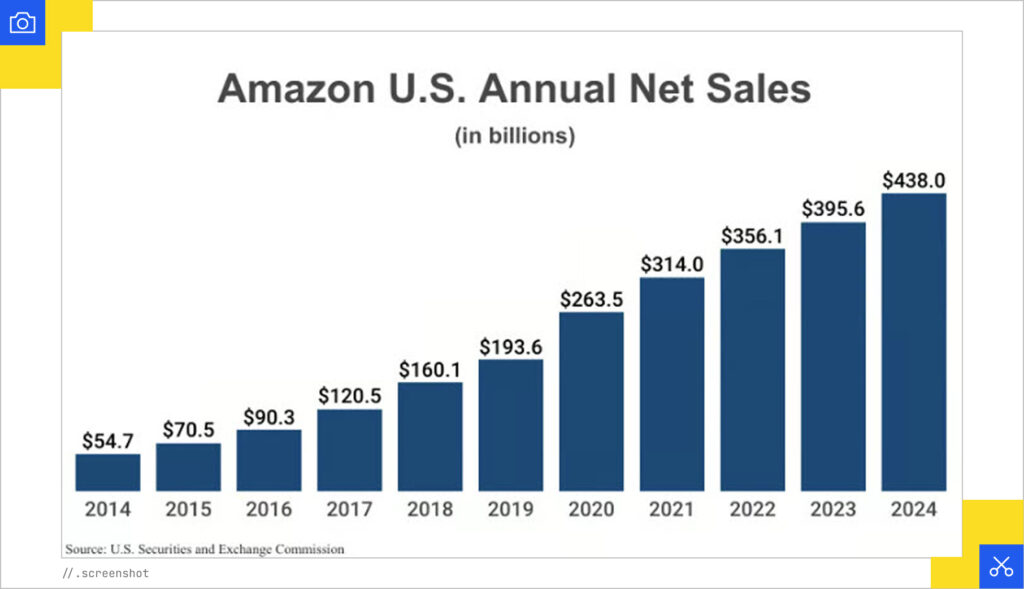

The global e-commerce market is now a $6.8 trillion industry, projected to reach $8 trillion by 2027, and Amazon, Walmart, and eBay remain the largest ecommerce companies. For now.

The Evolution: Google's Ecommerce Renaissance

For years, shoppers primarily did their research on Google but went to Amazon for direct purchases.

To compete, Google recently introduced AI-powered tools that help people discover, evaluate, and purchase products.

AI-Driven Visual Commerce

Google’s most visible transformation has been in visual shopping experiences. Virtual try-ons now let shoppers see how jeans will look on them or how sunglasses will fit their face shape.

The platform now prioritizes 360° product images, automatically surfaces size recommendations based on user reviews and fit data, and uses AI to generate product visualization that helps shoppers understand scale, texture, and real-world appearance.

Google Lens has also evolved from a novelty into a genuine shopping tool, allowing users to photograph products in the wild and instantly find where to buy them, along with reviews, price comparisons, and similar alternatives.

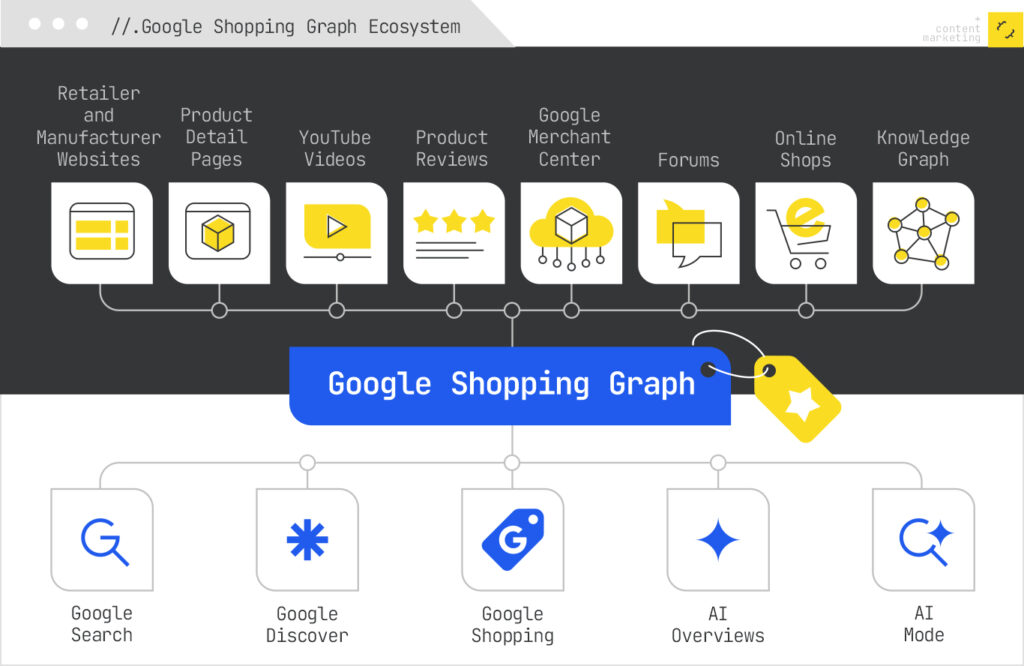

The Shopping Graph

The Google Shopping Graph (Google’s underlying product knowledge base) pulls from merchant feeds, structured data markup, product reviews, pricing information, and availability signals across the web. It’s comprehensive, but access to prime real estate within that graph required a credit card. Organic product listings existed but were demoted, buried, or displayed in contexts where nobody was actually looking.

“Google’s Shopping feed was designed for a world of keywords and clicks. Its job is to make sure your product shows up when someone types a query, gets filtered correctly, and leads to a transaction on your site.”

- Mike King

By indexing billions of product attributes from merchant feeds, web pages, and user reviews, Google has built a knowledge layer that understands products.

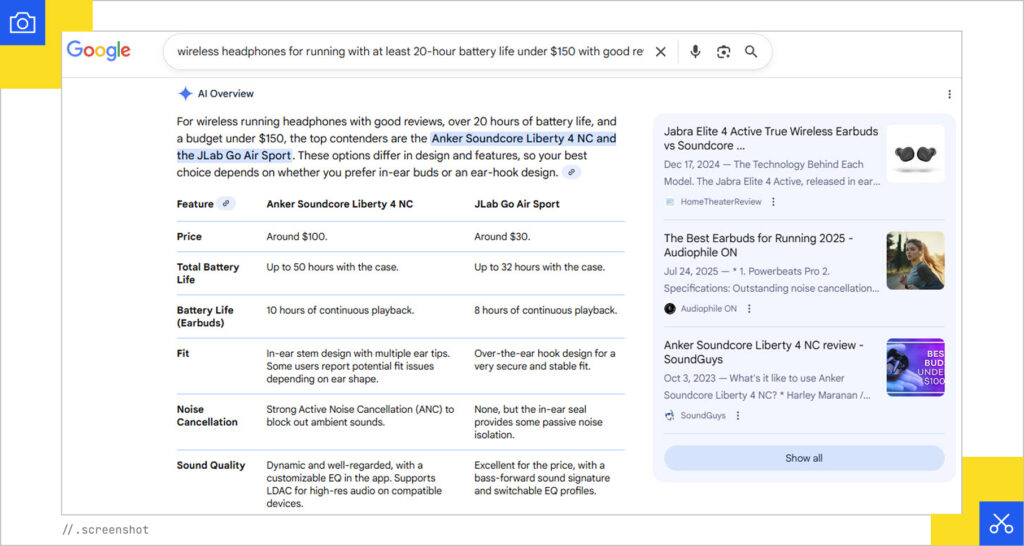

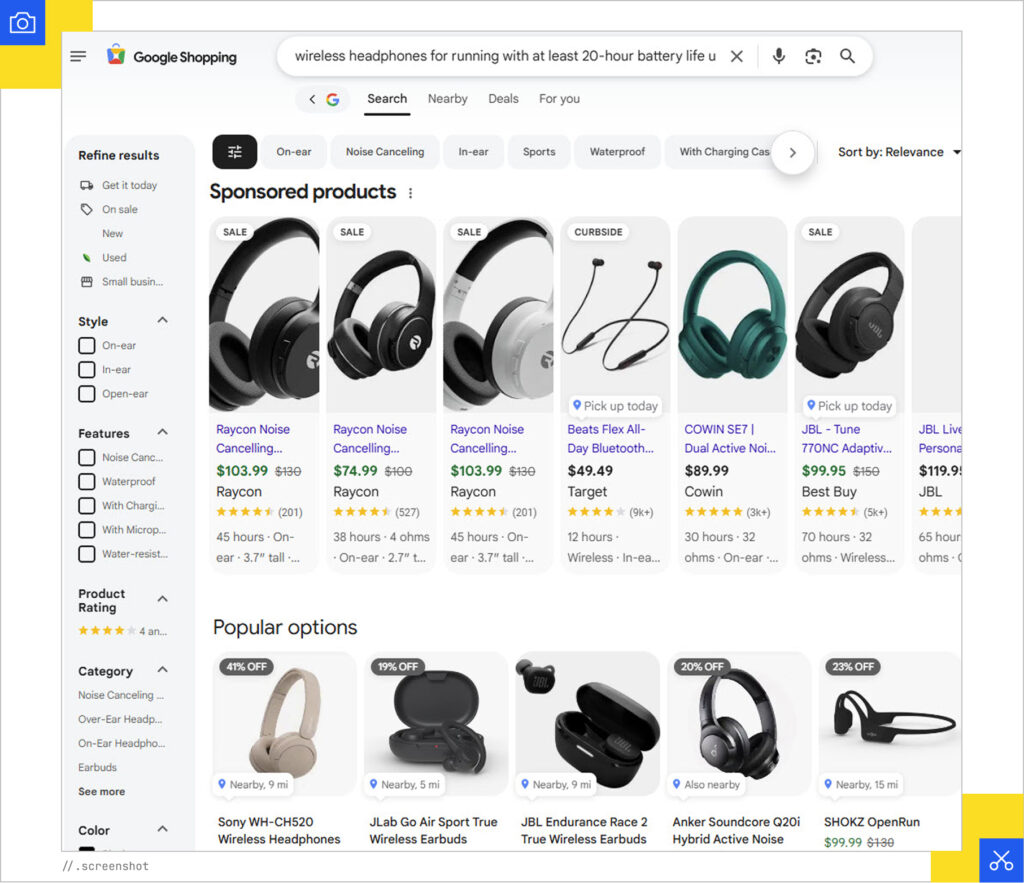

Google can now answer queries like “wireless headphones for running with at least 20-hour battery life under $150 with good reviews” by actually understanding product specifications instead of just matching keywords.

For brands, this means your product data is as important as your content strategy.

The Merchant Center

Google Merchant Center is where ecommerce brands submit their product feeds of structured data files containing everything from product titles and descriptions to prices, availability, images, and GTINs (Global Trade Item Numbers).

Without it, your products simply don’t exist in Google’s shopping universe. No Shopping tab results, no product carousels in search, no visual try-ons, no AI-powered recommendations.

But submitting a feed is just the beginning. Google Merchant Center enforces strict data quality standards. Products with missing GTINs, low-quality images, price mismatches between your feed and your website, or availability discrepancies are not approved.

The feed itself requires constant maintenance, like price changes and inventory fluctuations, and Google expects your feed to reflect real-time accuracy. You can automate this through platform integrations (Shopify, WooCommerce, BigCommerce), but even automated feeds require monitoring for errors, policy violations, and optimization opportunities.

Merchant Center now supports enhanced attributes that feed Google’s AI systems such as product highlights, detailed descriptions, lifestyle images, 360° views, and structured attributes that help the Shopping Graph understand context.

From Search to Purchase

Organic shopping surfaces have grown across Google’s properties. Product carousels now appear prominently in traditional search results. “Best products for…” collections curate AI-driven recommendations based on reviews, specifications, and user behavior.

The Shopping tab has transformed from a paid-placement marketplace into an AI-curated discovery engine that surfaces both ads and organic results based on relevance and quality signals.

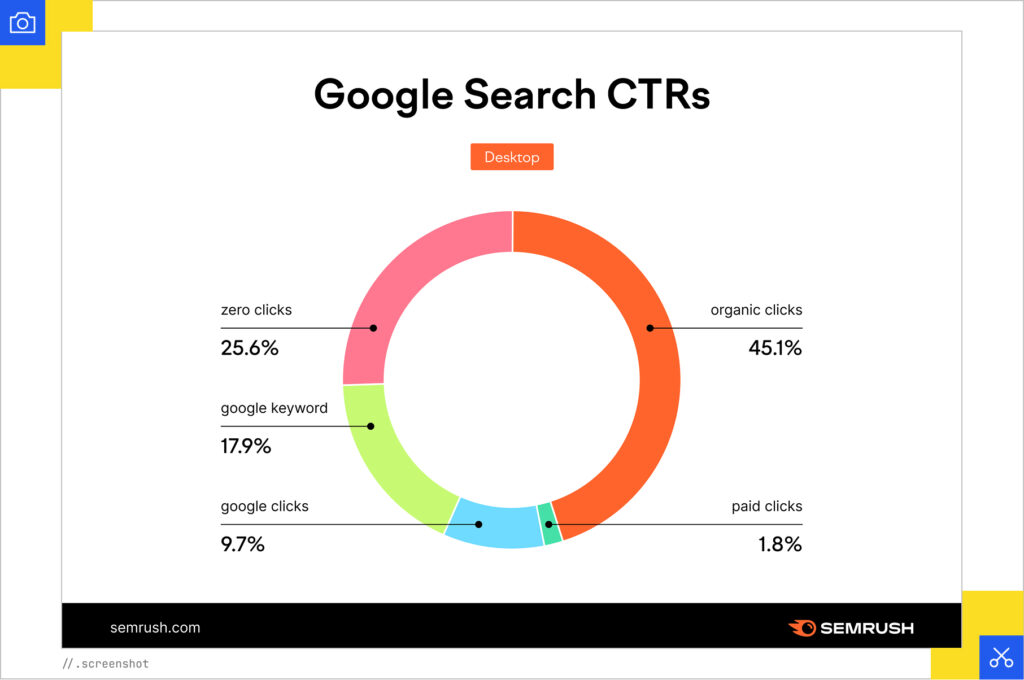

The shopping tab doesn’t collect much traffic overall, though. A study by Semrush found that clicks within the Google universe (i.e., to the Images, Shopping or News tabs) only amounted to 9.7% of clicks:

The New Ecommerce Content Journey

The traditional funnel of awareness, consideration, and conversion still exists, but the surfaces where it plays out have multiplied and the signals that determine visibility have changed (there’s that “Messy Middle” again).

Shoppers can now compare products, read synthesized reviews, check availability, and assess fit without clicking through to your site. Your product page might be the fourth or fifth touchpoint, not the first, and each touchpoint needs optimization.

For ecommerce brands, this requires:

- Structured product data that feeds the Shopping Graph accurately and comprehensively.

- Visual assets optimized for AI interpretation (think 360° views, contextual lifestyle imagery, video content, etc.).

- Multi-surface optimization that recognizes shoppers might engage with your brand across five different Google touchpoints before converting.

Google is attempting to rebuild the entire discovery-to-purchase journey with AI and merchant data. Ecommerce shops will have to meet shoppers exactly where Google’s AI delivers them, with exactly the information needed to convert.

The Amazon Effect

To understand why Google is investing so much into its shopping infrastructure, you need to understand what it’s competing against: the Amazon machine, which has a decade-plus head start with product discovery and logistics.

Amazon went beyond simply building an online store and created an entirely self-contained shopping universe, including search, evaluation, purchase, and fulfillment.

Approximately 52% of consumers start their product searches directly on Amazon. Not Google, not brand websites, not social media. This disrupts Google’s historic role as the internet’s front door.

What makes Amazon’s grip so difficult to break is Amazon’s algorithm, which operates as a unified intelligence layer that processes ads, organic rankings, inventory availability, shipping speed, review quality, purchase history, and personalization signals simultaneously, in real-time, within a single closed system.

When you search for “wireless headphones” on Amazon, the company knows things like:

- Which products you’ve bought or browsed before

- Your Prime membership status and delivery address

- Which sellers have inventory in nearby fulfillment centers

- Which advertisers are bidding on that query and at what margins

All of this intelligence flows into a single decision: what to show you, in what order, optimized for both relevance and Amazon’s revenue.

Google's Fragmentation Problem

When Google surfaces a product, it’s looking at:

- Product feed data from a merchant’s Google Merchant Center account

- Scraped content from the merchant’s website

- Review data from multiple sources (the brand’s site, third-party platforms, sometimes nothing at all)

- Inventory data that might be hours or days old

- Pricing that may not reflect current promotions

- Shipping estimates based on generic location data, not actual fulfillment proximity

However, this fragmentation can cause accuracy issues. A shopper might see a product on Google, click through, and discover it’s out of stock, more expensive than advertised, or won’t arrive for two weeks. Amazon shoppers rarely encounter this disconnect because Amazon controls the entire experience.

But Amazon’s most underestimated advantage might be its reviews. Amazon hosts millions of verified purchase reviews with detailed ratings, thousands of customer photos showing products in real-world contexts, and Q&A sections where previous buyers answer questions from prospective ones.

Amazon’s algorithm learns which review patterns correlate with purchases, which products have review sentiment that drives repeat buying, and which Q&A responses reduce return rates. This behavioral data feeds back into ranking, recommendations, and even product development insights.

Google can display review snippets and compile ratings from third-party sources, but it can’t replicate the depth, verification, or behavioral learning of Amazon’s native review system.

The Logistics Layer No One Else Has

Beyond digital discovery, Amazon’s physical infrastructure creates advantages Google simply cannot match. When product quality, price, and reviews are roughly equivalent across options, delivery speed becomes the tiebreaker. And Amazon wins that tiebreaker almost every time with its two-day (or same-day) Prime shipping.

Google can facilitate checkout, but it can’t promise delivery. It can surface products, but it can’t guarantee they’re in stock at a nearby fulfillment center.

ChatGPT's New AI Shopping Model

OpenAI recently announced that it was launching shopping within ChatGPT, allowing shoppers to find and purchase products directly within the AI system. In doing so, OpenAI might be building the first genuine competition to Amazon and Google.

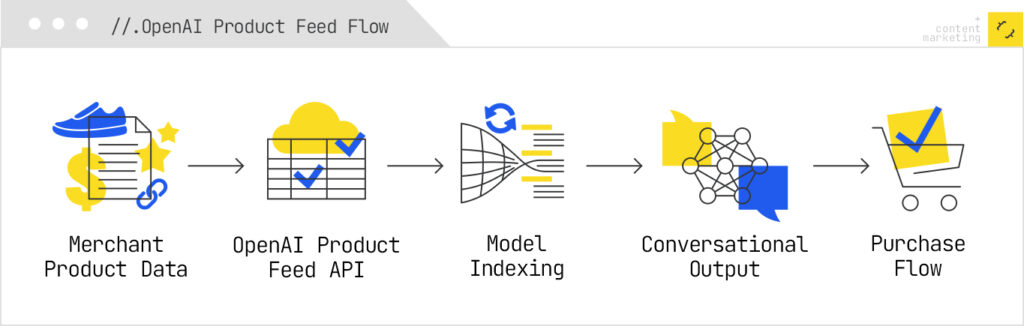

It uses their Product Feed Specification, which defines how merchants share structured product data with OpenAI so ChatGPT can surface their products in search and shopping experiences.

Here’s how OpenAI explains how it works:

- Relies on merchant-provided feeds to ensure accurate pricing, availability, and other key details.

- Powers product matching, indexing, and ranking in ChatGPT.

- Defines the preferred delivery method and file format for reliable ingestion.

- Provides a complete list of required and optional attributes (with examples) to help you validate your feed.

- Frequent updates improve match quality and reduce out-of-stock or price-mismatch scenarios.

The goal here is to build a reasoning layer that understands what makes products similar or different.

Conversational Discovery: How Humans Actually Shop

As Mike King wrote in his recent ecommerce article, “In a conversational commerce experience, there is no ‘position one.’ There’s just the most contextually relevant response.”

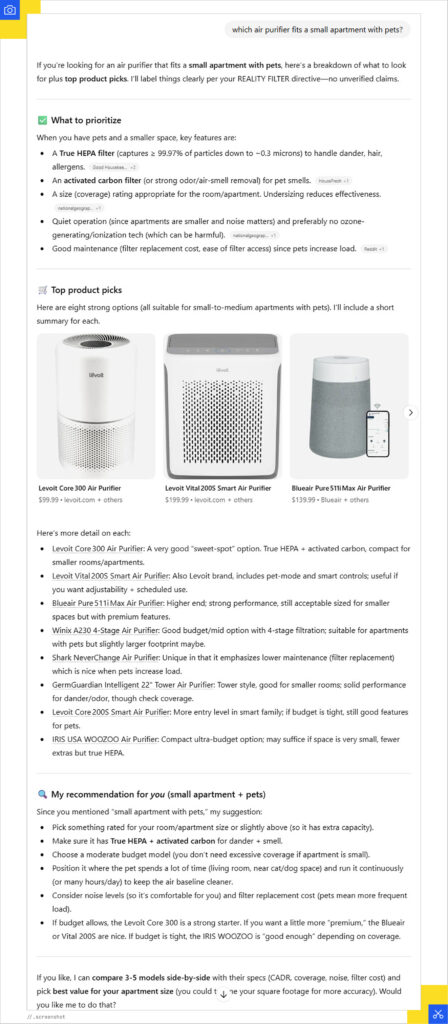

Ask ChatGPT “which air purifier fits a small apartment with pets?” and you might get something Amazon and Google still can’t quite replicate: a genuine conversation that asks clarifying questions, reasons through trade-offs, and arrives at personalized recommendations.

This isn’t so much a search anymore but rather a shopping consultation. It mirrors how humans actually make purchase decisions: conversationally with clarifying questions and contextual reasoning. Not “here are 10 results ranked by relevance,” but “let me understand your situation and recommend what fits.”

This turns product discovery into a dialogue instead of a query. Brands can’t just optimize for “air purifier for pets” as a keyword anymore. They need to become the right answer when AI sorts through dozens of possible variations of that need.

The Cross-Platform Marketplace

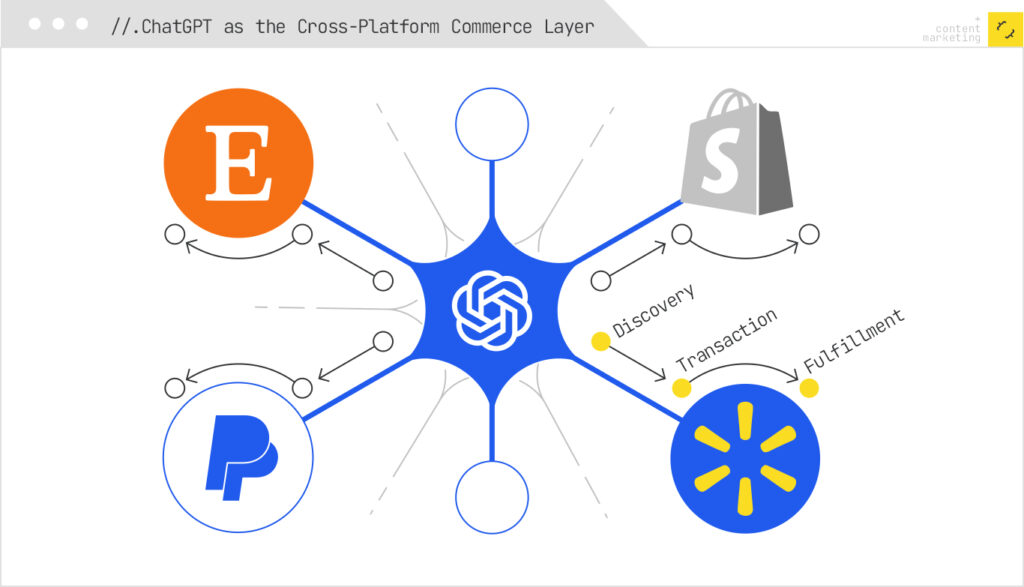

What makes OpenAI’s approach genuinely threatening to both Google and Amazon is its infrastructure-agnostic model. ChatGPT is positioning itself as a conversational layer that sits above existing commerce infrastructure.

Through integrations with Shopify, Walmart, Etsy, and most recently PayPal, ChatGPT can facilitate product discovery and purchase completion across multiple merchants and platforms without owning inventory or managing shipping. A user might discover a product through a ChatGPT conversation, purchase it through a Shopify merchant’s native checkout via ChatGPT’s integration, and complete payment through PayPal, all without leaving the conversation.

ChatGPT becomes the discovery and transaction layer, but the actual commerce happens across various merchants and platforms. You could say it’s kind of the anti-Amazon model.

Merchant Control

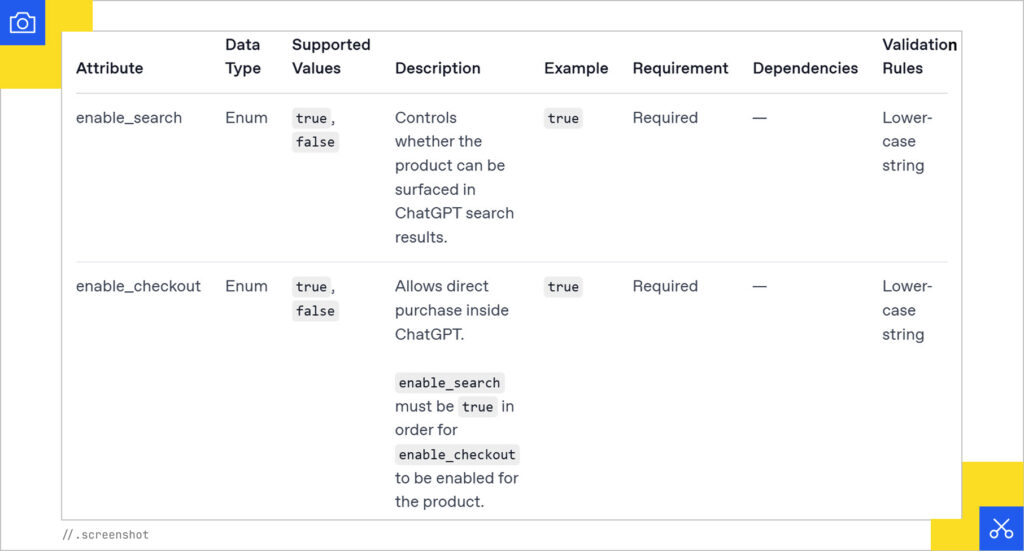

Perhaps most significantly, OpenAI’s product feed includes something Google and Amazon don’t offer: explicit merchant control over AI participation through enable_search and enable_checkout flags.

With enable_search, merchants can control whether their products appear in conversational discovery at all. With enable_checkout, they can control whether ChatGPT facilitates the transaction or simply refers users to their site. This gives merchants optionality that doesn’t exist in Google’s Shopping Graph or Amazon.

On Google and Amazon, merchants compete for algorithmically-allocated visibility. On ChatGPT, merchants can choose their level of integration and maintain more control over the customer relationship.

A direct-to-consumer brand might enable search (to gain visibility) but disable checkout (to preserve first-party customer data and email capture). A marketplace seller might enable both to maximize conversion. A premium brand might disable search entirely, keeping ChatGPT from recommending their products in generic queries.

How to Use AI as the Product Shelf

We’re entering an era where the product shelf isn’t a webpage or a search results page anymore. And the shelf space isn’t determined by who paid the most or optimized best for keywords. It’s determined by which products AI decides to recommend.

ChatGPT, Perplexity, and other AI chat interfaces eliminate the visual SERP entirely. Shopping queries become conversations where the AI acts as a personal shopping assistant and the “search results” are whatever products the model decides to mention. So what does that mean for you and your ecommerce business?

Google’s Shopping Graph feeds its AI models with billions of product attributes, teaching them to understand that “wireless headphones for running” implies needs for secure fit, durability, and good battery life, even if those terms weren’t explicitly mentioned. OpenAI’s models are learning similar patterns from whatever product data they can access through partnerships, web scraping, and API integrations.

Semantic Resonance Over Keyword Ranking

This creates an entirely new optimization challenge: semantic resonance. Product data, descriptions, and structured content must align with how AI models reason about product categories and user needs.

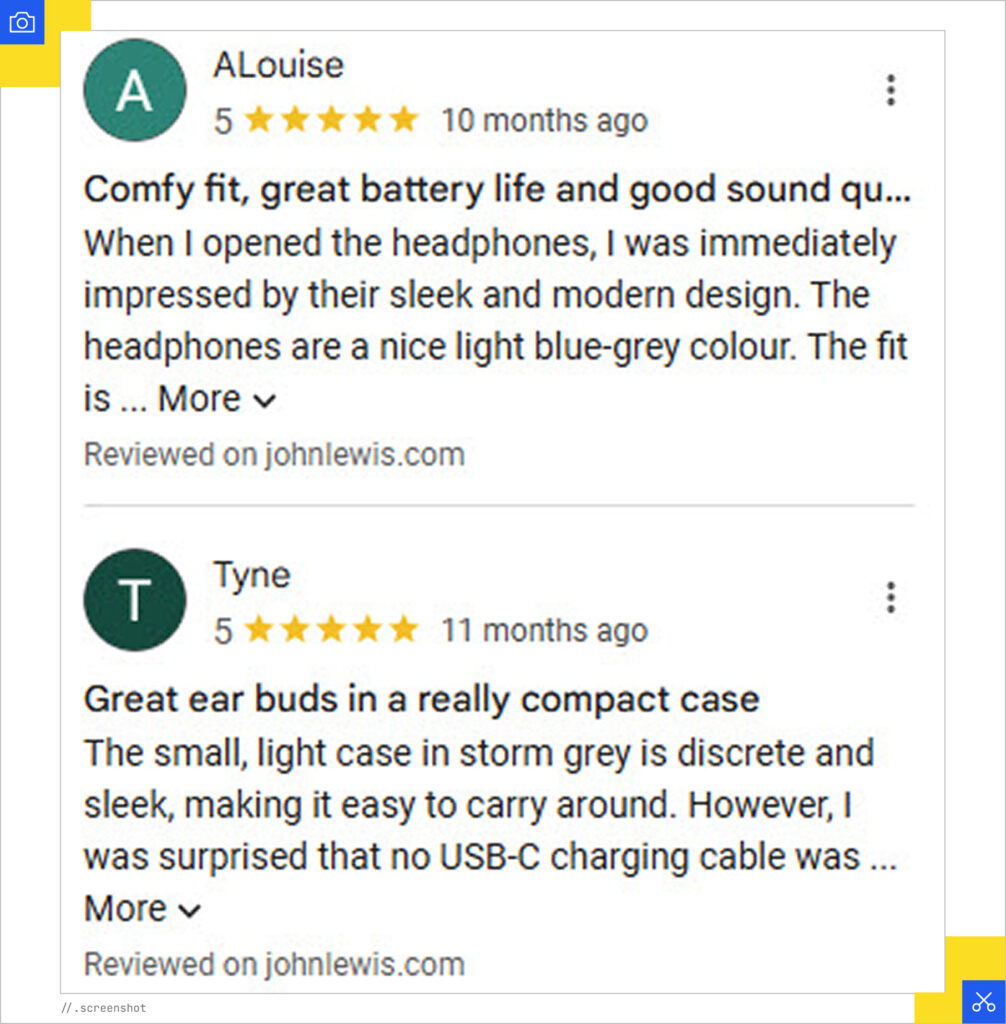

If your product feed describes “wireless earbuds with 8-hour battery” but a competitor’s feed includes detailed use-case context like “8-hour battery life suitable for full workday use, commuting, or long flights without recharging,” the AI model has more semantic material to work with and match against user intent.

Similarly, reviews that describe specific use cases, detailed attribute feedback, and comparative context give AI models training data for understanding when your product is and isn’t the right fit. A review that says “perfect for small ears, stayed secure during a marathon” teaches the model something actionable. A review that says “great product, 5 stars” teaches it nothing.

The Next Step for Ecommerce

Google’s business model depends on paid search ads appearing alongside organic results. But AI Mode responses don’t have traditional ad units because they’re conversational, synthesized answers. How does Google insert sponsored products into an AI-generated recommendation in an authentic way?

The answer could be a hybrid model like AI Overviews that include “sponsored” products alongside organic recommendations, with informational content that attempts to maintain trust while monetizing the interaction.

But if users perceive that AI is recommending products because advertisers paid for placement rather than genuine fit, this won’t work well. It’s a thin line between preserving search ad revenue and building credible AI shopping experiences.

The most likely scenario: Google leans into ads within its AI recommendations, OpenAI pursues affiliate partnerships and premium subscriptions because it lacks Google’s ad platform, and Amazon builds its own AI shopping features.

How you can prepare for the future of ecommerce:

- Semantic product data: Structured attributes, detailed specifications, and context-rich content that teach AI models not just what your product is, but why it matters, when it’s appropriate, and how it compares.

- Multi-modal presence: Robust Google Merchant Center feeds, strategic partnerships with AI platforms, and comprehensive Amazon catalog optimization to ensure your products are discoverable.

- Review cultivation: Detailed reviews help train AI models to understand your product’s strengths, limitations, and ideal use cases.

The ecommerce industry will continue to constantly evolve as AI becomes more integrated with our daily lives. Is your shop ready?