How do luxury brands fare in a recession?

Conventional wisdom says only essential services perform well – healthcare, child care, plumbing, electrical, grocery, transportation, etc. It seems obvious that an economic downturn would hammer enterprise luxury brands, right?

But is that the case?

Are luxury brands being hit hard by our current economic climate? Well, it’s no bed of roses, but as you’ll soon see, this is an incredible opportunity in disguise.

How luxury brands fare in an economic downturn

U.S. inflation hit a 40-year high in June (peaking at 9.1 percent). What was the impact on luxury brands? Well, it was negligible, to be honest.

According to the Bain & Company Luxury Study, the luxury segment contracted in 2020 due to the pandemic, “the market grew by 13% to 15% in 2021 to €1.14 trillion, according to our estimates. However, this is still 9% to 11% below 2019 levels.”

But wait, there’s more.

“The market for personal luxury goods—the “core of the core” of luxury segments and the focus of this analysis—has come roaring back, experiencing a V-shaped recovery in 2021. After a sharp contraction in 2020, personal luxury goods sales are set to beat their pre-Covid record, with the market forecast to grow by 29% at current exchange rates to hit €283 billion, likely finishing the year up 1% from its 2019 record.”

It gets better.

“Regional shifts were indeed marked by the persistent rebalancing of where luxury purchases are made. Purchases made locally have grown by 50%–60% since 2019, and tourist purchases have declined 80%–90% vs. 2019. The Americas posted solid growth, particularly in the US, where a new map of luxury is fast emerging with the increased importance of secondary cities and suburban areas. The Americas account for €89 billion in annual sales (31% of the global market).

Overall, online and monobrand stores were the key channels for 2021’s recovery and should lead growth in the medium term. After a 50% jump from 2019 to 2020, online continued to power on, thanks to accelerated adoption during Covid-19. Websites devoted to a single brand gained ground on other types of online platforms and now make up 40% of the online segment, up from 30% in 2019.” (emphasis added)

A deeper dive into their study shows that “luxury sales bounced back to 301 billion dollars in 2021, up 7 percent from 2019 and pre-COVID-19 lockdown levels.” We’ll unpack this in a minute but let’s look at some additional data points to see if these facts bear out.

Bain & Company’s report shows that:

- Shoes grew by 11% compared with 2019 to reach €23 billion

- Accessories (the largest luxury goods category in 2021) increased by 8%, compared with 2019, to €62 billion

- Jewelry reached €22 billion, up 7% from 2019

- Watches and beauty grew back to their 2019 levels

- Beauty recovered to €60 billion, just 1% below its 2019 levels

“The prompt 2021 rebound suggests that growth will be healthy for the personal luxury goods market in the medium term. We expect the sales recovery to continue over the next four years, with the personal luxury goods market reverting to annual growth rates between 6% and 8% until 2025.”

There’s a lot to unpack here.

- Consumers are spending despite the downturn

- The luxury segment has fully (or almost fully) recovered from the pandemic

- The luxury segment has shifted to a focus on earned (organic and local search) owned media (websites)

- Websites devoted to a single brand are gaining ground over traditional approaches

- Brand growth continues undeterred, recovering and moving past previous losses

This is great news – if you’re prepared.

- READ MORE: Your SEO Playbook in Economic Uncertainty

Why luxury brands need Organic Search

Take a look at this keyword data for Gucci.

What do you see?

According to the Semrush data (in the screenshots above), Gucci would need to spend $10.6 million in Google Ads to attract 9.4 million visitors. The vast majority of that traffic, 9.1 million visitors (96.81% of their traffic), arrives via branded keywords. Only 267.8K (3.19%) of those visits come from non-branded traffic.

All of this traffic arrives via 651.7K keywords.

Calling this out as a missed opportunity is an understatement. There’s an opportunity here, one Gucci can use to steal market share from inattentive competitors.

What am I talking about?

They’re ignoring a tremendous amount of non-branded keywords. These keywords are a chance for Gucci to condition its customers. When you think of a specific category, think of Gucci.

Here’s why this matters.

Research from Uberall makes the significance of this crystal clear.

“According to our research, consumers discover global brands more often through unbranded queries (58 percent), which are highly competitive compared to branded searches (42 percent).

Brands often assume that people seek them out directly. But failure to address unbranded search means they could be missing out on a great deal of potential exposure. A clear understanding of consumer search behavior is essential to optimizing your digital marketing. And in a time of budget constraints, it’s now more critical than ever.”

We’re using this percentage from Uberall’s research; this means:

9.1 million visits is 42% of 21.7 million visits (total). This means Gucci may be leaving 12.6 million additional visits on the table! (21.7 – 9.1 = 12.6)

That’s painful to look at.

It’s just an estimation, of course, but even if the reality is 25% of the number I’ve listed above, it’s still a significant loss.

This is no good.

If we head to Gucci’s site and mouse over “women,” we see that they have the following categories in their navigation menu.

Gucci has nine main navigation categories – gifts, what’s new, handbags, women, men, children, jewelry and watches, decor and lifestyle, and beauty. There’s some overlap in the main categories in the section “women” these include:

- Latest arrivals

- Gifts

- Handbags

- Travel

- Ready-to-wear

- Shoes

- Wallets/small accessories

- Accessories

Each of these includes a substantial list of subcategories, each with its own list of products. These categories are a great way to identify profitable organic search queries (top, middle, and bottom of the funnel) throughout the buyer’s journey. Looking back at Gucci’s list of branded vs. non-branded keywords, one thing stands out.

Gucci is leaving money on the table.

This means they’re not part of purchase discussions and queries that are taking place online.

So how do we fix this?

How can enterprise luxury brands leverage SEO to tap into new markets?

Step #1: Optimize owned media

Focus your attention on optimization first. You may be surprised to learn that there are missed opportunities on this front as well. Google’s recent Product Review Updates and enhancements of eCommerce search results mean brands have a lot of work to do to bring their websites up to speed.

Let’s take a closer look at what this means.

Add structured data to your web pages (and Google Merchant Center Feed)

Google’s recent announcement means brands can now appear in Google Shopping results simply by using structured data on their web pages.

Meaning what, exactly?

Add structured data to your web pages, and you may be eligible for enhanced product experiences (e.g., Rich Snippets)

There are two classes of eligible experiences:

- Merchant listing experiences: These web pages allow shoppers to purchase on their site

- Product snippets: Web pages that include product information (e.g., sell products, share product reviews, curate or aggregate data from third-party websites)

If luxury brands decide to share product structured data with Google, their products may be displayed in search results via Rich Snippets, Google Shopping, Google Images, and other Google products. Merchants may be eligible for merchant listing experiences – without a Google Merchant Center account (which was needed in the past).

Google is signaling the importance of eCommerce websites as they build out a Shopping Report in Google Search Console.

Optimize Core Web Vitals

Last year, SEOs over-indexed on Core Web Vitals (CWV) fearing that it would be a significant ranking factor.

Well, it hasn’t made waves, but CWV still matters. In fact, a fast-loading website can be the difference in millions of dollars of revenue for a luxury brand like Gucci. And right now, that’s exactly what we’re talking about.

Take a look at Gucci’s score on Google Page Insights.

Yikes.

Gucci.com failed the Core Web Vitals Assessment for both mobile and desktop. I get it, presentation is foundational for luxury brands, but that doesn’t mean you can’t optimize both form and function. Gucci.com fails to load quickly, display properly, or function adequately.

It looks fantastic, but more work needs to be done here.

Who cares, though?

So it’s a little slower than expected. That’s not really a big deal now, is it?

It’s a very big deal.

Google explains why this is so important.

“Through both internal studies and industry research, users show they prefer sites with a great page experience. In recent years, Search has added a variety of user experience criteria, such as how quickly pages load and mobile-friendliness, as factors for ranking results. Earlier this month, the Chrome team announced Core Web Vitals, a set of metrics related to speed, responsiveness and visual stability, to help site owners measure user experience on the web.

Today, we’re building on this work and providing an early look at an upcoming Search ranking change that incorporates these page experience metrics. We will introduce a new signal that combines Core Web Vitals with our existing signals for page experience to provide a holistic picture of the quality of a user’s experience on a web page.

As part of this update, we’ll also incorporate the page experience metrics into our ranking criteria for the Top Stories feature in Search on mobile, and remove the AMP requirement from Top Stories eligibility.”

The user experience (via Core Web Vitals) is a ranking factor!

That’s right.

The performance of your web page determines whether Google will rank your pages in search (or not). The results from Google’s assessment of Gucci’s website tell us that they’re probably not receiving the number of rankings and traffic from Google they should receive.

They’re vulnerable to competitors.

This isn’t just Gucci; many luxury brands failed this assessment, including Bulgari, Givenchy, Louis Vuitton, Dolce & Gabbana, and Chanel. Interestingly, Hermes was one of the few brands on our list that performed well on this front. Brands that put in the time and effort needed to optimize for Core Web Vitals will reap the rewards. It’s an essential component that large brands often miss.

Sacrifice the user experience, and your brand sacrifices traffic and revenue.

Step #2: Use audience research to create your content strategy

Content is the foundation of SEO. What’s the most important piece of your content?

That’s right, it’s your audience.

Audience research is the beginning, the must-have component that enables you to create exceptional 10x content. Begin with audience research in mind and SEO is so much easier.

In his book How Will You Measure Your Life, Clayton Christensen writes “Questions are places in your mind where answers fit. If you haven’t asked the question, the answer has nowhere to go. It hits your mind and bounces right off. You have to ask the question – you have to want to know – in order to open up the space for the answer to fit.”

Audience research is simply asking questions.

- Who is our audience? This list includes customers, competitors, suppliers, journalists, linkerati, and others.

- Who are our (ideal) customers? These are your ideal customers including key segments and cohorts. Your content strategy should revolve around the people who are willing and able to support your business.

- What do they want from us? With luxury products, customer expectations typically revolve around factors like culture, identity, prestige, and presentation.

- What drives their behavior? You should have a detailed understanding of the motivators that prime their behavior. Remember luxury brands tend to be recession-resistant.

Why does this matter?

Oftentimes, luxury brands are forced to deal with a variety of conflicting circumstances.

- Social class: Customer cohorts/segments are often a mix of working, middle, and upper-class customers. The brand messaging for a luxury brand like Gucci or Hermès is clear; however, the values, culture, norms, and expectations for each of these groups.

- Presentation: The working-class values (ownership), the middle-class values (quality), and the upper class (presentation). Customer segments shop for luxury brands, products, and services that exemplify their, so it’s an important detail to manage in your organic search campaigns.

- Values and culture: Values are written down, culture is living values. As a luxury brand, you’ll want to create content that aligns closely with your customer’s desires, interests, values, and expectations. Again, this is difficult as each class has a different set of criteria they use to determine value.

What does this look like in action?

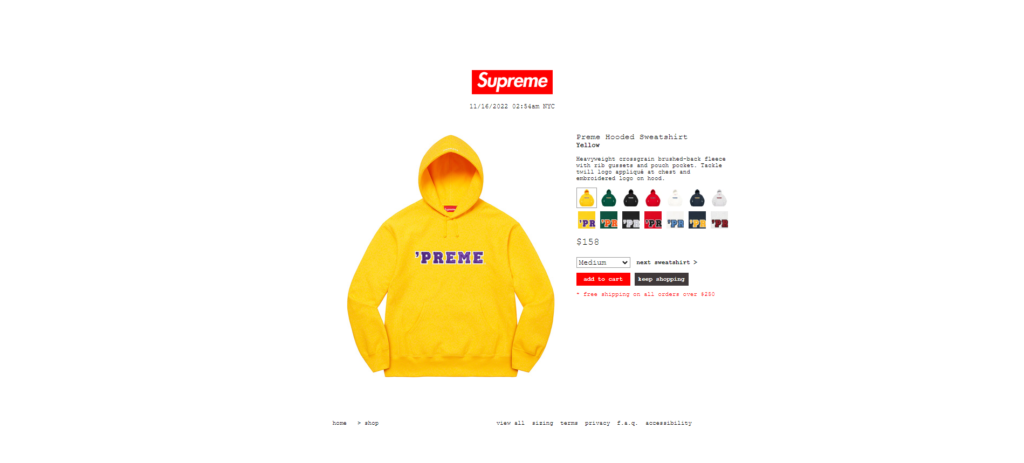

Enter Supreme.

Supreme is focused on youth culture in general and skateboarding and hip-hop culture in particular. They’re a culture brand that produces clothes, accessories, and skateboards.

What does this tell us regarding content?

Well, some brief audience research via Subreddit Stats outlines a list of (broad) topics that are popular in skate culture. According to Subreddit Stats,

“The scores listed are “probability multipliers”, so a score of 2 means that users of r/skateboarding are twice as likely to post and comment on that subreddit. A score of 1 means that users of r/skateboarding are no more likely to frequent that subreddit than the average Reddit user. A score of 0 means that users of r/skateboarding never post/comment on that subreddit.”

So what sort of related topics did we find with this analysis?

- 15.66 streetwear

- 14.04 cannabis cultivation

- 13.03 benzodiazepines

- 11.28 took too much

- 10.03 meditation

- 9.90 opiates

- 9.58 leaves

- 9.29 weed

- 9.09 punk

- 8.67 playstation plus

And just like that, you have a list of new topics (and keywords) you can use to reach these audiences. A quick scan and we see that skaters are very interested in streetwear, meditation, Tom Segura’s podcast, gaming, bitcoin, and a long list of other interests.

What does this mean?

This is obviously a thin slice of data (that’s not intended to be comprehensive). Focusing your attention on the right set of topics and keywords mean you have the data you need to speak to your customers directly.

If you’re Supreme, you can use your audience research to:

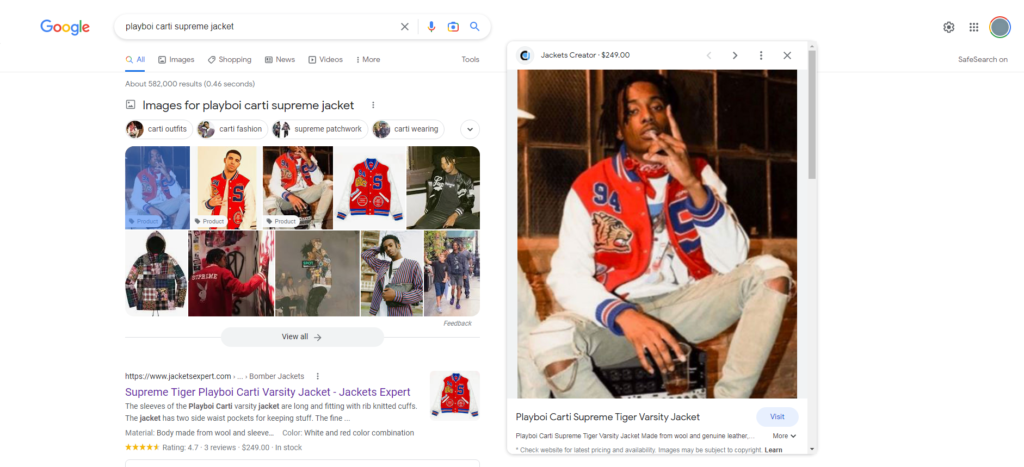

- Promote limited runs of specialty products (e.g., playboi carti supreme jacket) via organic search, channel partnerships, social media, etc.

- Create legitimately helpful resources for those in the community struggling with addiction.

- Sponsor relevant podcasts with select artists, athletes, and comedians, (and optimize content for organic search)

Each of these topics can be used to shape your content strategy, creating opportunities for Supreme and a chance to rank well in organic search.

Content recommendations for Supreme:

- Build out written content on your product-level pages and category pages.

- Create companion articles for your cross-promotional campaigns with celebrities and the media.

- Develop buying guides powered by the voice of culture and your values.

If you are any other luxury brand, here’s how you do it.

- Create your content engineering package; a list of relevant topics you’ll cover, topical clusters, keyword clusters, and groups. This package should outline what searchers expect when they use the topics and keywords in your report, and the series of pages you’ll need to meet searcher needs

- Create a content plan that outlines your organization’s content; the content you’ll need to produce over the short and long term, the structure of that content, and how it all fits together

- Use your content plan to create a strategy that governs how your content plan will be implemented, and how you’ll respond if your plan needs to change over time

- Create an information plan that outlines and governs the technical details of your organic search campaigns and your content strategy. Your information plan should cover details like taxonomy, tagging structure, linking structures, information architecture, navigation structure, structured data, and more.

Use this strategy to develop content for keywords that luxury brands don’t normally appear on. Identify the informational, navigational, transactional, and commercial keywords. Use your audience research to develop a cohesive content strategy.

Remember, Google favors brands.

It’s no secret that Google prefers brands. They’re focused on high-quality E-A-T content. Luxury brands have invested the time and resources needed to earn their trust.

Google wants to reward you.

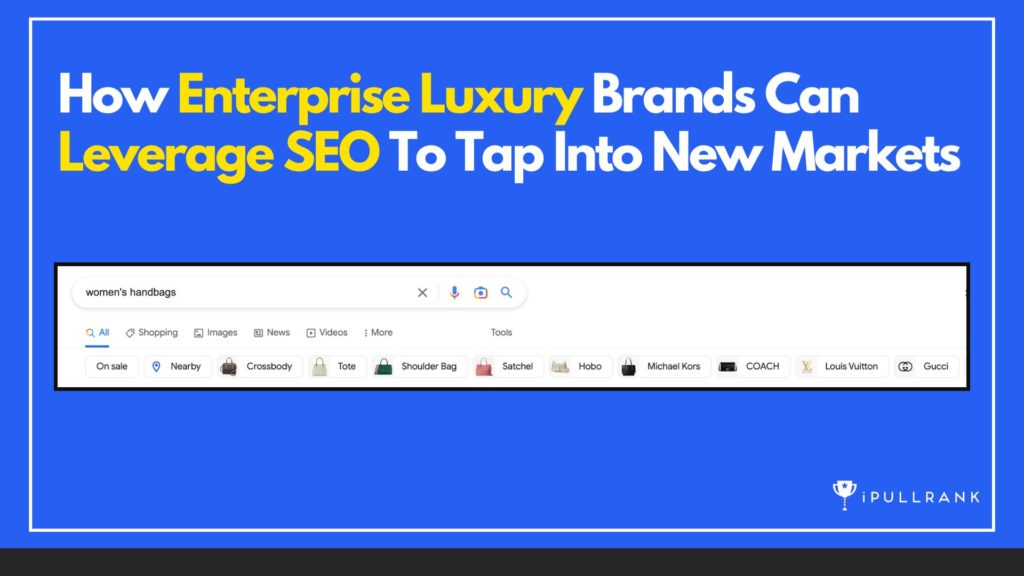

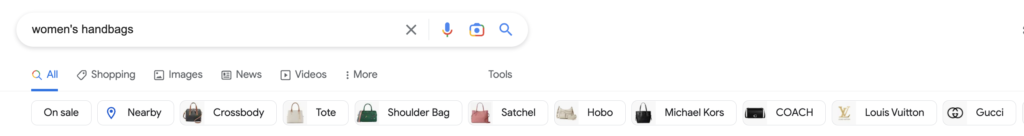

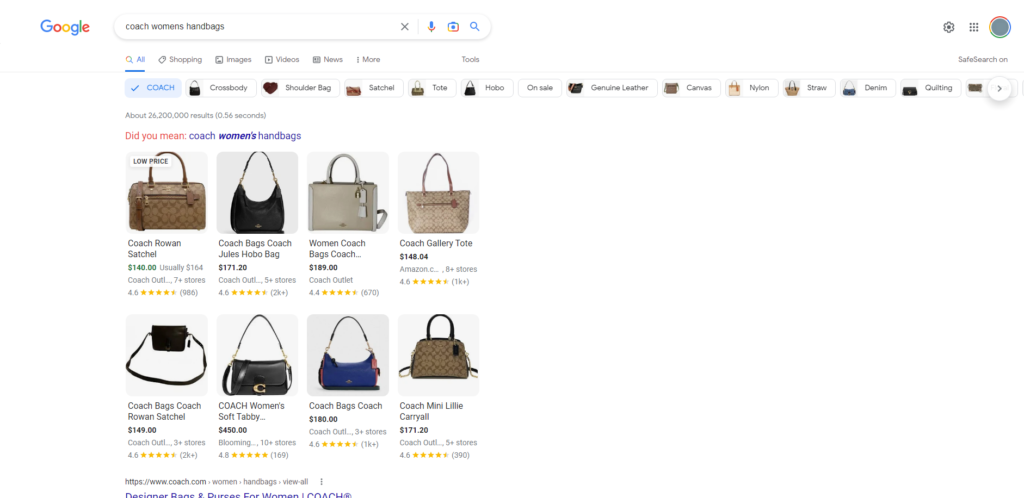

Take a look.

See those query refinement chips underneath the search box? Google is including branded terms for general queries like “womens handbags.” When you click on the Gucci or COACH chip, for example, you’re taken to a branded query “coach womens handbags.”

See what I mean?

Google wants you to win. If you’re optimizing your web pages (e.g., structured data) you’ll have what you need to leverage SEO and tap into new markets.

So what do we do with this information?

It’s simple.

You produce more content around the keywords and product categories that are attracting more attention. Category pages are typically limited in content beyond the product images but there’s no reason why your category pages have to be. You can build out these pages with more content – buyer’s guides to help inexperienced customer segments, incentives or rewards for loyal customers, and more product information.

Fossil pulls this off beautifully by adding helpful content at the bottom of their product category pages.

Bonus: Use paid search to identify strong performers in organic search

The luxury segment is competitive.

How are brands supposed to go about identifying the keywords that are worth their time? Is there a way to determine which keywords will lead to revenue in the short, medium, and long term?

Absolutely.

Use your paid search campaigns to feed your organic search campaigns.

Here’s how you do it.

- Create a campaign for your personas and cohorts. You’ll want to identify your buyer types and the products they frequently purchase.

- Generate a comprehensive list of keywords for each persona, accounting for each segment in your product lines.

- Divide your keywords list into tightly themed ad groups. Your ad groups are tightly themed if each of the keywords has at least two words in common, and those words consistently appear in your ad text.

- Group these ad groups into specific buckets (informational, navigational, commercial, and transactional queries). This is essential as these buckets help you to identify how you should be spending your ad budget. Your ad budget should be lower for ad groups in the informational and navigational buckets and higher for ad groups in the commercial and transactional buckets.

- Use conversion rate optimization to split test and optimize your copy, offers, images, risk reversals, and landing pages. Verify that your web pages meet the expectations laid out via Google’s Page Speed Insights.

- Rollout winners in your organic search campaigns, creating content that’s based on the lessons you’ve learned during the paid search process. If you’re dealing with silos and turf wars in your organization, this is where an agency becomes essential.

This is how you consistently create high-performance organic search campaigns that outperform your competitors over the short, medium, and long term. It’s a systematic process you can use

Luxury brands can leverage SEO to tap into new markets

Luxury brands have a huge opportunity.

U.S. inflation hit a 40-year high in June; the impact has been negligible so far. We’ve seen that 96.81% of Gucci’s traffic comes from branded keywords. The vast majority of luxury brands focus their attention on branded keywords.

Don’t make their mistake.

Brands often assume that people seek them out directly, which isn’t isn’t the norm. Research tells us consumers discover brands more often via unbranded queries than branded searches. Ignoring these unbranded search queries means brands miss out on a great deal of potential exposure.

The current downturn is no bed of roses, but as we’ve seen, this is an incredible opportunity for brands that are willing to invest the time and effort needed to produce results for organic search.

- The Cost of SEO Services in 2024 - January 4, 2024

- The 2024 SEO Guide To Successful Website Migration - April 4, 2023

- How Audience Research Shapes Financial Services Marketing - February 16, 2023