Google seemingly got away with a mere slap on the wrist after a judge’s ruling in the landmark antitrust case accusing Google of a monopoly.

The case is the first government monopoly lawsuit against a modern tech giant to go from filing to remedies, and the most significant attempt to level the tech playing field since an antitrust ruling against Microsoft more than 20 years ago.

Google won’t face the most severe penalties like having to divest Chrome and Android, but they do have to share certain data contained in Google’s Search Index. Will that be enough to absolve Google of its guilt? Will it impact Google’s leading position in the future of AI? What does this all mean for Google?

Google has proven to be a frontrunner in the generative AI race, possessing what we consider an “unassailable advantage” that we covered heavily in chapter 5 of the AI Search Manual. iPullRank’s Director of Marketing Garrett Sussman also broke down the antitrust case one year ago on our blog and thinks Google got off pretty easy here.

“It's hard to argue that any search engine is better than Google, given the scale, index, resources, and quality search results that they’ve refined and improved over the decades. What surprises me is the lack of a stronger remedy to address Google's dominance as the default search engine across devices (Apple and Samsung) and browsers (Firefox). The entire trial centered on whether that default status created a monopoly by exploiting status quo bias, knowing that most consumers won’t actively switch providers. Yet the outcome left Google largely untouched. The consequences are minimal, and while I can’t say I’m shocked, it highlights how entrenched their position really is.”

- Garrett Sussman

From its deep integration across the full tech stack, including data, hardware, research, infrastructure, distribution, and user behavior, to its pioneering work in AI, Google seemed uniquely poised to win.

However, the recent rulings in its antitrust case could introduce new dynamics that challenge this lead, particularly impacting its AI development and deployment strategy. Let’s look at the possible ramifications of the remedies in this case and how they could impact Google.

Google's Foundational AI Strengths

Before we look at the potential impacts, let’s briefly recap Google’s core AI advantages as outlined in our AI Manual:

- Proprietary Data at Scale: Google boasts an enormous, constantly updating stream of data from its products like Search, YouTube, Maps, Gmail, and Android. This real-time behavioral data helps understand user intent, training models like Gemini, personalizing answers, and adapting to new trends. The sheer volume of this data creates a feedback loop that helps its AI adapt and improve at an unmatched pace.

- First-Party Chip Development: Unlike many competitors who rely on third-party chips, Google developed its own Tensor Processing Units (TPUs), custom-designed for deep learning operations. TPUs enable faster training of massive models like Gemini, more efficient inference for live queries, and lower costs, allowing Google to train larger models more frequently and deliver answers faster and more affordably.

- Inventors of the Transformer Architecture: Nearly every major large language model today is built on the Transformer architecture, an innovation that came from Google researchers in 2017. This gives Google a deep understanding of the tech’s limits and strengths, early access to optimization strategies, and tight integration between research, hardware, and deployment, allowing it to move from theory to product faster.

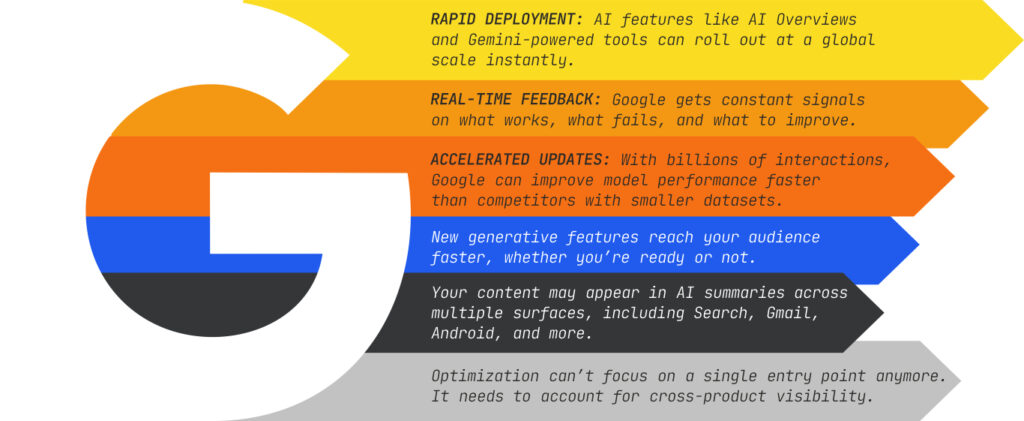

- Billion-User Products and AI Overviews: Google owns multiple platforms with over a billion active users (e.g., Search, YouTube, Gmail, Android), providing an instant audience to test, deploy, and refine AI features at unmatched speed. Its AI Overviews, now appearing in over half of all Google searches, are the most widely used generative product in the world.

These advantages have created a cycle of more users, more data, better models, and even more adoption.

The Antitrust Remedies

U.S. District Judge Amit Mehta ruled that Google illegally held a monopoly on internet search. While Google avoided the most severe penalties, the court did impose a few remedies.

Two key ones stand out:

- Prohibition of Exclusive Contracts: Google will be barred from exclusive contracts that condition payments or licensing for being the default search engine. Historically, Google paid billions annually to partners like Apple, Android device manufacturers, and browsers like Firefox to secure its position as the default. While Google can still make payments for preloading or placement, these deals cannot be exclusive.

- Mandated Data Sharing: Google will be required to make certain search index data and user interaction data available to rivals, though it will not have to share ads data or granular data with advertisers. This sharing must occur on “ordinary commercial terms”.

Marie Haynes outlined examples of what is stored in Google’s Search Index on her X feed (and also her recent blog), including the time a URL was first seen and the spam score:

How The Remedies Could Negatively Impact Google

These remedies seem to strike at the heart of Google’s power, which is its data advantage and distribution channels.

One revelation from the antitrust trial was the extent to which Google leverages user data to improve its search results:

- Navboost is described as one of Google’s “strongest ranking signals” and is trained on click data from queries over the past 13 months. While Navboost is an important signal, Pandu Nayak of Google said it is just one of the factors in the information retrieval process, and that some relevant documents might not have clicks.

- Glue (also known as Super Glue) is the counterpart to Navboost. It informs which other features are populated on a SERP. Although not explicitly stated, it is inferred that Glue logs user interactions with features for all queries over the last 13 months.

- Google’s modern deep learning models used in ranking, including RankBrain, RankEmbed BERT, and DeepRank, are all trained, in part, on click and query data.

- Google tracks search performance by measuring “information satisfaction” (IS) scores on a 100-point scale. These scores are measured blindly by human Search Quality Raters based on the Search Quality Evaluator Guidelines.

- Beyond specific algorithms, Google fundamentally values engagement signals, also referred to as implicit user feedback or user interaction signals.

Our resident Relevance Engineer at iPullRank, Patrick Schofield, thinks the antitrust remedies are a direct shot at Google’s data fortress and is giving competitors the building blocks to construct a rival.

“The real test now is whether Google is truly superior on a level playing field, or if it was just a product of having more user data than anyone else,” he said.

Let’s break down the potential impacts:

- Weakening the Proprietary Data Advantage:

- Google’s massive proprietary dataset, which fuels its models and personalization, comes from its position as the default search engine across billions of devices. By losing the ability to enforce exclusive default search engine contracts, competitors can have a greater opportunity to become the default on various devices and browsers. This could lead to a diversion of user queries and interactions away from Google, slowing down the unique, real-time data stream that gives Google its edge in understanding user intent and training its models.

- The order to share “certain search index data and user interaction data” undermines Google’s claim of having a unique real-time dataset. Any sharing of this data will empower rivals to train and fine-tune their own models, accelerating their AI development and narrowing Google’s lead. Competitors could gain insights into search queries and click behavior that were exclusive to Google.

- Challenging the Billion-User Distribution:

- Google’s dominance has depended on the tendency for users to stick with default options because it’s easier than changing them. The exclusive contracts solidified Google’s default status on a large scale. While Google can still pay for placement, the removal of exclusivity allows other search engines to compete for these default positions. If competitors secure default spots, they could leverage this behavioral bias to capture more users and data.

- Google’s AI Overviews are the most widely used generative AI product because they appear for over 50% of queries for 1.5 billion users. If Google’s market share in search starts to erode due to increased competition for default placements, the reach and engagement with AI Overviews could also be affected. And a smaller user base means fewer daily interactions.

“They're creating a window of opportunity for AI-native companies to build truly competitive answer engines without spending a decade trying to catch up on data collection.”

- Patrick Schofield

A More Competitive AI Space?

While Google still retains advantages, the antitrust remedies represent a shift. By mandating data sharing and eliminating exclusive default contracts, the court aims to “pry open the market for general search services” and “prevent Google from using the same anticompetitive tactics for its GenAI products,” as the Department of Justice said in a statement.

This could lead to a future where competitors, now with access to some of Google’s previously exclusive data and a fairer shot at becoming default search engines, can develop their AI models and features more rapidly. That is, if they’re able to do so fast enough. AI search changes so quickly and frequently that this may not be a benefit for long.

There is also the likelihood of Google appealing the ruling that could possibly slow down the process of having to share the data.

And with Google constantly evolving and innovating, they might come up with a new advantage. As Patrick said, the DOJ is “forcing Google to win on pure innovation, not just on inertia.”

Google will likely remain a dominant force, but its lead in generative AI may become subject to greater competition, forcing it to innovate even more aggressively on product quality rather than relying on its entrenched market position and default status. And, quite frankly, I wouldn’t mind an AI search future that challenges Google’s reign.