Why dominating the space doesn’t always mean dominating the AI answer

Where do you learn about beauty products? Some might depend purely on YouTube, TikTok, Reddit, or…ChatGPT?

Marketers of the world’s largest brands conduct extensive research on their target audience. Beauty is purely visual. Despite your image and video channels driving traffic and visibility, brands can’t ignore the emergence of AI Search platforms. If you’re not monitoring and strategizing for AI Search, you’re opening the door for competitors to establish a stronger foundation that could hurt your brand in the long run.

As AI becomes the front door to information, brand visibility is being rewritten. It’s no longer enough for a product to appear in search results or dominate social. In large language models, the rules have changed. Visibility now depends on how well a brand is represented within the structure of the LLM’s knowledge —not just that it’s mentioned, but also the topics it’s associated with.

Even brand giants have blind spots when it comes to AI.

The Problem: You Might Be Present, But Not Relevant

When someone asks an LLM like ChatGPT about a topic, it doesn’t just repeat what it finds on the top-ranking site. It builds an answer by drawing from a web of entities and concepts: mascara ingredients, application techniques, and product performance in humidity. If your brand hasn’t clearly articulated its presence in those topic areas, it simply doesn’t appear in the response.

Some of this insight is captured by the LLMs in the training data (compiled over a long period), and some is often captured in the final mile through a search lookup, known as “Retrieval Augmented Generation” or RAG for short. If you get picked up in the training data, you stand a much better chance of your brand getting a good airing than if you have to rely on the RAG alone to get seen.

You could make the argument that Entity SEO has been a staple of a responsible Organic Search strategy for years, but it doesn’t fit neatly into the various best practice blog posts that you’ll see on the topic. But as search engines (and LLMs) increasingly depend on a semantic web driven by the relationships between words, concepts, and things, brands need more than a keyword strategy. They need an entity strategy. A way to understand how LLMs interpret them and where they’re being outplayed by competitors consistently on their underlying topics.

A Quick Example: L’Oréal Paris vs. Fenty vs. Estée Lauder

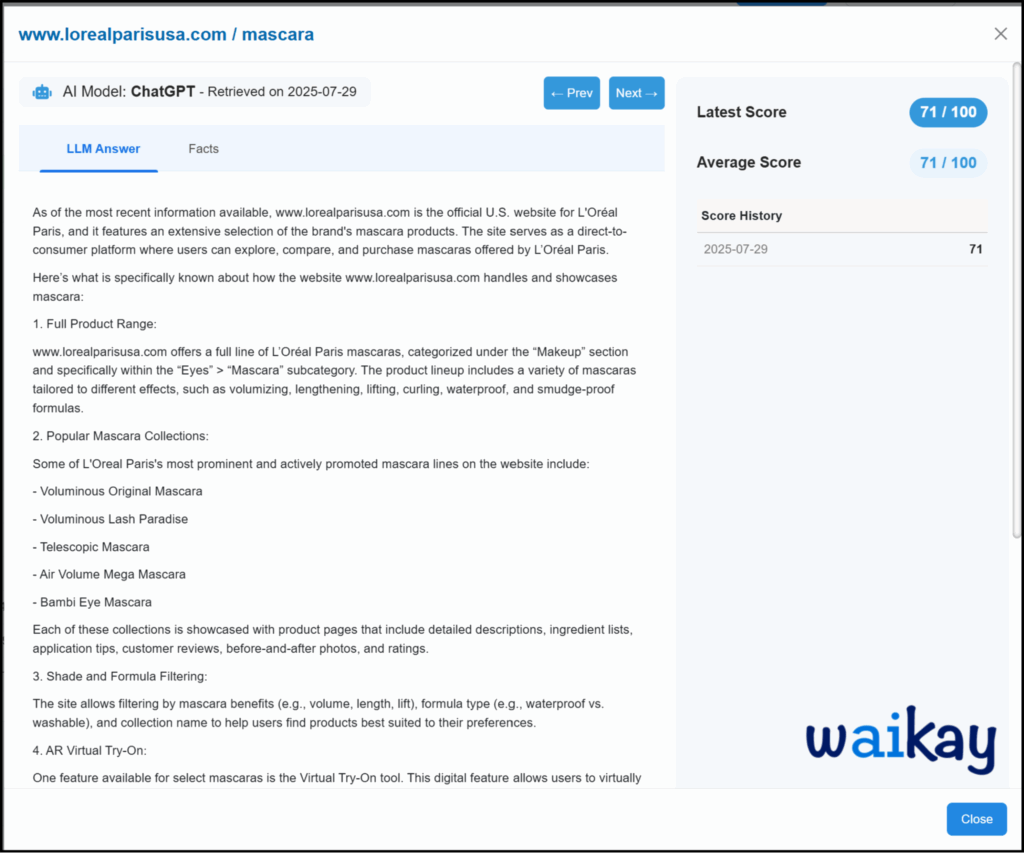

To explore how LLMs understand brands in specific product contexts, I ran a structured comparison across four leading models: Gemini, Sonar, ChatGPT, and Claude. Each was asked the same question three times, varying only the brand: What do you know about [brand] in the context of mascara? The brands tested were L’Oréal, Fenty, and Estée Lauder.

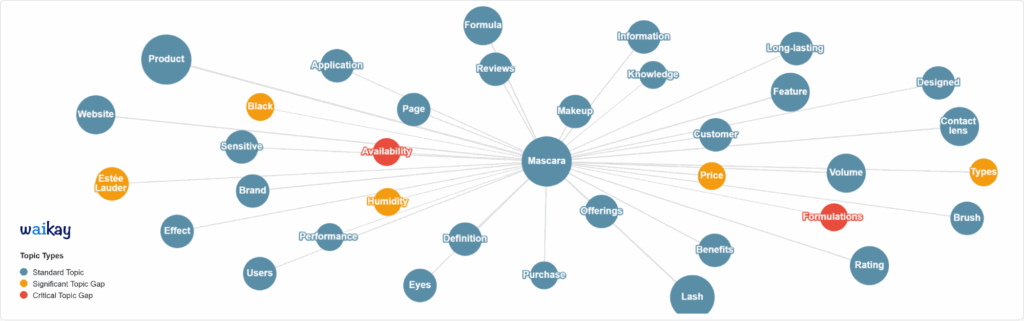

From there, I broke down each response into a knowledge graph—mapping out the key entities and topics mentioned. This allowed me to see how each brand is represented conceptually by the model, and where certain ideas or attributes are more (or less) likely to appear.

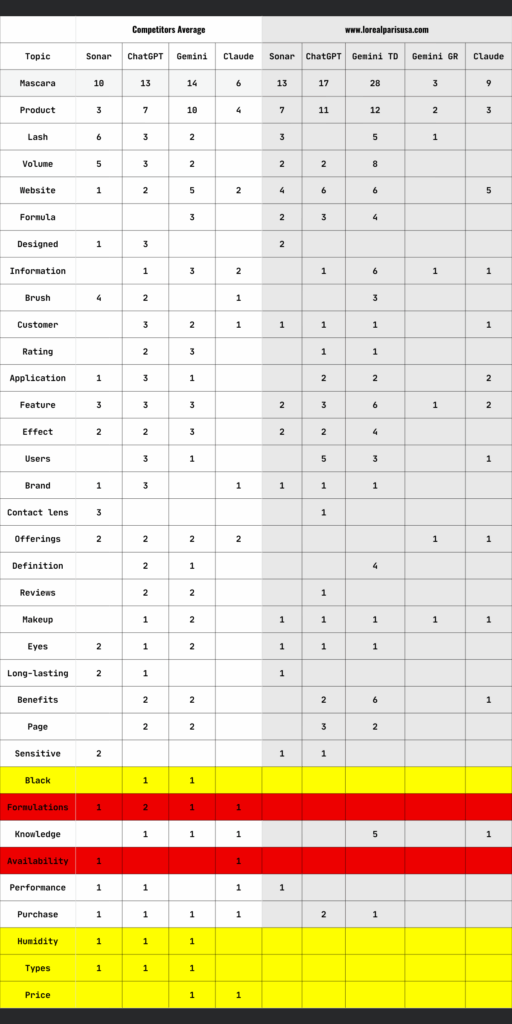

The above Knowledge Graph in table form:

A little context to explain the table below. By asking 5 LLMs what they know about Mascara in relation to three brands, we get 15 long-form responses. I go through every response, with the help of a tool like Waikay, to count every mention of every topic (by which we mean “entity” for the purists amongst you), and we tabulate the number of occurrences.

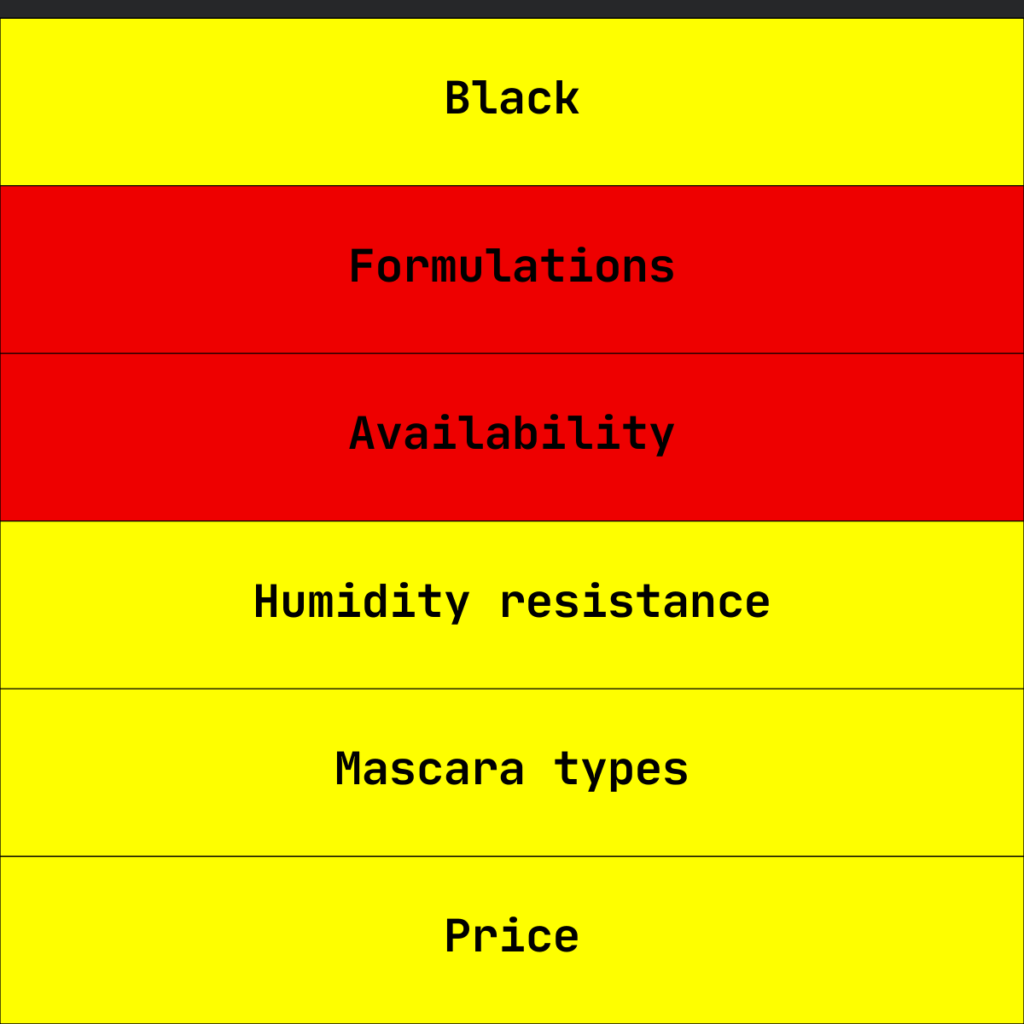

To highlight differences, I used:

- Yellow to mark entities that appeared in some competitor responses but not L’Oréal’s

- Red to mark entities that appeared in all competitor responses but were missing from L’Oréal’s

This approach gives a clearer view of the gaps in brand visibility across LLMs—and begins to reveal why they happen.

L’Oréal clearly holds strong authority in the mascara category, but the knowledge graph reveals some surprising gaps in how that authority is represented by LLMs. Several key entities were either inconsistently mentioned or missing altogether—including:

Of these, formulation and availability were the most significantly underrepresented.

By contrast, Estée Lauder’s responses emphasized detailed formulation benefits—things like volumizing polymers and wear time—while Fenty consistently tied its messaging to diverse skin tones, lash types, and targeted results. These aren’t just marketing angles—they act as structural cues that LLMs use to build their internal representation of the brand.

In short, brands that anchor their product narratives in specific, repeated, and semantically rich entities are far more likely to show up comprehensively in model outputs. L’Oréal has the scale and authority—but without clearer signals, key parts of its story are getting lost in generation.

Why This Happens: The Missing Pieces in L’Oréal’s LLM Presence

The results were telling. Across all three queries, most of the core entities—things like product names, application benefits, and category terms—were broadly consistent. But two important concepts showed up in both competitors’ responses and were completely absent from L’Oréal’s: formulation and price.

That’s not a random omission.

It’s a signal of how fragmented LLM knowledge really is.

Unlike search engines, LLMs aren’t pulling answers from a central index. They’re building probabilistic guesses based on whatever content they’ve encountered. For L’Oréal, that means content pulled from:

- Investor pages like loreal-finance.com (which don’t talk to consumers)

- Regional microsites with patchy product info

- Encyclopedic sources like Wikipedia

- Outdated product pages or SEO content with little contextual depth

So even though L’Oréal obviously does talk about mascara formulations and pricing across its ecosystem, that information might not be:

- Consistently structured

- Present in the right domains

- Embedded in pages that LLMs “understand” as authoritative on mascara

That last point is key. LLMs interpret brands through the topic lens first. If your site doesn’t clearly tie the brand to the topic, here, “mascara”, in a structured and repeated way, you’re easy to skip.

This isn’t just about content volume or SEO anymore. It’s about entity clarity. If formulation and pricing aren’t surfaced in L’Oréal’s LLM presence, it’s not because they don’t exist. It’s because they weren’t expressed in ways that made them learnable.

What the LLM Should See: Filling the Topic Gaps

Using this kind of topic-level entity analysis, we generated ten concrete recommendations for how L’Oréal could improve its presence on “mascara” in LLMs:

- Create a blog post on mascara formulation science, highlighting key L’Oréal ingredients

- Enhance product pages with ingredient-level detail

- Develop content on drugstore vs luxury positioning

- Launch a mascara ingredient glossary

- Address weather and humidity performance

- Add clear retail availability and purchasing guide content

- Improve category navigation using formulation filters

- Create a product performance testing series

- Develop comparison content against luxury alternatives

- Fix 404 errors and broken links still being cited by LLMs

These aren’t ideas pulled from a hat. Each one reflects a topic where competitors are clearly represented and L’Oréal is not.

The Bigger Idea: Topic Ownership is the Future of Brand Visibility

This analysis isn’t just about mascara. It’s about understanding how LLMs fan out from a user query, and whether your brand is positioned to appear in that chain of reasoning. If you’re not associated with the right entities – like formulation science or retail access – you won’t be suggested, compared, or remembered.

And here’s the deeper truth: No human team can reliably spot these gaps at scale. But LLMs can. And with the right methodology, we can use their logic against them, mapping their output, identifying weaknesses, and reverse-engineering a plan to own the next query.

Want to dig deeper?

Here is the full mascara topic action report of recommendations generated for this article.

AI Search Strategy vs. SEO Strategy

L’Oréal is one of the most dominant beauty brands on earth. But when it comes to AI-generated content, dominance isn’t inherited – it’s earned, topic by topic.

The brands that understand this shift won’t just show up in LLMs. They’ll shape the conversation entirely.