If you’re a marketer, you’ve probably invested heavily in content marketing over the years, but the Organic Search payoff isn’t delivering, and you’re questioning your SEO strategy.

For example, for those in the finance industry, your retirement planning guides might rank pretty well, your pages explaining investment strategies get decent traffic, and your calculator tools actually help people. But maybe lately, something feels off.

Your rankings are holding steady, yet Organic Search traffic keeps declining. Is this the impact of AI Search?

Maybe you’re barely showing up in AI Overviews or AI Mode results for topics that are core to your business goals, and when potential clients ask ChatGPT or Perplexity about retirement planning, your firm doesn’t get mentioned at all.

The problem might be that you have an outdated perspective on SEO. You’re familiar with optimizing for single keywords, but that’s not how it works in AI Search. AI Search Platforms are leveraging query fan-out.

When someone searches for “What’s the best way to save for retirement,” Google’s Gemini is simultaneously running dozens of related searches for AI Overviews, such as 401(k) contribution limits, Roth IRA comparisons, retirement calculators, savings benchmarks by age, and common mistakes to avoid. If your content doesn’t include passages that satisfy your search across all of these relevant sub-queries, you’re losing visibility, brand awareness, and performance metrics.

So what’s a better, more modern strategy for AI Search? Let’s approach this problem using a fictional mid-sized financial services firm as an example. I’ll walk through the complete process: map out fan-out queries, analyze what actually ranks and gets cited by AI (including which formats and sources dominate), and build an omnimedia content plan. You can’t only worry about your owned properties, like your website. You need to cover every channel that contributes to AI Search results: YouTube, Reddit, industry trades, and every other channel where your prospects are searching.

Let’s get started.

What Is Query Fan-Out and Why Does It Matter for SEO Now?

Today, your content might rank on page one for your target keyword and still be invisible in AI Search results, and a lot of that has to do with query fan-out.

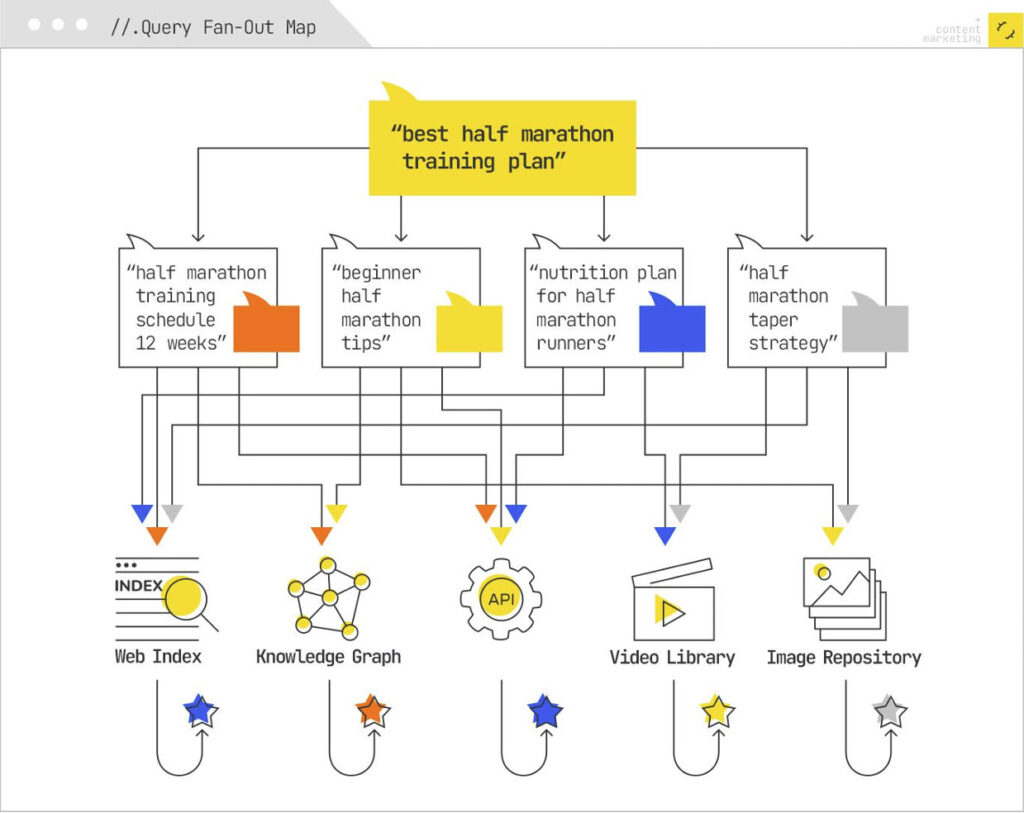

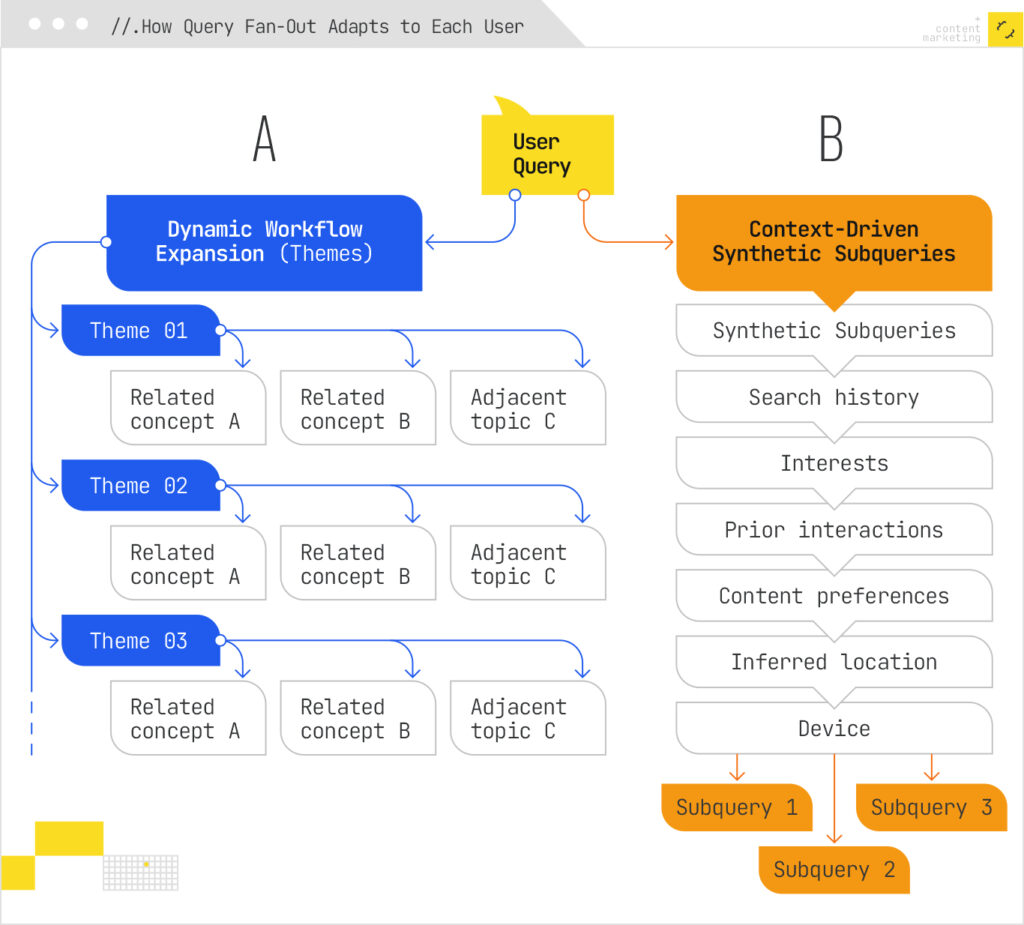

Query fan-out is the process by which AI systems and modern search engines expand a single user query into related sub-queries that run simultaneously in the background. Rather than treating your search as an isolated request, these systems interpret it as a starting point for exploration.

When you ask Google a question in AI Mode, what appears to be one search is actually dozens or even hundreds of synthetic queries working in parallel. As Mike King explained in his detailed technical analysis, these include:

- Related queries that are semantically adjacent to your original search.

- Implicit queries that capture what you likely meant but didn’t explicitly state.

- Comparative queries that help you make decisions between options.

- Personalized queries tailored to your search history, location, and behavioral patterns.

Mike’s research into Google’s patent applications revealed that it uses large language models like Gemini to generate these synthetic queries through structured prompting that emphasizes intent diversity, lexical variation, and entity-based reformulations. (If this feels like too much jargon, revisit Chapter 6 of our AI Search Manual, where we discuss some of these fundamentals that influence information retrieval.)

Modern AI Search systems use query fan-out to understand and satisfy your full search intent.

This approach enables AI systems to:

- Synthesize comprehensive answers by pulling all relevant information.

- Build reasoning chains that connect different aspects of a topic logically.

- Anticipate follow-up questions before users ask them.

- Diversify information sources to avoid relying on a single perspective.

The query fan-out process helps ensure that AI-generated responses are robust, multi-dimensional, and genuinely helpful.

Helping a Financial Brand Win Retirement Searches

What’s the practical application?

Let’s say you’re working with a mid-sized financial services firm specializing in retirement planning and investment management.

Their primary business goal is to increase qualified leads from people actively researching retirement planning options. To achieve this, they need to earn more visibility in search than direct and indirect competitors.

This company’s core audience persona is a mid-career professional in their 40s, earning over $90K annually, who has been contributing to a 401(k) for years. They have a couple of kids who are in high school and parents who have retired, so now they’re thinking about their own financial future.

The core audience also:

- Have accumulated some retirement savings but lack confidence in their strategy.

- Feel overwhelmed by financial jargon and competing advice.

- Want personalized guidance but aren’t ready to commit to a financial advisor.

- Increasingly turn to AI Search tools for quick answers to complex financial questions.

This person doesn’t search for “financial advisor near me” or “best IRA provider” (at least not yet). They start with broader, more exploratory questions.

So, we’re going to ask a broad question to start our search.

The Query

For this analysis, we’ll focus on a query that represents the prospective customer’s starting point in the retirement planning journey:

“What’s the best way to save for retirement?”

This question is exploratory rather than transactional, requires synthesized information from multiple sources, and triggers dozens of related questions that the searcher hasn’t yet articulated.

A little digging around in Ahrefs showed that this question is a difficult keyword for which to rank. The more succinct “best way to save for retirement” is more popular than the question form, which isn’t surprising. People tend to ask full questions to LLMs rather than Google these days.

We can also see where this phrase appears most often, including sites for the Department of Labor, Trinity College, Fidelity, Merrill Edge, Bankrate, and Reddit (remember these sites because they’ll appear often later in our research).

But for the financial company, ranking well for this single query in traditional search isn’t enough. They need to appear across all subqueries about 401(k) contribution limits, retirement calculators, average retirement savings by age, and much more.

Now that we’ve researched the initial query, let’s get to the query fan-out.

Generating a Query Fan-Out with Qforia

Qforia is a tool developed by Mike King at iPullRank to simulate a query fan-out. Begin by visiting the Qforia site, then enter a paid Gemini API key (the free ones won’t work) and enter your query. After a few moments of thinking, your results will appear:

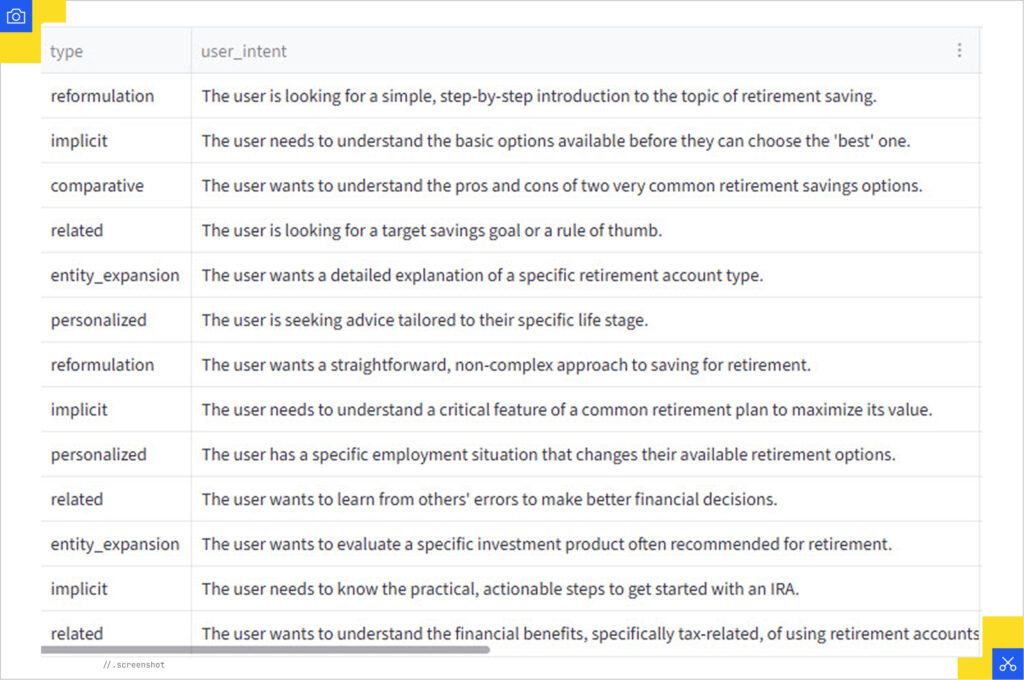

Qforia leverages the same Gemini model used by AI Overviews and AI Mode, so the output is still probabilistic, but the goal is accuracy, not precision. Plus, Mike’s tool bakes in a lot of useful information to the results:

- The “query” column shows you other related queries.

- The “type” column shows you what kind of question the query is likely asking. Is it comparative like a 401K vs. Roth IRA or personalized like “retirement savings strategies for someone in their 30s”?

- The “user intent” column tells you what the searcher is looking for with a particular query. Do they need to understand the basic options? Are they seeking advice tailored to a specific life stage? These classifications help you group your queries based on who is asking and why.

Implicit and personalized queries seem to be common in this fan-out, showing that asking about the best way to save for retirement can be very specific to a certain person.

Another useful bit of data is the “format reason” column. This is a relatively new feature of Qforia that lays out what type of content would be best to answer the query, be it a guide, article, table, interactive tool, etc.

In this example, Qforia suggests a table for a side-by-side comparison of 401Ks and Roth IRAs. And for “retirement savings strategies for someone in their 30s”, it recommends a checklist with actionable steps to take. The “steps to open an IRA account” phrase is another implicit query that would benefit from a numbered or bulleted step-by-step list to follow.

The query “what is an employer 401K match” is considered to be a frequently asked question, so Qforia recommends answering it within an FAQ page about retirement benefits. An interactive tool seems to be the best way to help someone answer “how much money should I save for retirement?”

Now that we’ve performed our fan-out research, let’s take a look at the search engine results pages (SERPs) and see what we can learn.

Analyzing the SERPs for Fan-Out Queries

For this experiment, I will choose five of the fan-out queries Qforia suggested (in addition to our original query) and see what the SERPs look like for each:

- Beginner’s guide to saving for retirement

- What are the different types of retirement accounts?

- How much money should I save for retirement?

- Retirement savings strategies for someone in their 30s

- Common retirement savings mistakes to avoid

Let’s start with the SERP for the initial query: What’s the best way to save for retirement?

Once you get past the litany of sponsored posts and the AI Overview, the rest of the results give a wide range of helpful resources. There are top 10 lists of tips from Merrill Edge and the U.S. Department of Labor, Reddit and Quora forum answers, YouTube videos, and articles from universities and credit unions.

Bankrate even offers a retirement calculator to estimate how much you should save, even though I didn’t even ask that yet (we’ll see if it shows up again later for that query).

Business | Media Type | Content Type | Website Type |

U.S. Dept. of Labor | PDF article | Listicle | Government site |

Forum posts | Various | Forum | |

Trinity College | Article | Beginner’s guide | College site |

Texas Hospital Association | Article | Listicle | Brand site |

Bankrate | Calculator | Informational | Brand site |

Space Coast Credit Union | Article | Informational | Brand site |

California Credit Union | Article | Listicle | Brand site |

When it comes to the AI Overview and AI Mode results, they both offer a bulleted list of strategies for saving. The AI Overview is more detailed, though, with a table showing the different types of retirement accounts and an action plan to follow:

Now let’s see the results for “Beginner’s guide to saving for retirement”:

We see many similar results to the original query, such as the “6 Essential Steps” video, the “Retirement 101” article from Trinity College, the “top 10 ways to prepare for retirement” article from the U.S. Department of Labor, and the Reddit thread on how to start saving for retirement. The AI Overview was also another list of tips and steps to take to save.

Business | Media Type | Content Type | Website Type |

|---|---|---|---|

NerdWallet | Calculator | Interactive | Brand site |

SuperGuy | Video | List | Brand account |

Trinity College | Article | Informational | College site |

Amazon (Author Dan Clay) | Book | Informational | Brand site |

U.S. Dept. of Labor | PDF article | Informational | Government site |

Bankrate | Article | Informational | Brand site |

Forum posts | Multiple | Forum |

The process can be applied to every fan-out sub-query, but here we want to focus on the organic rankings.

Next up is “What are the different types of retirement accounts?”:

This query is very specific, and so the results were highly specific lists of definitions. The AI Overview and AI Mode both had the same bullet lists, and the rest of the SERP featured articles from sources like Charles Schwab, Northwestern Mutual, and American Express that were all laid out in list form.

There’s also a “people also ask” section at the top of this query with even more related and highly specific questions.

Business | Media Type | Content Type | Website Type |

|---|---|---|---|

IRS | Table of contents | Links to informative webpages on the site | Government site |

Fidelity | Article | Listicle | Brand site |

U.S. Dept. of Labor | Article | Informational | Government site |

Thrivent | Article | Informational | Brand site |

Forum posts | Multiple | Forum | |

Equifax | Article | Informational | Brand site |

Charles Schwab | Article | Listicle | Brand site |

Northwestern Mutual | Article | Listicle | Brand site |

American Express | Article | Informational | Brand site |

As for “How much money should I save for retirement?”:

The results consisted of:

- Articles that all gave the same recommendation: save between 10 and 15% of your annual income, implying that it really is a best practice that everyone follows (or simply everyone is copying each other’s advice).

- A couple of retirement calculator tools from NerdWallet and Merrill Edge but there weren’t nearly as many as I expected to see (maybe they are difficult to build or not very accurate), so perhaps our financial organization can capitalize on that with a better one.

Based on the lack of diversity in results, it would appear that Google feels this question has already been answered and nothing else is needed.

Business | Media Type | Content Type | Website Type |

NerdWallet | Calculator | Interactive | Brand site |

Citizens Bank | Article | Informational | Brand site |

Texas Hospital Association | Article | Listicle | Brand site |

The People’s Bank | Article | Informational | Brand site |

Merrill Edge | Calculator | Interactive | Brand site |

Brookings | Article | Informational | Brand site |

The AI Overview had some recommended guidelines, a table with age-based benchmarks for saving, and a list of methods to estimate how much, including a link to the NerdWallet calculator. The same result was found in AI Mode.

The query “Retirement savings strategies for someone in their 30s” gave a bunch of highly specific results mainly consisting of articles and videos making recommendations. The results even had a “find related products and services” section, implying that this query is so bottom of the funnel that people searching this very specific query probably want to select an actual account/financial institution.

However, one thing to note is that some of the results misunderstood the question. The article from Farther Financial talks about early retirement, as in how to retire when you’re in your 30s instead of starting to plan in your 30s.

Overall, nothing linked on this SERP was a repeat of the other queries:

Business | Media Type | Content Type | Website Type |

Securian Financial | Article | Informational | Brand site |

Forum posts | Multiple | Forum | |

Fidelity | Article | Listicle | Brand site |

Bankrate | Article | Listicle | Brand site |

Thrivent | Article | Informational | Brand site |

Hancock Whitney | Article | Informational | Brand site |

MassMutual | Article | Informational | Brand site |

Farther Financial | Article | Informational | Brand site |

America’s Wealth Management Show – YouTube | Video | Informational podcast | Brand account |

Aside from a few videos up top, the results for “Common retirement savings mistakes to avoid” were hilariously all list articles ranging from 10 important tips to 5 mistakes to avoid. AI Mode and the AI Overview simply listed out the mistakes grabbed from many of the articles listed on the SERP:

Business | Media Type | Content Type | Website Type |

T. Rowe Price – YouTube | Video | Informational | Brand account |

CBS Philadelphia – YouTube | Video | News story | News station account |

MeaningfulMoney – YouTube | Video | Informational | Brand account |

Louisiana Office of Financial Institutions | PDF Article | Informational | Government site |

Morgan Stanley | Article | Listicle | Brand site |

Charles Schwab | Article | Listicle | Brand site |

Next, we’re going to look at all these results together and start analyzing what it all means.

Matching Content Formats to Intent

It’s clear that format choice matters just as much as topic choice. As we’ve seen from the screenshots, the SERPs seem to favor list articles, videos, and interactive calculator tools.

One thing I noticed (and was pretty excited about) was how many reputable sources were cited. Actual financial institutions with experience in the subject matter like Fidelity, Charles Schwab, Wells Fargo, and others topped the SERPs and were cited in AI Overviews and AI Mode. I read the AI Overviews and actually believed they were telling the truth, which isn’t something that happens often.

This is great for the people doing the searching, but a challenge for our financial organization to overcome in rankings. They will have to work hard to produce the kind of content that can compete with these huge firms. But thanks to our query fan-out and SERP research, we know what type of content ranks well to give them an idea of where to focus their marketing efforts.

However, it’s also important to consider the fact that a new type of content that hasn’t been seen on the SERPs like an FAQ page or guide might capture more eyeballs than the same listicle over and over. It’s all about experimentation and seeing what works.

A successful content strategy will need to be creative, helpful, and omnimedia to focus on every search channel in order to compete on these SERPs.

Expanding Beyond Web Pages into Omnimedia

What is an omnimedia and omnichannel strategy? It focuses on everything in every channel and in every media format: videos on YouTube, text in Reddit forums, social media, review site tables, TikTok videos, literally anywhere a person can search for something.

In our finance company example, there weren’t any instances of social media or TikTok posts showing up in the SERPs, but we did see quite a few YouTube videos and Reddit and Quora forum posts.

I looked at the same queries in a few LLMs (ChatGPT, Gemini, and Perplexity) to analyze their results. Rather than inundate you with mountains of screenshots, I will just sum up the findings for a few of the queries. I started with the original query of “What’s the best way to save for retirement”:

- ChatGPT’s answer was a simple list explaining the types of retirement accounts, a recommended target percentage of income to save, and some tips for smart saving. I didn’t see any links or citations in this summary.

- Gemini focused on tables that could be exported to Google Sheets that showed age benchmarks and how to choose the right account type. At the bottom, there was a sources button that opened a window on the right with a list of sources including AARP, T. Rowe Price, Fidelity, and Empower.

- Perplexity offered links to cited sources throughout its summary after each section, which included Guardian, Schwab, Vanguard, and even Reddit.

For the “Beginner’s guide to saving for retirement” prompt:

- ChatGPT had an overly simplistic list of steps with no cited sources.

- Perplexity had a 5-step list with cited sources throughout (mainly the same ones cited the last time like Schwab and Fidelity).

- Gemini had a 3-step list, a table of benchmarks, and a checklist, but the most interesting part for me was it specifically recommended several companies with which to open a Roth IRA. This is important for brands to note. With enough content on this topic, financial companies could be added to this list:

For the next query of “What are the different types of retirement accounts”:

- ChatGPT gave a list with brief explanations and no citations again.

- Perplexity detailed what each plan was and how it worked, citing a source at each line.

- Gemini did the same citing many different sources:

For the sake of brevity, let’s go straight to “Common retirement savings mistakes to avoid” since this query is a different style – a serious prompt with negative implications on a person’s life, aka. Your Money or Your Life (YMYL) prompts:

- ChatGPT offered a list of mistakes with a “why this hurts” and “do this instead” line for each.

- Gemini gave a much more detailed list of mistakes with sources such as Discover, LPL Financial, T. Rowe Price, and Kiplinger. These sources differed from those that Gemini cited for the other prompts.

- Perplexity cited 10 sources in their brief list of mistakes to avoid, this time with a few reputable news sources like the New York Times and The Harvard Gazette.

Since this prompt opened up the citations to new sources we hadn’t seen with the other prompts, it shows that organizations like Fidelity and Schwab don’t have a monopoly on citations for this topic. That means our financial business could possibly join the citations.

It also means that this type of prompt that’s focused on YMYL issues, such as making mistakes with your retirement savings, can impact the sources cited. Therefore, depending on their status in the industry, this may not be the right prompt for our financial company to focus on.

Let’s look at the results as a whole to see how our finance firm can fit in.

Reverse-Engineering Citations to Inform Content Creation

AI citations, derived from analyzing SERP features and LLM responses, help content planning by revealing the types of sources, formats, and channels necessary to gain visibility, especially in competitive areas like financial services.

AI Overviews and LLMs draw from a diverse ecosystem of content, which can be categorized by the credibility and nature of the source and the channels they utilize:

Source Type | Examples of Channels and Sources | Insight for Content Planning |

Institutional/Financial Firms | Web pages, articles, and tools from established firms like Fidelity, Charles Schwab, T. Rowe Price, Vanguard, and LPL Financial. | These sources dominate citations for core financial topics, signaling the need for high-authority, expert-level content to compete. |

Official/Educational | Articles and guides from government agencies and educational institutions, such as the U.S. Department of Labor, Trinity College, and AARP. | Citations favor unbiased, fact-checked authority, especially for complex or sensitive topics like retirement planning. |

Reputable Media/News | Articles from established publishers and news sources like NerdWallet, Bankrate, Kiplinger, The New York Times, and The Harvard Gazette. | Targeting queries focused on specific angles, like “Common retirement savings mistakes to avoid” (a negative prompt), can broaden citation opportunities beyond traditional financial firms into reputable media sources. |

Community/ | Posts and threads from forums like Reddit and Quora. | An omnimedia strategy should recognize and target platforms where prospective customers are having exploratory, non-transactional conversations, as these are cited in both SERPs and LLMs. |

The channels cited are primarily traditional web pages/articles, but an effective content strategy must be omnimedia, focusing on all channels where people search.

The type of content that receives citations is often determined by the specific query intent and is heavily favored by formats that are easily synthesized by AI. Cited assets tend to be highly structured and actionable:

- List Articles (Listicles): Many SERP results and AI Overviews for queries like “mistakes to avoid” or “types of retirement accounts” heavily feature content formatted as lists.

- Tables: AI Overviews frequently use tables to detail complex information, such as age-based benchmarks for saving or comparisons of different retirement accounts.

- Interactive Tools and Calculators: For questions about specific quantities, such as “How much money should I save for retirement”, interactive tools and calculators from sources like Bankrate and NerdWallet are featured prominently in results and AI Overviews. Qforia also specifically recommends interactive tools for certain queries.

- Actionable Formats: Both Qforia analysis and LLM outputs favor step-by-step lists and checklists for actionable queries like retirement strategies for someone in their 30s.

- Videos: Videos are visible on SERPs across multiple exploratory queries, indicating the necessity of including video production in an omnimedia strategy.

Analyzing these citation patterns transforms competitor analysis into actionable content strategy, allowing a financial firm to focus its marketing efforts:

- Prioritize Format Over Topic Saturation: Since many SERPs repeat listicles, opportunity may lie in creating different asset types, such as FAQ pages, comprehensive guides, or tables, that might capture more attention than yet another listicle.

- Target Implicit Transactional Intent: Although the customer starts with exploratory questions like “What’s the best way to save for retirement”, AI models like Gemini are willing to suggest specific companies for opening accounts. This creates an opportunity for a financial business to position itself to be specifically recommended by AI.

- Use Specific Query Styles to Bypass Citation Monopolies: While major firms like Fidelity and Schwab often dominate general retirement citations, queries focusing on specialized or negative topics, like “mistakes to avoid” (which touches on YMYL issues), open up citations to different types of high-authority sources, including news publications. This suggests either focusing resources on specific, highly authoritative content addressing nuanced concerns, or just letting this query go.

- Adopt an Omnimedia/Multi-Channel Presence: The appearance of Reddit, Quora, and YouTube content in both SERPs and LLM citations shows that high-quality content planning must extend beyond official website articles. To fully compete, content must be tailored for, and distributed across, these community and video channels.

Now that we have an idea of how these results can inform content strategy, we’ll put together a generalized omnimedia strategy for our hypothetical finance business.

Building an Omnimedia Strategy

Here’s what we do at iPullRank:

- Keyword Matrix: Establishes the groundwork for topical presence in AI Search by identifying synthetic keyword gaps, potential opportunities, and valuable terms at the passage level. It reveals which areas are strengthening or weakening your AI presence, enabling you to allocate resources toward terms that create competitive differentiation.

- Omnimedia Content Audit: Comprehensive assessment of content spanning all formats and channels, covering owned, earned, and shared media properties. It uncovers what’s limiting your authority while pinpointing where focused resources will generate results.

- Omnimedia Content Plan: Strategic blueprint for enhancing Content Resonance and expanding coverage across discovery channels, complete with content frameworks and governance structures. It provides a defined pathway to greater prominence in AI-generated responses.

- AI Search Measurement Plan: Monitor input indicators, channel data, and performance benchmarks across AI Search environments. It identifies how AI Search influences growth trajectories, allowing you to connect spending with outcomes and refine your approach based on evidence.

Given that our fan-out research gave us the keywords we need and we already analyzed their presence in searches, let’s put together a plan for our financial company. This plan leverages the query fan-out analysis for retirement planning to create resonant, structured content across multiple channels.

Query Fan-out Prompt | Recommended Asset Type & Structure | Omnimedia Objective |

“What’s the best way to save for retirement” (Core) | Pillar Guide / Comprehensive List: Create a definitive, long-form guide. Structure the article so it begins with the core answer or takeaway, followed by supporting detail and nuance. | Semantic Resonance: Ensure the title, description, and internal linking structure establish this as the canonical source for all related fan-out queries. |

“Beginner’s guide to saving for retirement” | Actionable Checklist/Step-by-Step Guide: Develop a simplified, numbered list of steps for beginners. Content should be clear and simple. | Passage-Level Extraction: Optimize for easy extraction of the 3 or 5 essential steps by LLMs (like ChatGPT’s simplistic lists). |

“What are the different types of retirement accounts?” | Comparison Table and FAQ Page: This requires highly specific definitions. Create a dedicated FAQ page featuring a comparison chart or table detailing account types and their features. | Structured Data: Ensure the data is provided in a clean, easily digestible format (table) that AI Overviews and LLMs already favor when detailing complex information. |

“How much money should I save for retirement?” | Interactive Tool/Calculator: The primary format requested for this query is an interactive tool. This must be accompanied by structured data (tables) showing age-based benchmarks for saving. | High-Value Utility: Provide functional utility (the tool) and support the quantifiable answer with authoritative data (the table), increasing the chance of citation over static articles. |

“Retirement savings strategies for someone in their 30s” | Personalized Checklist/Segmented Guide: Content should be highly specific and actionable for a segmented audience. Use the product grouping concept to show a progression_from or complementary_with path for financial products relevant to this age group. | Targeted Personalization: Customize the content to fit the behavior and specific needs of this persona, making the recommendations feel personalized, which is crucial for AI agents. |

“Common retirement savings mistakes to avoid” | YMYL List Article with Solutions: Create a list detailing the mistakes, each paired with a solution. Must be accurate, with citations and data sourced from trusted research. | Trust and Authority: This content relates to YMYL issues. It must be highly detailed and authoritative to compete with reputable news sources and large financial institutions (otherwise don’t bother). |

Because LLMs often prioritize user-generated content, the content plan must actively generate and integrate these signals across all channels:

Channel | Content Focus based on Retirement Queries | Strategic Goal |

YouTube | How-To Videos & Guides: Create short, instructional videos for the “Beginner’s guide” and “Strategies for someone in their 30s” queries. Ensure video descriptions include relationship attributes to related website guides and link to the interactive tool. | Capture Exploratory Search: Videos are crucial for user education in the finance industry. Position the firm as an authority where consumers compare accounts and learn how they work. |

Community Forums (Reddit/Quora) | Monitoring and Engagement: Focus resources on monitoring discussions related to “Common retirement savings mistakes to avoid” and “Beginner’s guide”, as these forums appear frequently in SERP and LLM citations. | Influence Citation Flow: While the firm cannot directly control these posts, understanding the conversation context allows for developing content that directly answers community-driven questions with clarity and context. |

Thought Leadership: Utilize LinkedIn Pulse for “Retirement savings strategies for someone in their 30s”. Publish educational, semi-formal posts that bridge technology and business to capture a broader professional audience. | Professional Authority: Establish individual and corporate credibility on a channel that ranks well for thought leadership. |

By implementing this omnimedia plan, the financial company treats every content touchpoint from the interactive tool on its site to a checklist shared on LinkedIn as a signal that reinforces a clear, emotionally grounded, and contextually rich narrative about retirement planning to maximize visibility in SERPs and LLMs.

But what if your financial business is enterprise-sized with a massive library of webpages? How can you scale your content strategy? And how can you easily prune old, irrelevant content that is no longer serving your site?

Scaling Query Fan-Out and Omnimedia Planning

For a single topic or article, traditional content pruning involved manual work that was often time-consuming and subjective. This process required manually pulling traffic data, checking rankings, looking at backlinks, and skimming posts to make a “best guess” about relevance.

The content pruning methodology we’ve developed at iPullRank uses a Relevance Engineering framework that blends AI-driven semantic relevance analysis with SEO and content metadata to make data-driven decisions at scale. This will help ensure all the content on your site is relevant and identify what content should be removed.

The steps for executing this workflow involve defining your strategic benchmarks, quantifying meaning using vector embeddings, integrating performance data, and applying a final decision framework.

Here are the steps we follow to perform the content pruning:

Step 1: Define Strategic Focus

The entire analysis is grounded in business reality by defining what relevance means for the organization.

- Work with the client to solidify their core solution areas or strategic pillars.

- For each area, develop representative keyword portfolios reflecting user intent and product capabilities.

- Draft a concise business relevance statement (a short paragraph capturing the ideal focus).

Step 2: Generate Topic & Business Relevance Centroids

This step translates the strategic pillars into quantitative benchmarks.

- Using the chosen embedding model, generate an embedding for each individual keyword within a topic’s portfolio (developed in Step 1).

- Calculate the average of all keyword embeddings within that cluster. This averaged vector becomes the topic centroid, serving as a robust mathematical representation of the topic’s semantic space.

- Generate a single embedding for the overall business relevance statement.

Step 3: Generate Article Embeddings

The meaning of every post in the library is represented numerically.

- Run the extracted article content through basic Python cleaning routines (removing excess whitespace or stray HTML tags).

- Combine the Title text and the cleaned main body content for each article.

- Generate a single embedding for each article using the same model used in Step 2 for consistency.

- Store these individual article embeddings, typically in a NumPy array paired with their corresponding URLs.

Step 4: Calculate Similarity Scores

This step objectively measures how semantically aligned each article is with the strategic targets.

- Using Scikit-learn in Python, calculate the cosine similarity between each article’s embedding (from Step 3) and each of the topic centroid embeddings (plus the business relevance embedding from Step 2).

- The output is a matrix added to the spreadsheet, showing scores between -1 and 1, where scores closer to 1 indicate a stronger semantic alignment.

Step 5: Layer SEO Performance & Metadata

Real-world performance and freshness data are integrated with the relevance scores.

- Pull standard SEO metrics, primarily trailing 3 to 6 months of organic clicks from Google Search Console, focusing on a recent window to avoid rewarding historical performance.

- Pull Publish Date and Last Modified Date from the CMS or crawl data.

- Join this performance and freshness data to the master spreadsheet containing the URLs and similarity scores.

Step 6: Apply the Decision Framework (Making Informed Choices)

The combined data points are translated into actionable categories to guide pruning and optimization efforts.

- Establish data thresholds to categorize each article into three main actions:

- KILL: Candidates typically have low similarity scores across all core topics, low recent GSC clicks, and are old (more than 5 years with no significant updates).

- KEEP: Articles that qualify if they have high similarity to at least one core topic or have strong recent SEO performance.

- REVIEW/REVISE: Articles that are relevant but underperforming, outdated, or highly similar to other posts (potential consolidation targets).

- Conduct manual review of edge cases, confirm decisions, and identify specific actions.

Reframing SEO with Query Fan-Out

For firms competing against giants on the SERPs and in LLMs, focusing on an omnimedia query fan-out approach to content strategy is essential. The citation analysis we walked through shows that specialized queries, especially those focused on specific concerns like “mistakes to avoid” or personalized scenarios like “strategies for someone in their 30s”, open up opportunities for smaller firms to break through with unique and truly valuable content.

You can’t out-budget the big players, but you can out-execute them on format diversity, omnimedia presence, and targeting the fan-out queries they’re ignoring. And when you scale this with the Relevance Engineering framework for content pruning, you’re optimizing your entire content library to align with how AI Search works.

We know that this can be overwhelming for a limited staff to achieve, but we can handle it for you. If you want to do this for your own business, talk to iPullRank about our AI Search Strategy Program with a full Omnimedia Content Audit and Content Plan, tied directly to a Keyword Portfolio Matrix, designed to improve visibility across traditional search, AI search, and third-party platforms. Let us help you be the first thing customers see (and trust) wherever they search.