Investing over the last decade has been a wild ride. You are reading this article so surely you feel the same. Whether you are an individual investor or a private equity firm with ample resources, no one has been immune to the recent levels of uncertainty and volatility. So the grand question we seek to answer in this article is, “What more can we do to make better investing decisions?” One answer that is often overlooked, but highly valuable, is SEO Due Diligence. In this article, I’ll explain what SEO Due Diligence is, the need for it, the warning signs that it uncovers, how it is done, and how you can leverage it for your investing purposes.

What is Due Diligence?

In short, due diligence is the preliminary research that a potential investor performs before deciding to invest in a company or asset. This process is intended to uncover and evaluate the risks, benefits, and potential ROI of the investment being considered. But this investigation has traditionally overlooked a deep dive into the company’s website and online visibility, which can uncover valuable insights into its current and potential profitability. This type of analysis is called SEO Due Diligence.

See what a traditional Due Diligence procedure entails

What is SEO Due Diligence?

SEO Due Diligence, shouldn’t be a simple SEO audit, although this is a core component. At iPullRank we believe that this analysis should involve a combination of Technical SEO, content, and backlink audits. The data from this large analysis is then interpreted from a technical standpoint into relevant business-impacting factors. This higher-level translation is the key to communicating and understanding any telltale signs and their implications on an acquisition, merger, or investment.

Facebook was growing. Yahoo’s huge mistake not buying.

What need does SEO Due Diligence fulfill?

The need for SEO Due Diligence has come to the forefront during these times where we have seen the rise of highly innovative companies and the fall of the most iconic brands of our century. From the public to the private sector we can call out examples of notable brands such as Toys R US, Radioshack, Sports Authority, Sears Inc, and many others who lost their thrones. With both the veterans and even some of the most promising IPOs getting pulled under by the digital wave, SEO Due Diligence reveals missing pieces of the puzzle when determining why.

Read 7 of the worst IPO stocks in 2019

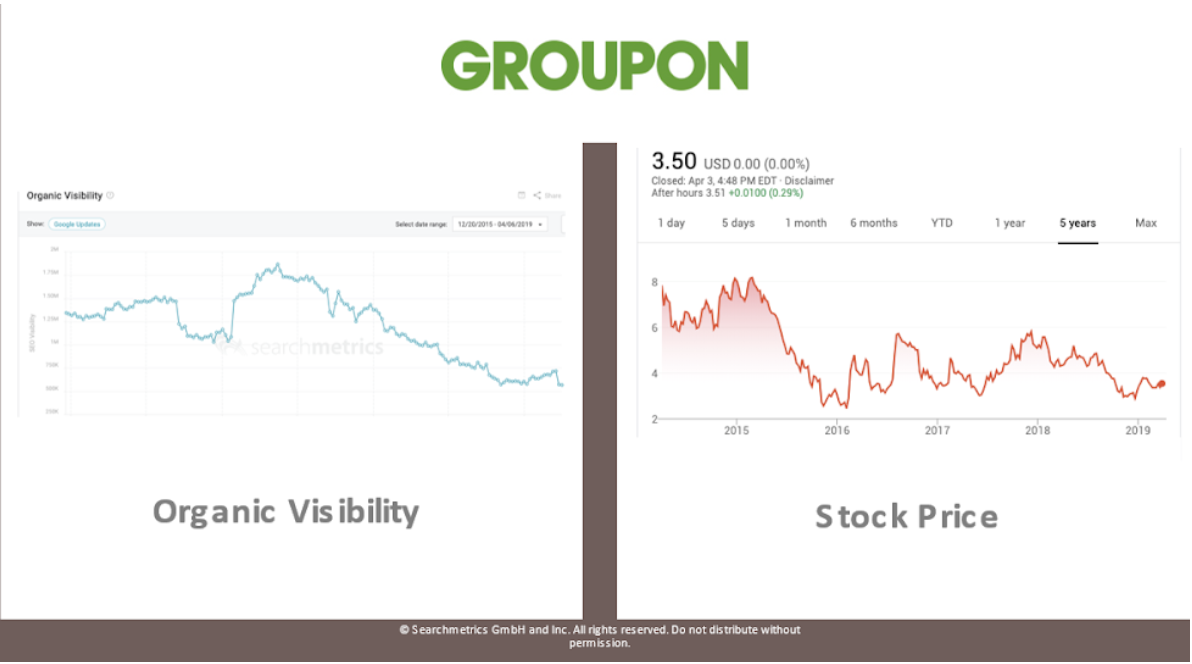

When analyzing visibility in search, we can see that it is the high-impacting reality that can be used as a strong indicator of the growth or decline of a company. For example, when we take a look at Groupon’s organic visibility and its stock price, we can see corresponding trends.

When looking at data like this, whether it was during a “Retail Apocalypse” or the turmoil of a financial crisis, we can often connect most companies’ failures to lack of innovation, their omnichannel presence, and most commonly their digital marketing strategy.

Here’s a list of 68 Bankruptcies in the Retail Apocalypse

While the missteps vary widely, the recent rounds of failed companies all shed light on the fact that a strong presence online supports a successful modern business model. Consumers are online first. But don’t believe me, believe the numbers:

This buyer trend is one of many signals highlighting the need for companies to focus on and continuously innovate their online user experience, even if only to support their local presence. If they don’t, their competitors will. And those brands that build the strongest digital marketing presence are positioned to be the most attractive and successful investments.

Read how a lack of digital innovation contributed to the decline of Sears

The Relationship Between Digital Presence and Brand Strength

A company’s online presence has become a strong driver for its brand awareness, growth, and revenue. It also gives insight into its internal marketing team and offers valuable context and data for potential investors who can no longer rely solely on traditional data points such as financials, assets, and infrastructure to gauge a company’s value. So any pre-acquisition research should evolve to take the pulse of a company’s digital marketing health to uncover potential opportunities for growth and, perhaps more importantly, important warning signs.

The Warning Signs from Search Visibility

“The presence of your business isn’t about just the foot traffic that comes into your store…it’s about how you gain awareness through the internet.”

Jordan Keone, CEO of Searchmetrics (at Rank UP 2019)

When acquiring a company, a big part of it is assessing risk. In our Groupon example, we could see corresponding trends between search visibility and stock price. Therefore, a negative trend would be a valuable warning sign. We can take this a step further and even match the timing for bankruptcies with major negative trends in search visibility.

Using Diesel as an example, their decline in search visibility directly leads up to and coincides with their bankruptcy filing in 2019.

In this case, with competition from online retailers like Amazon eroding their brick and mortar sales, Diesel continued to invest over $90 million in retail stores rather than bolstering their online presence. And the end result? Diesel’s admission that those investments in physical stores were “ill-timed, excessive, and unfruitful” in their own bankruptcy filing.

Diesel invested over $90 Million in retail stores, ignoring buyers’ online-first trends

Let me be the first to say here that correlation doesn’t always mean causation. The analytics that we dig into here are meant to offer valuable insights that contribute to a larger analysis and helps a researcher with data to support deductions, forecasting, and “connect the dots” so to speak. This is how we can use search visibility as one indication of a brand’s strength.

Take careful note, there are Black Hat SEO tactics that can temporarily boost a site’s visibility at the cost of violating search engine rules. These practices of manipulating a company’s site traffic are not sustainable and can provide a false indication of growth. This is something that only a highly skilled SEO expert can determine, and is information that investors need to know to validate, expose, and evaluate risks that a normal due diligence auditor may not be capable of identifying.

Walkthrough of a SEO Due Diligence Project

Our walkthrough of a SEO due diligence is based on a scenario where we do not have access to internal resources and data. When conducting due diligence, an investor normally does not have full access to internal marketing data. And even if it is available, it is likely limited or there is a chance that it is misrepresented. After all, it is in the candidate for acquisition’s best interest to present positive data to improve their perceived value. To avoid this possibility, we lean towards the skeptic’s approach by sourcing our data externally and impartially as a 3rd party investigator.

Investor Questions an SEO Due Diligence Should Answer

Although they often vary between industries/verticals, there are common questions that companies may pose for an SEO Due Diligence report. And should always be catered to service your particular needs. When we approach a SEO Due Diligence project, our experts seek answers to these particular questions, then go further by outlining other factors that investors should be alerted to. We wouldn’t recommend a bad investment or let a great investment slip through your fingers.

Here are a few standard questions that the SEO Due Diligence report should answer:

- Historically, how has the company grown online?

- Is the company’s digital marketing strategy scaled for continued growth?

- How well is the website positioned against competition?

- Are there any external products/assets contributing to the company’s success or decline?

The Technical Audits That Support SEO Due Diligence

If a marketer tells you that an SEO audit is the same as SEO Due Diligence, then that person isn’t doing it right and won’t deliver highly informed results. A Technical SEO audit, a content audit, and a backlink profile should all be at the core of an SEO due diligence process. This holistic approach may sound like overkill, but it helps to ensure that nothing is overlooked. This is vital when investment dollars and the futures of brands are on the line.

These in-depth audits require multiple tools that analyze and crawl the entire website. They provide the data needed to gauge technical, content, linking, page speed, mobile usability, and any other off-page or on-page concerns that should be evaluated to meet the needs of each project. These analyses yield large data sets with metrics from which an SEO can make both quantitative and qualitative evaluations of the investment property in question. Overall, the more data in your audit, the more informed are your insights.

Download our SEO Site Audit One Sheet to learn more about our Technical SEO Audits.

To add more context, the results of all these audits are normally delivered to internal marketing teams and SEOs with technical backgrounds. This data is then leveraged to drive digital marketing strategy, content strategy and creation, social media strategy, and more. The goals of an SEO Due Diligence differ in that its results are interpreted into actionable insights to help guide investment decisions.

Since our goal in this article is to understand SEO Due Diligence, its value, and applications, we won’t go into the technical details of audits themselves. And, let’s be honest, if an auditor presented a ton of raw site data to your room of investors, what information would they be able to take away from a list of error codes and backlink profiles? Investor board meetings are filled with businessmen, not SEOs. Presenting a huge list of raw analytics won’t tell the story they need or answer their performance-related questions. You need a business translation and key takeaways. An SEO Due Diligence report should present the most relevant data and illustrate it in a format that any audience can digest.

At iPullRank, our evaluations are used to formulate a graded SEO Due Diligence scorecard that focuses on the most pertinent investment-related concerns and ties them to key items that would affect a prospective company’s valuation. Here’s an example of our scorecard:

The iPullRank SEO Due Diligence Scorecard

- Technical Issues

- Site Architecture

- Indexing

- Caching

- Rendering

- Content Issues

- Content performance

- Content potential

- Content opportunities

- Algorithmic Resistance

- Past performance during search algorithm updates

- Resilience against future updates

- Internal Linking

- Link Equity

- External Linking

- Page Speed

- Mobile Usability

- Black Hat

- Prohibited tactics for manipulation of traffic

Translating SEO Issues to Answer Investor Concerns

After our audit has been completed and our scorecard is ready, we can answer some common and important investor questions based on real data. To provide some samples of the high-level answers I will pull some data one one of my favorite websites, Asos.com. I will act as if I were performing an SEO Due Diligence for an eCommerce investor who is planning to purchase this site in order to expand market share and remain an authority in the vertical.

Question: Historically, how has Asos.com grown online?

Answer: According to this data, the site has seen a significant decline in Search Engine Results Pages (SERPs) and there are indications that the site may have been impacted by Phantom Core Algorithm updates. The site has yet to recover from this huge drop in traffic since early 2018, has since then remained stagnant, and suggests that Asos.com has site-related issues that have not been addressed as of yet.

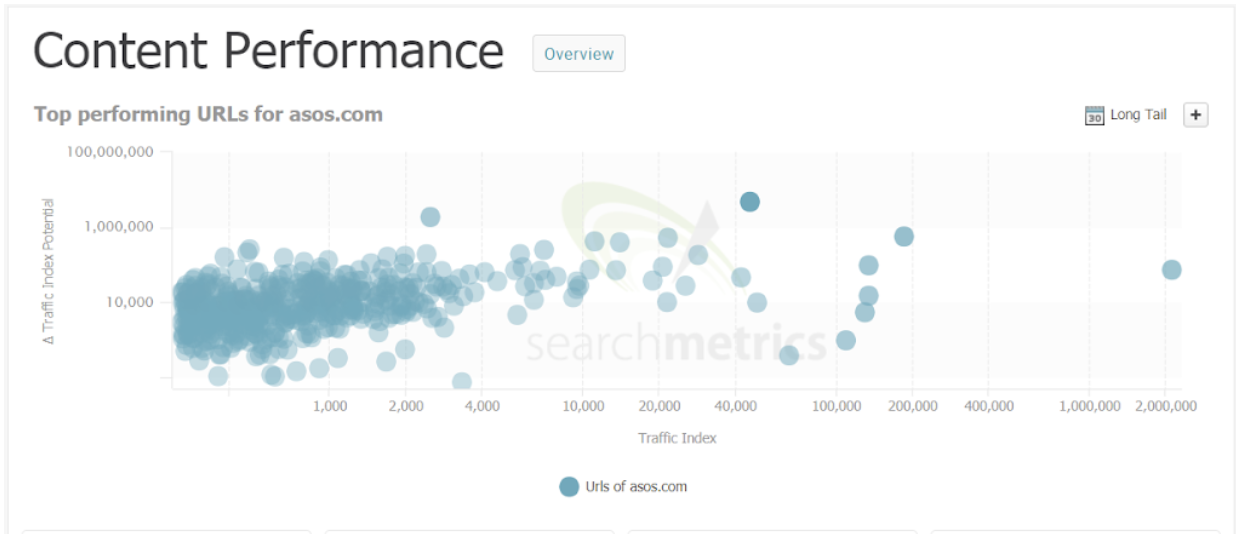

Question: Is Asos.com’s digital marketing strategy scaled for continued growth?

Answer: According to this data, Asos has a tremendous opportunity to improve its content performance. The performance potential of URLs, shown above, throughout the site has not been met yet. This reflects both a need and opportunity to improve upon the content strategy. Most of its traffic is from branded keywords, so it is missing a lot of opportunity on non-branded keyword traffic.

Question: How well is the website positioned against competition?

Answer: Asos.com fluctuates between performing on par with or better than its competitors. Two years ago, in 2017, its traffic far surpassed some of its main competitors including Zara, Mark and Spencer, and BooHoo. Although historical data indicates that Asos has outperformed its competitors in the past, the causes for its decline since 2018 should be identified and addressed prior to any purchase. Otherwise, this decline should factor in as a discount to the purchase value to offset the unknown costs associated with resolving the underlying website or internal marketing issues.

Question: Are there external products/assets contributing to the company’s success?

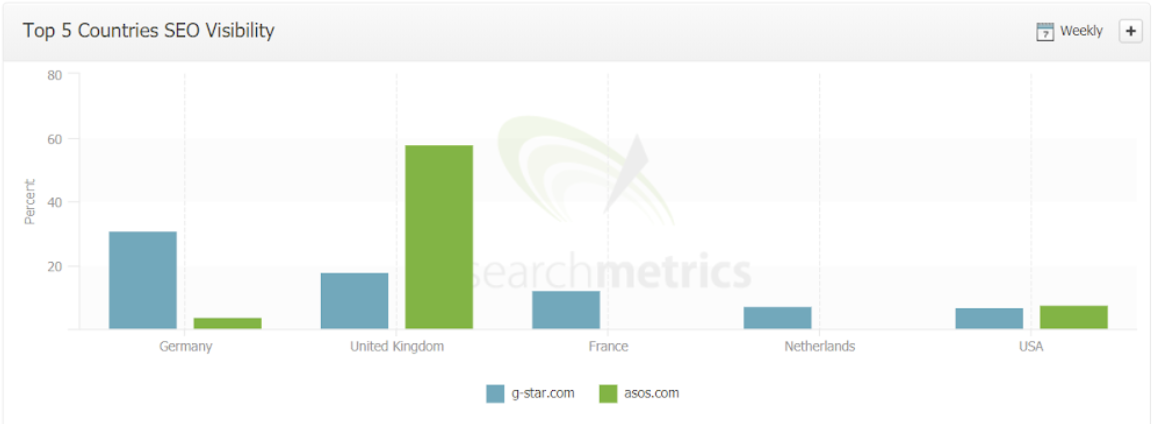

Answer: The brands Mac, G-Star, and Ted Baker are among some of their top-performing search queries driving traffic to the site besides Asos branded keywords. Creating more content, cross-promotions, a backlinking strategy, or considering a purchase of one of these sites could potentially build more equity for Asos.com.

While Mac would be a costly investment, G-star and Ted Baker are better prospects for price/value. Current data indicates that the company Ted Baker is currently in the red for revenue. On the other hand, G-star generates approximately $156 million in revenue annually so it could be a better opportunity for acquisition cost-wise. It also has strong visibility in Germany and UK markets (as Asos does) that could further improve traffic to the Asos property via backlinking opportunities. G-star also has significant retail locations globally that could be leveraged to support an omnichannel strategy.

Now given these answers, you can already see how many sound insights and recommendations that I came up with from just a preliminary audit. With this, you were able to get an idea of where the Asos brand stands in its space, the internal issues that may be present, and what other brands could be assets.

How SEO Due Diligence Supports A Strategic Investment

An experienced Technical SEO auditor points investors in the right direction. This expert analysis sees opportunities and risks where normal investigations might not. The right expert wouldn’t let an opportunity to buy a Google or Facebook pass you by like Yahoo did! It’s a wonder where the SEOs were when those deals were happening.

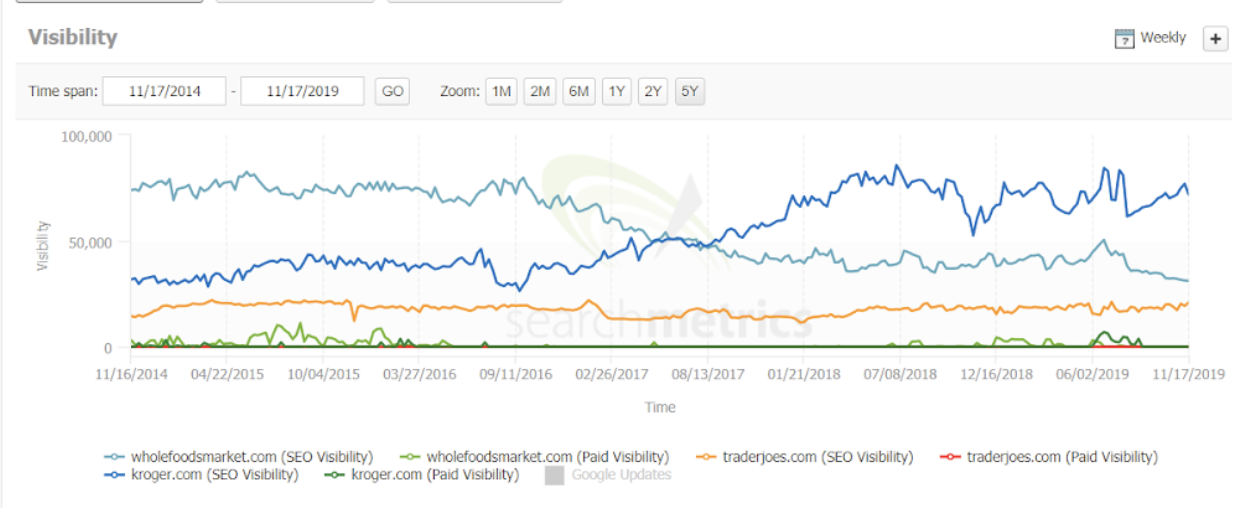

To get the idea of a sound investment that an SEO due diligence would have supported, let’s use Amazon’s acquisition of Whole Foods as an example. At a glance, we can see that Whole Foods was purchased during a peak in their visibility, at a time when it was on the top of its game even beating Kroger’s, one of its top competitors in the space, in search visibility.

Amazon went on to incorporate the Whole Foods retail locations as a brick and mortar backbone for its AmazonFresh and AmazonNow offerings, and essentially absorbed the Wholefood.com’s traffic into its primary property Amazon.com. They didn’t do this with simple redirects, instead, they built more value in and diversified their Prime membership with Whole Food’s products.

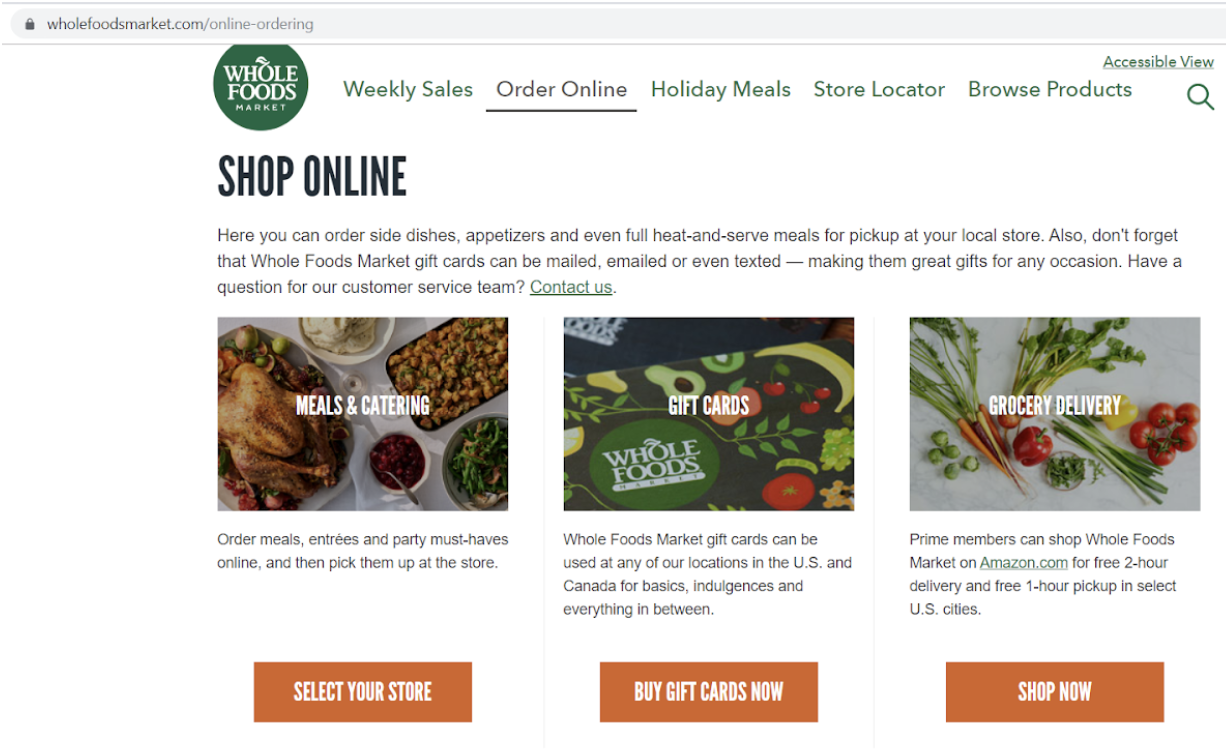

To achieve this, Amazon moved the ordering of individual items to its Amazon.com property and created a unified Amazon checkout to streamline the user experience. Grocery orders that you start on WholeFoods.com can be finished at Amazon checkout with added benefits of 2-hour delivery or 1-hour pickup. As you can see from the 2 screenshots below, Amazon.com offers the online purchase option on this organic avocado, while that option is removed from the Wholefoods.com site.

On Amazon.com there are clearly more upsell opportunities for purchase add-ons, and thus the more profitable checkout point. By removing the purchase option from Wholefoods.com, buyers have no other choice but to visit Amazon.com for their Wholefoods online order. This then drives more traffic to Amazon.com, adds more value for Amazon Prime members, and leads to more subscriber signups as Whole Foods members migrate over.

Overall, the acquisition of Whole Foods aligned with Amazon’s long-term growth strategy to change the way people shop for groceries by converting them into online-first buyers and loyal subscribers! There’s that online-first buyer trend being reinforced.

Read more about the Amazon acquisition of Wholefoods

In the end, every investor wants to identify good opportunities and weed out the risky ones. The objective is to eliminate those investment blindspots, and thus far the online presence has been one of them. SEO due diligence offers actionable insights and another perspective on a business’ potential by identifying key issues that investors should take note of. When delivered by a seasoned expert, audit data can be interpreted to answer most investor questions and perhaps even offer predictions with a high degree of certainty. This process helps to fill in the gaps of information that traditional due diligence misses and supports sound investing decisions in a time where digital success can determine the fate of a company.