Inflation has grown.

More than fifty brands, including several blue chip companies and tech companies, have announced a string of layoffs. A growing number of consumers fear we may be headed into a recession. What does this mean for financial services?

Do financial services need to adapt to shifts in the economy?

The dangerous answer is yes. Dangerous because the temptation to make changes based on assumptions about consumer behaviors is extraordinarily strong.

How the economy changes consumer behavior toward personal finance

This seems really obvious.

In times of a recession or depression, consumers double down on spending. They scrimp and save, working to pay down their debts. A resource guide from the Library of Congress confirms this.

“Many associate the Great Depression with the stock market crash in October 1929, but the economy started contracting in August of that year, beginning an economic downturn that lasted 43 months until March 1933. By the end of 1933, production had decreased dramatically, and real GDP fell 29%. Consumer expenditures decreased from $77.5 billion in 1929 to $45.9 billion in 1933. Buying on credit or using installment plans had been normalized in the 1920s, but the market crash in October 1929 resulted in a sharp drop in the number of consumers purchasing on credit by 1930, while households focused on paying off their existing debts.” – (emphasis added)

See? Customers spend less money during an economic downturn.

Not so fast.

In a recent study, Keith Wilcox et al. made an interesting observation.

“Luxury goods that prominently display their brands are out. The recession has led wealthy consumers to adopt more subdued designs that reflect taste rather than signal status. At least, that is what the pundits in the press would have you believe. ‘The muted, logo-free look is gaining traction as the standard-bearer for a new kind of luxury: subtle, long-lasting, and recession proof,”

In their study, they decided to use luxury handbags as an indicator of consumer spending and shifts in behavior.

“We examine data on product offerings collected from luxury handbag superpowers Louis Vuitton (LV) and Gucci, the world’s top two luxury brands, before and in the midst of the recession. We contrast what occurs with these two brands with what occurred at Hermès, a boutique brand concentrating on subtlety prior to the recession. If consumers are indeed demanding less conspicuous products, it would be reflected in these manufacturers’ product lines, and we should observe LV and Gucci offering more understated designs. Or, if firms do not tone down their products, we should observe a marked decrease in profitability as they fail to meet customer demand.” – (emphasis added)

Well, what were the results?

“Our research finds evidence that Louis Vuitton and Gucci have changed their product lines during the financial crisis to offer significantly more conspicuously branded products. These brands are far more prominently displayed on new product introductions when compared to those products withdrawn. Further, both brands simultaneously increased prices significantly. Louis Vuitton’s new designer handbag line was priced an average of 31% higher than its product line one-and-one-half years earlier, while Gucci raised prices on 50% of those products the manufacturer did not remove, by 1% to 5%.” – (emphasis added)

Okay, what does that tell us, then? How do consumers approach personal finance during a recession?

The unsatisfying answer is it depends.

As a whole, the government data seems to support the idea that customers decrease spending in key areas (i.e., durable goods). But the research also supports that consumers modify their behaviors, so they’re able to continue doing the things they enjoy (i.e., eating out).

It’s all about nuance.

Read more: Recession Proof: Your SEO Playbook in Times of Economic Uncertainty

Using personas to attract financial service customers

If you want to gain a deeper understanding of your target audience, you’ll need to identify the elements driving your audience’s decisions. These elements include:

- Age: Baby Boomers, Millennials, and Gen Z all have differing views on money. These views are shaped by a variety of external factors, including – life experiences, milieu, and training.

- Demographics are the more commonly assessed factors that include education, nationality, religion, and ethnicity.

- Psychographics are areas shaped by internal factors, such as – activities, interests, personality, beliefs, values, behavior, expression, and attitudes.

- Ethnographics includes elements like social class, culture, and social norms. What’s not said/done is just as important as what is said/done. It’s an important distinction that helps you to position your brand appropriately and avoid social or cultural faux pas.

This is the easy part.

If you’re like most companies, you’re well aware of these areas and the impact they have. However, brands begin to stumble when it’s time to integrate all of this into their business.

Here’s what I mean.

Here are some ads for Wells Fargo’s financial services.

These ads show that Wells Fargo relies on personas. But a comprehensive look at their ads, landing pages, and content shows that the implementation could be more efficient and precise.

It isn’t just mortgages.

Here are a series of ads for their wealth advisors.

If you’re looking for a financial advisor, how does this help you?

Okay then,

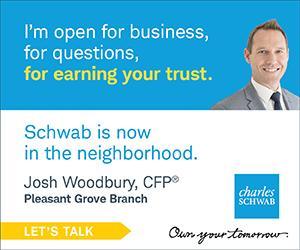

Now let’s compare and contrast this to Charles Schwab.

This isn’t some rando from a stock photo.

If you live in the Pleasant Grove area, this is the person you’ll see when you go into a Charles Schwab branch. If you have a complaint or a pressing concern, he’s your guy.

What about content?

Quite the contrast, no?

Can you see the difference between these two brands? They’re both well known, with hundreds of thousands of customers. But their ads paint a very different picture of their level of understanding regarding their customers.

So what?

Well, precise audience research is the tool you need to create your personas. Audience research drives traffic and improves customer retention; the more you know about your audience — the demographics, psychographics, and ethnographics — the easier it is for you to create content and marketing that generates consistent revenue and commissions in a down economy.

This is easier if you’re aware of your target demographic cohorts and what they actually want.

Here are a few examples.

Baby Boomers

Boomers are looking for established, trustworthy financial institutions. They prefer to open accounts or do business in person; if they’re opening accounts, they want to do it via face-to-face interactions. There’s a strong emphasis and degree of trust due to these in-person relationships.

Boomers are currently the biggest spenders in the economy, but this will decline over time. Boomers are responsible for the care and protection of their families – helping their parents manage their finances, supporting their kids as they go through major life stages, and managing their own finances.

Millennials

According to CB Insights, millennials want to (a.) move from in-person to online transactions, (b.) move from large, established institutions to small, challenger institutions. (c.) From the way it is now to the way it could be. Millennials have been shaped by three life-changing events: The Great Recession, the student loan crisis, and the Covid-19 pandemic.

Each of these experiences has permanently shaped millennials’ experiences, specifically around finance.

Gen Z

Gen Z-ers want the same things Millennials want, but more.

According to Accenture, 68% of Generation Z are more fiscally responsible than previous generations. More than a third have $1,000 or more saved. Like Millennials, Gen Z-ers have fully embraced fintech, and are focused on minimizing and avoiding debt.

Half of Gen Z and Millennials want to arrange in-person appointments via mobile apps; they expect self-service and on-demand support. Personalization, automation, education, and 24/7 support are key anchor points for Gen Z.

What about personas?

Personas are an essential part of audience research; they distill buyer motivations down for specific cohorts, showing you how to support your customers with the education they need to purchase with confidence.

Let’s look at some personas.

Richard

Age: 60

Life stage: Approaching retirement

Income: $6K – $11K per mo.

Milieu: Middle class

Motivation: Maintain his current standard of living

Rich is terrified. He plays it cool, but he’s really worried about the loss of income when he retires. To complicate matters further, there’s been talk in his company that most middle managers in his age group will be ‘forcibly retired’ in the next few years.

He’s not ready.

He’s had to borrow from his 401K over the years to fund various family expenses, and he’s been hit with penalties as a result. He needs to replace his income yesterday to relieve the significant amount of stress on him and his family. To complicate things further, he needs to increase the amount of income he can earn over the long term to provide a sizeable nest egg for his children and grandchildren.

Richard doesn’t understand newfangled financial products like Bitcoin. He’s looking for financial products with a strong margin of safety, e.g., insurance, stocks, annuities, gold, etc.

Audrey

Age: 25

Life stage: Recent grad

Income: Under $5K per mo.

Milieu: Working class

Motivation: Increase income and save for a house

Audrey has just finished college. She’s just landed an entry-level role in an accounting firm. She feels she’s underpaid, but she’s eager to prove herself. She’s engaged and wants to save money as quickly as possible so she and her husband can buy a home.

At this point, life is a grind.

She works long hours but feels like unexpected emergencies and routine expenses continually chip away at her savings. The news on inflation isn’t really helping, either. She’s worried about the future if either of them loses their job.

Malcolm

Age: 33

Life stage: Seasoned entrepreneur

Income: $29K per mo.

Milieu: Tech/upper middle class

Motivation: Aggressive expansion/increasing wealth

After 7 years of struggle, Malcolm has finally started to see the fruits of his labors. His income has grown considerably, but he still opts to put the majority of his income back into his company, only taking home $29K per mo.

He’s a bachelor, and he’s frugal.

He keeps his expenses low and spends most of his time at work or in the gym. He’s nervous about the things he’s heard on the news; he wonders how his company would fare in a severe recession. He’s fairly liquid and wants to move a large portion of his cash into assets that maximize his cash flow, but he’s not sure where to start. He’s also interested in aggressive expansion on this front, as he’s worried his parents may need his help in the coming months.

Research shows 94% of Crypto Buyers are 18-40 Years Old, and Malcolm is no different. He wants to expand his position in Cryptocurrency.

See what I mean?

If you offer a variety of services (e.g., banking, credit, insurance, investments, loans, etc.) You can redirect these personas to the right products – Malcolm to an investment advisor, Audrey to banking, savings, or loan products, and Richard to an annuities and insurance specialist.

You may find that it’s necessary to treat customer concerns as a team sport – bring your employees in on an as-needed basis to support your customers.

What if you don’t offer lots of services?

Your audience research helps you identify important details you can broadcast to your company and customers.

- The customers you want

- The customers you don’t want

- Minimum standards customers must meet (e.g., a minimum of $25K in savings)

- The specific problems or challenges your company addresses

This reduces cost, lowers cost-per-lead and ad costs, and increases your returns simultaneously. These limitations make it easy for you to find, attract, and retain your customers, enabling you to create precise messaging that speaks directly to their problems.

This also helps because it enables you to map the buyer’s journey.

The buyer’s journey for financial services

Matthew Bellows, VP at Amex, had this to say about the buyer’s journey.

“Buying a financial product is completely different. Whether it’s insurance or retirement, you are paying for something now whose main benefit won’t come for decades. You are buying a gift or a tool for your future self. Unlike a book, it’s not clear how much this future gift should cost. Large purchases for the future only make sense when you have perspective on your entire life.”

This makes sense, but it introduces a problem.

Research firm IDC famously noted that “The buyer journey is nothing more than a series of questions that must be answered.” If you’re offering financial services, you’ll need to field more questions than other industries, provide more assurances, and address more problems.

For many financial products, the reward comes (much) later.

That said, the buyer’s journey for financial services in organic search isn’t that much different than other industries. The stages are largely the same, though the implementation may be different.

- Recognizing the problem: “I don’t have enough money for retirement” or “I need a loan to buy a new home” these are both examples of financial problems. Buyers need to be aware of the problem before they’re ready for a solution to that problem.

- Searching for a solution: Buyers begin educating themselves on a solution to their problem, using the limited knowledge they have available. They’ll consume anything that moves them closer to the solution they feel is best for them.

- Evaluating solutions: At this stage, customers dive into the minutia; they read through terms and conditions, monitor interest rates, comb through the list of dos and don’ts, and scrutinize reviews from other customers who have made the same purchase.

- Making a purchase: Buyers narrow their choices down to the best provider (from their point of view), then they make their purchase. They double-check things to confirm that they’re making the right decisions, then they move forward.

- Evaluating their purchase: If buyers ignore any of their concerns, this becomes an issue post-purchase. Buyers’ remorse kicks in if their experience is less than expected. If their experience is poor, they begin the journey again, searching for a new provider who can meet or exceed their expectations.

Read more: 6 Technical SEO Challenges for Financial Institutions

Remember, the buyer’s journey is a bit different with financial services.

Whether it’s stocks, insurance, or retirement, you’re asking customers to pay now but benefit later, much later. Each step needs to be amplified.

What do I mean by that?

Help customers recognize their problems and the consequences of ignoring them (both now and later). Give them a framework they can use to evaluate solutions to their problems. Incentivize them to make a purchase with you and onboard them properly to eliminate buyer’s remorse.

The buyer’s journey has changed

Audience research is the key to understanding the buyer’s journey.

Financial services must adapt to shifts in the economy, customer cohorts, and the various strata of customer expectations they’re expected to manage. If you want to gain a deeper understanding of your target audience, you’ll need to identify the elements driving your audience’s decisions.

This is the easy part.

If you’re like most companies, you’re aware of these elements and the impact they have. That’s the problem; brands stumble when it’s time to implement and integrate, to fold all of the lessons from their audience research into their business.

If the shoe fits, get the help you need.

Vet your audience research, then create a team to help you navigate the rapidly changing financial landscape. Inflation has grown, and more brands are contracting – announcing layoffs and restructuring. Use audience research to find your true north. You can prosper in any economic climate with thorough research and efficient implementation.

When was the last time that you invested in market research for your financial services audience? Schedule a call with iPullRank to build an Audience Report that can inform your entire content strategy.

- The Cost of SEO Services in 2024 - January 4, 2024

- The 2024 SEO Guide To Successful Website Migration - April 4, 2023

- How Audience Research Shapes Financial Services Marketing - February 16, 2023

Leave a Comment